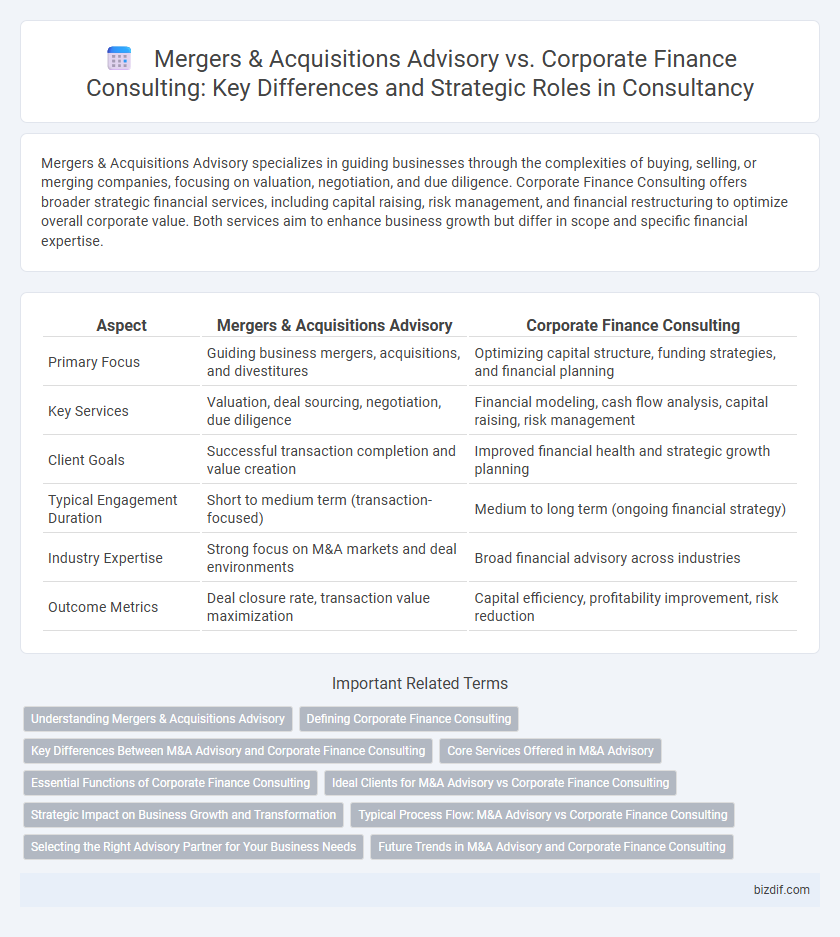

Mergers & Acquisitions Advisory specializes in guiding businesses through the complexities of buying, selling, or merging companies, focusing on valuation, negotiation, and due diligence. Corporate Finance Consulting offers broader strategic financial services, including capital raising, risk management, and financial restructuring to optimize overall corporate value. Both services aim to enhance business growth but differ in scope and specific financial expertise.

Table of Comparison

| Aspect | Mergers & Acquisitions Advisory | Corporate Finance Consulting |

|---|---|---|

| Primary Focus | Guiding business mergers, acquisitions, and divestitures | Optimizing capital structure, funding strategies, and financial planning |

| Key Services | Valuation, deal sourcing, negotiation, due diligence | Financial modeling, cash flow analysis, capital raising, risk management |

| Client Goals | Successful transaction completion and value creation | Improved financial health and strategic growth planning |

| Typical Engagement Duration | Short to medium term (transaction-focused) | Medium to long term (ongoing financial strategy) |

| Industry Expertise | Strong focus on M&A markets and deal environments | Broad financial advisory across industries |

| Outcome Metrics | Deal closure rate, transaction value maximization | Capital efficiency, profitability improvement, risk reduction |

Understanding Mergers & Acquisitions Advisory

Mergers & Acquisitions Advisory specializes in providing strategic guidance on identifying, evaluating, and executing merger or acquisition opportunities to enhance shareholder value. This advisory service involves detailed due diligence, valuation analysis, and negotiation support to ensure optimal deal structuring and integration planning. Unlike broader Corporate Finance Consulting, which covers capital markets, financial restructuring, and fundraising, M&A Advisory concentrates on transaction-specific expertise that drives successful corporate growth and consolidation strategies.

Defining Corporate Finance Consulting

Corporate Finance Consulting involves strategic financial planning and management services that help organizations optimize capital structure, funding strategies, and investment decisions to enhance overall financial performance. It encompasses advising on budgeting, valuation, risk management, and cash flow analysis to support business growth and sustainability. Unlike Mergers & Acquisitions Advisory, which focuses specifically on transaction execution and deal structuring, Corporate Finance Consulting provides a broader spectrum of financial guidance across various corporate financial activities.

Key Differences Between M&A Advisory and Corporate Finance Consulting

Mergers & Acquisitions Advisory focuses on deal structuring, target identification, valuation analysis, and transaction negotiation to facilitate company mergers, acquisitions, or divestitures. Corporate Finance Consulting covers broader financial strategy, including capital raising, financial planning, risk management, and performance improvement across various corporate activities. The key difference lies in M&A's specialization in transactional support, whereas Corporate Finance Consulting addresses overall financial optimization and strategic financial management.

Core Services Offered in M&A Advisory

Mergers & Acquisitions (M&A) advisory primarily focuses on core services such as target identification, valuation analysis, due diligence, deal structuring, negotiation support, and integration planning to facilitate seamless transactions. Corporate finance consulting offers broader financial advisory services including capital raising, financial restructuring, risk management, and strategic planning beyond M&A-specific activities. The specialized expertise in M&A advisory ensures optimized deal execution and value creation during mergers, acquisitions, divestitures, and joint ventures.

Essential Functions of Corporate Finance Consulting

Corporate Finance Consulting primarily focuses on optimizing capital structure, managing corporate funding strategies, and enhancing financial performance through valuation, risk assessment, and cash flow analysis. It involves advising on debt and equity financing, capital budgeting, and financial planning to support sustainable business growth. This advisory service ensures alignment with long-term corporate objectives by evaluating investment opportunities and restructuring financial mechanisms.

Ideal Clients for M&A Advisory vs Corporate Finance Consulting

Mergers & Acquisitions Advisory primarily targets mid-sized to large corporations seeking strategic growth through acquisitions, divestitures, or consolidations, often requiring specialized deal structuring and due diligence expertise. Corporate Finance Consulting serves a broader range of clients, including startups and SMEs, focusing on capital raising, financial restructuring, and optimizing financial performance to enhance overall business valuation. Ideal clients for M&A Advisory typically need transactional support and negotiation guidance, while Corporate Finance Consulting clients seek strategic financial planning and access to diverse capital markets.

Strategic Impact on Business Growth and Transformation

Mergers & Acquisitions Advisory centers on identifying, negotiating, and executing transactions that enable companies to expand market share, diversify product lines, and achieve rapid scale, directly driving transformative growth. Corporate Finance Consulting focuses on optimizing capital structure, enhancing financial performance, and managing funding strategies to support sustained business growth and long-term value creation. Both advisory services strategically impact business transformation by aligning financial decisions with growth objectives and operational synergies.

Typical Process Flow: M&A Advisory vs Corporate Finance Consulting

Mergers & Acquisitions (M&A) Advisory typically involves a structured process flow including target identification, due diligence, valuation analysis, negotiation, and deal closure, focusing on maximizing shareholder value through strategic transactions. Corporate Finance Consulting encompasses a broader scope with processes such as capital structure optimization, financial modeling, risk assessment, and fundraising strategy to enhance overall corporate financial performance. Both services emphasize financial analysis and strategic planning but differ in their transaction-specific focus and comprehensive financial management approach.

Selecting the Right Advisory Partner for Your Business Needs

Selecting the right advisory partner requires understanding the distinct roles of Mergers & Acquisitions (M&A) advisory and Corporate Finance consulting; M&A advisors specialize in transaction execution, deal structuring, and valuation, while Corporate Finance consultants focus on capital raising, financial planning, and strategic growth. Evaluating a firm's expertise, industry experience, and track record in similar transactions is crucial for aligning with your business objectives. Leveraging a partner with tailored advisory capabilities enhances decision-making and maximizes value creation throughout the transaction lifecycle.

Future Trends in M&A Advisory and Corporate Finance Consulting

Future trends in Mergers & Acquisitions Advisory emphasize increased use of AI-driven analytics for identifying strategic targets and optimizing deal structures, enhancing precision and speed in transaction processes. Corporate Finance Consulting is evolving with a growing focus on sustainable finance and ESG integration, guiding clients through regulatory compliance and green capital markets. Both sectors leverage digital transformation and data-driven insights to deliver tailored financial strategies that anticipate market disruptions and investor expectations.

Mergers & Acquisitions Advisory vs Corporate Finance Consulting Infographic

bizdif.com

bizdif.com