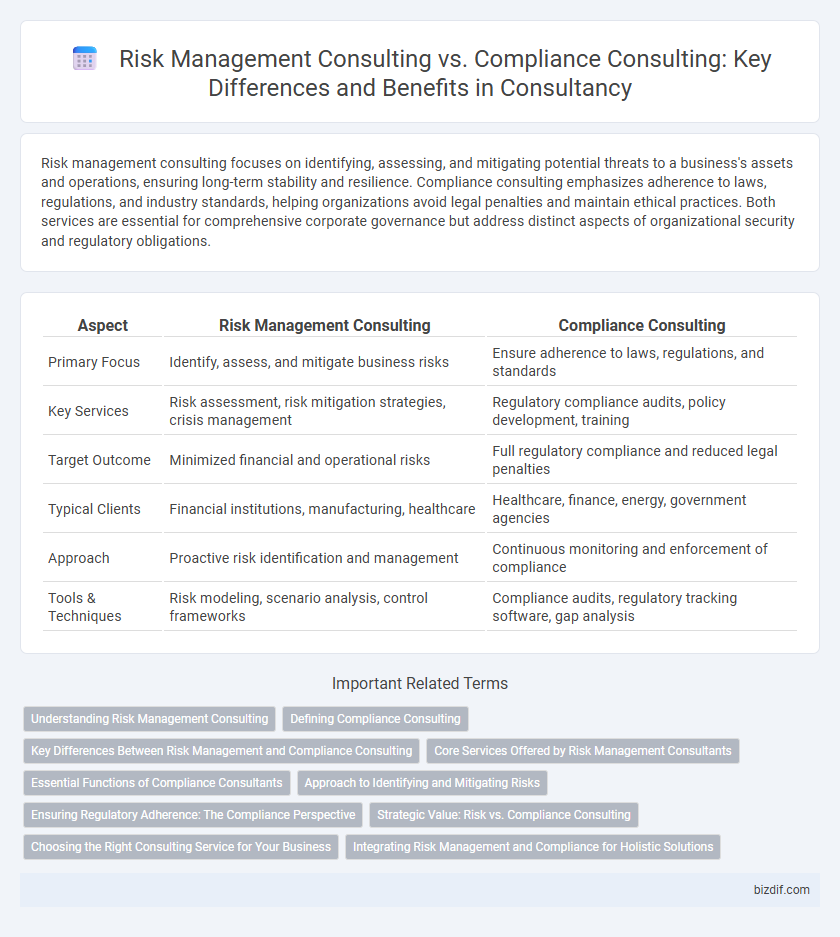

Risk management consulting focuses on identifying, assessing, and mitigating potential threats to a business's assets and operations, ensuring long-term stability and resilience. Compliance consulting emphasizes adherence to laws, regulations, and industry standards, helping organizations avoid legal penalties and maintain ethical practices. Both services are essential for comprehensive corporate governance but address distinct aspects of organizational security and regulatory obligations.

Table of Comparison

| Aspect | Risk Management Consulting | Compliance Consulting |

|---|---|---|

| Primary Focus | Identify, assess, and mitigate business risks | Ensure adherence to laws, regulations, and standards |

| Key Services | Risk assessment, risk mitigation strategies, crisis management | Regulatory compliance audits, policy development, training |

| Target Outcome | Minimized financial and operational risks | Full regulatory compliance and reduced legal penalties |

| Typical Clients | Financial institutions, manufacturing, healthcare | Healthcare, finance, energy, government agencies |

| Approach | Proactive risk identification and management | Continuous monitoring and enforcement of compliance |

| Tools & Techniques | Risk modeling, scenario analysis, control frameworks | Compliance audits, regulatory tracking software, gap analysis |

Understanding Risk Management Consulting

Risk management consulting focuses on identifying, assessing, and mitigating potential threats that could impact an organization's assets, operations, and reputation. This field involves developing risk frameworks, performing quantitative risk analysis, and advising on strategies to minimize financial loss and ensure business continuity. Understanding risk management consulting requires knowledge of industry-specific risks, regulatory environments, and enterprise risk management (ERM) principles.

Defining Compliance Consulting

Compliance consulting focuses on helping organizations adhere to industry regulations, standards, and internal policies to avoid legal penalties and reputational damage. This type of consulting involves assessing current compliance frameworks, implementing effective control systems, and providing training on regulatory requirements such as GDPR, HIPAA, or SOX. By contrast, risk management consulting addresses a broader spectrum of potential threats, including financial, operational, and strategic risks, emphasizing risk identification, evaluation, and mitigation strategies.

Key Differences Between Risk Management and Compliance Consulting

Risk management consulting focuses on identifying, assessing, and mitigating potential threats to an organization's assets and operations, aiming to minimize financial loss and enhance business resilience. Compliance consulting ensures adherence to laws, regulations, and industry standards, preventing legal penalties and maintaining corporate reputation. While risk management adopts a proactive strategy to anticipate uncertainties, compliance consulting emphasizes meeting mandatory requirements and regulatory frameworks.

Core Services Offered by Risk Management Consultants

Risk management consultants specialize in identifying, assessing, and mitigating potential threats to an organization's assets, including financial, operational, and strategic risks. Core services offered include risk assessment and analysis, development of risk mitigation strategies, implementation of enterprise risk management frameworks, and continuous monitoring to ensure resilience against emerging risks. These services differ from compliance consulting, which focuses primarily on ensuring adherence to laws, regulations, and internal policies.

Essential Functions of Compliance Consultants

Compliance consultants specialize in ensuring organizations adhere to regulatory requirements by developing internal policies, conducting audits, and providing employee training to mitigate legal risks. Their essential functions include assessing regulatory changes, implementing compliance programs, and monitoring ongoing adherence to industry standards. Unlike risk management consultants who focus broadly on identifying and mitigating various operational risks, compliance consultants concentrate specifically on navigating complex legal frameworks to prevent regulatory violations.

Approach to Identifying and Mitigating Risks

Risk management consulting employs a proactive approach by identifying potential threats through comprehensive risk assessments, scenario analysis, and risk modeling to develop tailored mitigation strategies. Compliance consulting focuses on aligning business processes with regulatory requirements, conducting gap analyses, and implementing controls to prevent legal and financial penalties. Both approaches prioritize risk reduction but differ in scope, with risk management addressing broader operational risks and compliance consulting targeting regulatory adherence.

Ensuring Regulatory Adherence: The Compliance Perspective

Risk management consulting focuses on identifying and mitigating potential threats to an organization's operations, while compliance consulting centers on ensuring strict adherence to regulatory requirements and industry standards. Compliance consultants develop and implement policies, conduct audits, and provide training to guarantee that organizations meet legal obligations and avoid penalties. Their expertise is essential for maintaining regulatory adherence in sectors subject to complex and evolving laws, such as finance, healthcare, and manufacturing.

Strategic Value: Risk vs. Compliance Consulting

Risk management consulting delivers strategic value by identifying potential threats and implementing proactive measures to mitigate financial, operational, and reputational risks, enabling organizations to maintain resilience and achieve long-term objectives. Compliance consulting focuses on ensuring adherence to regulatory requirements and industry standards, reducing the risk of legal penalties and enhancing corporate governance frameworks. While risk management emphasizes future uncertainty and opportunity optimization, compliance consulting prioritizes current legal obligations and ethical standards, both integral to holistic business strategy.

Choosing the Right Consulting Service for Your Business

Risk management consulting focuses on identifying, assessing, and mitigating potential threats to minimize business disruptions and financial losses. Compliance consulting ensures that your business adheres to relevant laws, regulations, and industry standards to avoid legal penalties and reputational damage. Selecting the right consulting service depends on whether your primary concern is preventing operational risks or ensuring regulatory adherence, which ultimately enhances corporate governance and organizational resilience.

Integrating Risk Management and Compliance for Holistic Solutions

Integrating risk management and compliance consulting streamlines organizational processes by aligning risk assessments with regulatory requirements, reducing redundancies and enhancing decision-making accuracy. Holistic solutions enable proactive identification of potential threats while ensuring adherence to industry standards, minimizing legal and financial penalties. Leveraging data analytics and governance frameworks fosters a cohesive strategy that supports sustainable growth and operational resilience.

Risk management consulting vs Compliance consulting Infographic

bizdif.com

bizdif.com