Choosing between a sole proprietorship and a partnership firm for your consultancy pet business depends on the level of control, liability, and capital investment desired. A sole proprietor maintains full control and claims all profits but assumes unlimited personal liability, whereas a partnership firm allows shared responsibility, resources, and decision-making, distributing risks among partners. Evaluating your business goals, risk tolerance, and collaboration preferences ensures the optimal legal structure for growth and sustainability in the consultancy pet industry.

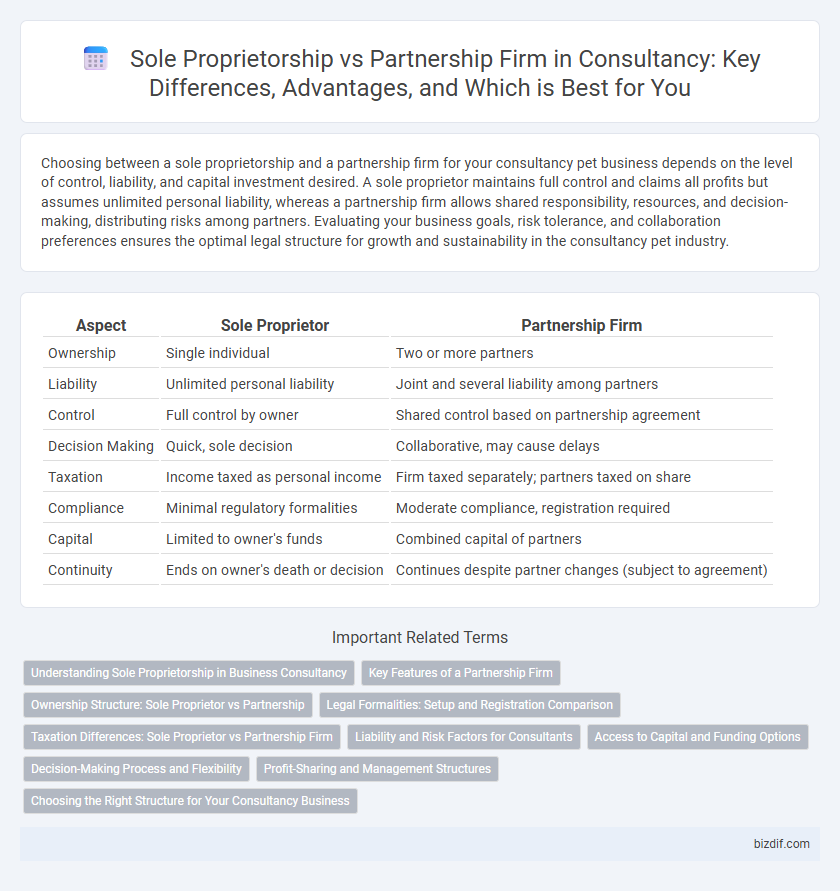

Table of Comparison

| Aspect | Sole Proprietor | Partnership Firm |

|---|---|---|

| Ownership | Single individual | Two or more partners |

| Liability | Unlimited personal liability | Joint and several liability among partners |

| Control | Full control by owner | Shared control based on partnership agreement |

| Decision Making | Quick, sole decision | Collaborative, may cause delays |

| Taxation | Income taxed as personal income | Firm taxed separately; partners taxed on share |

| Compliance | Minimal regulatory formalities | Moderate compliance, registration required |

| Capital | Limited to owner's funds | Combined capital of partners |

| Continuity | Ends on owner's death or decision | Continues despite partner changes (subject to agreement) |

Understanding Sole Proprietorship in Business Consultancy

A sole proprietorship in business consultancy provides complete control and decision-making authority to the individual owner, simplifying management but also assuming full liability for business debts. This structure offers straightforward tax reporting since profits are taxed as personal income, eliminating the complexities of corporate tax filings common in partnerships. Understanding the risks and benefits of sole proprietorship enables consultants to tailor their business strategy to maximize flexibility and financial efficiency.

Key Features of a Partnership Firm

A partnership firm is a business entity where two or more individuals share ownership, profits, losses, and management responsibilities. Key features include joint liability of partners, mutual agency where each partner can bind the firm, and a formal agreement outlining the terms of partnership. This structure allows pooling of resources and expertise, promoting shared decision-making and financial contribution.

Ownership Structure: Sole Proprietor vs Partnership

A sole proprietor holds complete ownership and decision-making authority, bearing full responsibility for the business's debts and liabilities. In contrast, a partnership distributes ownership among two or more partners, who share profits, losses, and management duties according to the partnership agreement. The choice between sole proprietorship and partnership affects legal obligations, tax treatment, and operational control.

Legal Formalities: Setup and Registration Comparison

Setting up a sole proprietorship involves minimal legal formalities, typically requiring basic registration like a trade license or GST registration depending on the business nature. In contrast, establishing a partnership firm necessitates drafting and registering a partnership deed with the Registrar of Firms, which outlines each partner's roles, profit-sharing ratio, and dispute resolution methods. Compliance with tax registrations and adherence to the Indian Partnership Act, 1932, are mandatory for partnership firms, making the registration process more complex and formal compared to sole proprietorships.

Taxation Differences: Sole Proprietor vs Partnership Firm

Sole proprietors report business income on their personal tax returns using Schedule C, subjecting all profits to self-employment tax, whereas partnership firms file an informational return (Form 1065) and allocate income to partners via K-1 forms, with partners paying tax individually on their share. Partnerships can deduct certain expenses like guaranteed payments to partners, reducing overall taxable income, while sole proprietors cannot separate business and personal tax liabilities. Tax rates for sole proprietors are based on individual brackets, whereas partnerships benefit from income splitting among partners, potentially lowering aggregate tax liability.

Liability and Risk Factors for Consultants

Sole proprietors bear unlimited personal liability, exposing their entire personal assets to business debts and legal claims, significantly increasing individual financial risk. Partnership firms distribute liability among partners, though in general partnerships, partners remain jointly and severally liable for business obligations and risks. Consultants must carefully evaluate the trade-offs between sole proprietorship's full control with high personal risk and partnership's shared liability coupled with potential conflicts among partners.

Access to Capital and Funding Options

Sole proprietors typically rely on personal savings, loans, or credit for capital, limiting their funding options compared to partnership firms. Partnership firms benefit from combined financial resources and the ability to attract external investors or business loans more easily due to shared liability and diversified capital contributions. These advantages enhance a partnership's capacity to access larger funding amounts and support business growth more effectively.

Decision-Making Process and Flexibility

Sole proprietors have full control over decision-making, enabling swift and flexible responses to business changes without needing consensus. In partnership firms, decision-making is shared among partners, which can lead to more diverse perspectives but may slow down the process and require negotiation. This collective approach provides strategic input but often reduces individual flexibility compared to a sole proprietorship.

Profit-Sharing and Management Structures

In a sole proprietorship, the owner retains full control over management decisions and exclusively receives all profits, simplifying the profit-sharing structure. Partnership firms distribute profits among partners based on pre-agreed ratios, reflecting their respective capital contributions or roles, and management responsibilities are often shared or divided according to the partnership agreement. Clear delineation of profit-sharing and management duties in partnerships enhances operational coordination and minimizes conflicts.

Choosing the Right Structure for Your Consultancy Business

Choosing the right business structure for your consultancy business significantly impacts liability, taxation, and management control. A sole proprietor offers simplicity and complete control but carries unlimited personal liability, while a partnership firm allows shared responsibilities and pooled resources, yet requires clear agreements to avoid conflicts. Evaluating your risk tolerance, growth plans, and operational needs ensures selecting the optimal structure for long-term success.

Sole Proprietor vs Partnership Firm Infographic

bizdif.com

bizdif.com