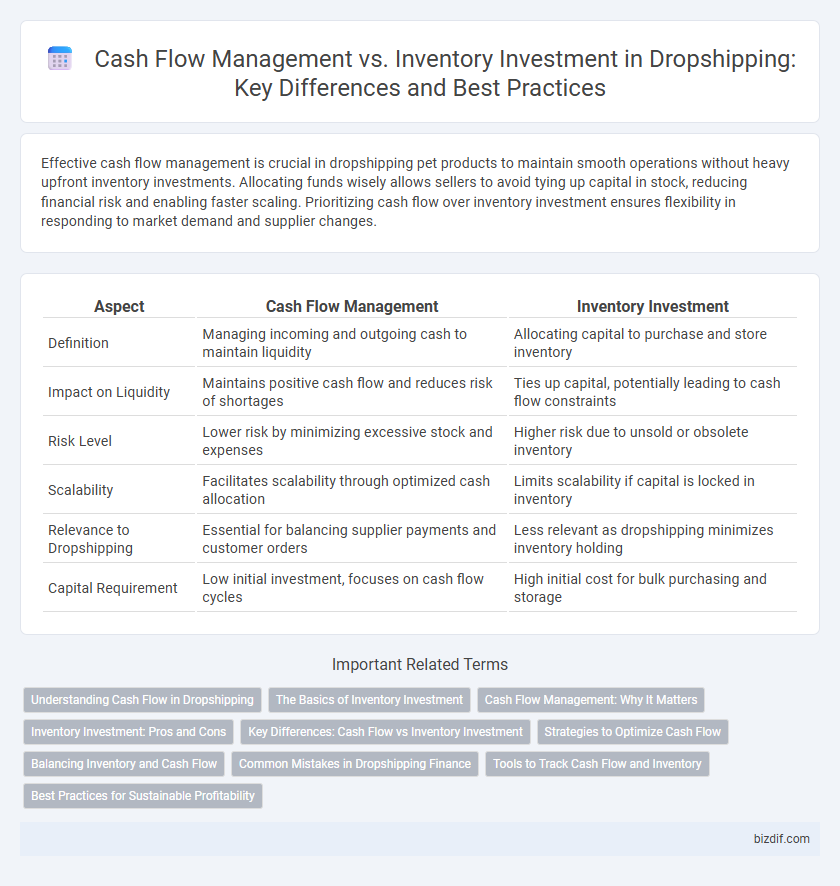

Effective cash flow management is crucial in dropshipping pet products to maintain smooth operations without heavy upfront inventory investments. Allocating funds wisely allows sellers to avoid tying up capital in stock, reducing financial risk and enabling faster scaling. Prioritizing cash flow over inventory investment ensures flexibility in responding to market demand and supplier changes.

Table of Comparison

| Aspect | Cash Flow Management | Inventory Investment |

|---|---|---|

| Definition | Managing incoming and outgoing cash to maintain liquidity | Allocating capital to purchase and store inventory |

| Impact on Liquidity | Maintains positive cash flow and reduces risk of shortages | Ties up capital, potentially leading to cash flow constraints |

| Risk Level | Lower risk by minimizing excessive stock and expenses | Higher risk due to unsold or obsolete inventory |

| Scalability | Facilitates scalability through optimized cash allocation | Limits scalability if capital is locked in inventory |

| Relevance to Dropshipping | Essential for balancing supplier payments and customer orders | Less relevant as dropshipping minimizes inventory holding |

| Capital Requirement | Low initial investment, focuses on cash flow cycles | High initial cost for bulk purchasing and storage |

Understanding Cash Flow in Dropshipping

Effective cash flow management in dropshipping ensures continuous operations without tying up capital in inventory, as products are only purchased after customer orders are received. Understanding cash flow involves tracking inflows from sales and outflows such as supplier payments, marketing, and platform fees to prevent liquidity shortages. Prioritizing cash flow over inventory investment minimizes financial risks and supports scalable growth in the dropshipping business model.

The Basics of Inventory Investment

Effective inventory investment in dropshipping involves minimizing upfront capital by leveraging supplier stock, reducing the need to purchase large quantities of products. Maintaining optimal stock levels ensures steady cash flow, preventing overinvestment that can lock funds in unsold inventory. Prioritizing accurate demand forecasting and supplier reliability supports efficient inventory management without compromising liquidity.

Cash Flow Management: Why It Matters

Effective cash flow management is critical in dropshipping, enabling sellers to cover operational expenses and respond swiftly to market demand without tying up capital in inventory. Unlike traditional retail models, dropshipping minimizes inventory investment, allowing funds to be allocated towards marketing and customer acquisition strategies. Maintaining positive cash flow ensures sustainability and the ability to scale by avoiding liquidity issues and enhancing financial flexibility.

Inventory Investment: Pros and Cons

Inventory investment in dropshipping reduces reliance on suppliers and enhances order fulfillment speed by holding stock, which can improve customer satisfaction and boost sales. However, it requires significant upfront capital, risks excess stock, and increases storage costs compared to a pure dropshipping model. Effective inventory management balances these trade-offs to optimize cash flow while minimizing stockouts and overstock situations.

Key Differences: Cash Flow vs Inventory Investment

Effective cash flow management in dropshipping emphasizes maintaining liquidity by minimizing upfront inventory costs, allowing for flexible operational control and quicker responsiveness to market demand. In contrast, inventory investment involves allocating capital to stock physical products, which can tie up funds and increase the risk of obsolescence or markdowns. Understanding the balance between cash flow and inventory investment is crucial for optimizing profitability and sustaining business growth in the dropshipping model.

Strategies to Optimize Cash Flow

Effective cash flow management in dropshipping hinges on minimizing upfront inventory investment by leveraging just-in-time purchasing from suppliers. Implementing real-time sales tracking integrated with supplier order automation ensures capital is not tied up in stock, optimizing liquidity. Strategic negotiation of payment terms with suppliers and the use of dynamic pricing models further enhance cash flow stability and business scalability.

Balancing Inventory and Cash Flow

Effective dropshipping businesses balance inventory investment and cash flow by minimizing stock holding costs while ensuring product availability to meet demand. Strategic cash flow management involves monitoring sales cycles and supplier payment terms to avoid liquidity shortages and optimize reorder timing. Maintaining this balance supports sustainable growth and prevents cash flow disruptions that can impede order fulfillment.

Common Mistakes in Dropshipping Finance

Poor cash flow management and excessive inventory investment are common mistakes in dropshipping finance that can lead to business failure. Many dropshippers mistakenly tie up capital in large inventory purchases, reducing liquidity and hindering their ability to respond to market changes. Effective financial planning prioritizes maintaining positive cash flow and avoiding overstocking to ensure sustainable operations.

Tools to Track Cash Flow and Inventory

Effective cash flow management and inventory investment in dropshipping rely heavily on specialized tools such as QuickBooks, Xero, and Zoho Inventory for real-time financial tracking and accurate stock monitoring. These platforms integrate sales, expenses, and supplier data to provide comprehensive dashboards that highlight liquidity and inventory turnover rates, crucial for maintaining operational balance. Utilizing tools like TradeGecko and DEAR Systems enhances forecasting accuracy and automates reorder points, minimizing stockouts and excess investment while maximizing cash flow efficiency.

Best Practices for Sustainable Profitability

Effective cash flow management in dropshipping prioritizes timely payments and accurate forecasting to avoid liquidity shortages, ensuring continuous order fulfillment without overextending capital. Minimizing inventory investment reduces holding costs and risks of obsolescence, vital for maintaining operational agility in a fluctuating market. Combining real-time sales analytics with vendor negotiation strategies optimizes working capital allocation, driving sustainable profitability in the dropshipping business model.

Cash Flow Management vs Inventory Investment Infographic

bizdif.com

bizdif.com