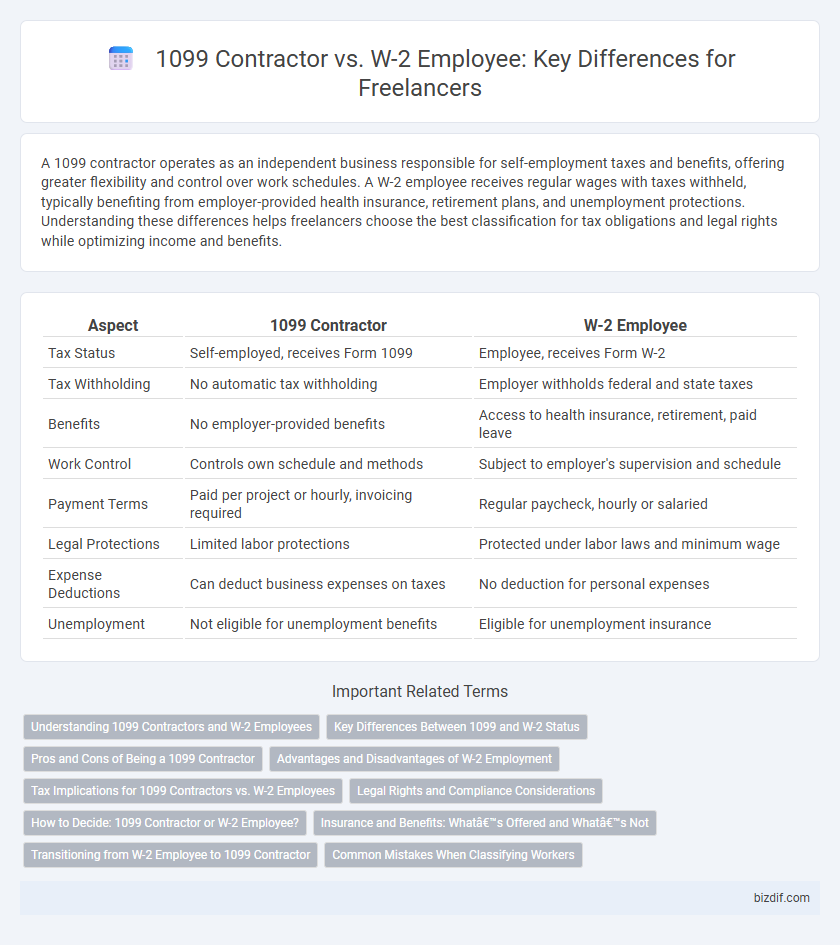

A 1099 contractor operates as an independent business responsible for self-employment taxes and benefits, offering greater flexibility and control over work schedules. A W-2 employee receives regular wages with taxes withheld, typically benefiting from employer-provided health insurance, retirement plans, and unemployment protections. Understanding these differences helps freelancers choose the best classification for tax obligations and legal rights while optimizing income and benefits.

Table of Comparison

| Aspect | 1099 Contractor | W-2 Employee |

|---|---|---|

| Tax Status | Self-employed, receives Form 1099 | Employee, receives Form W-2 |

| Tax Withholding | No automatic tax withholding | Employer withholds federal and state taxes |

| Benefits | No employer-provided benefits | Access to health insurance, retirement, paid leave |

| Work Control | Controls own schedule and methods | Subject to employer's supervision and schedule |

| Payment Terms | Paid per project or hourly, invoicing required | Regular paycheck, hourly or salaried |

| Legal Protections | Limited labor protections | Protected under labor laws and minimum wage |

| Expense Deductions | Can deduct business expenses on taxes | No deduction for personal expenses |

| Unemployment | Not eligible for unemployment benefits | Eligible for unemployment insurance |

Understanding 1099 Contractors and W-2 Employees

1099 contractors operate as independent workers who manage their own taxes, benefits, and work schedules, giving them greater flexibility but less job security compared to W-2 employees. W-2 employees receive employer-controlled benefits such as health insurance, retirement plans, and payroll tax withholding, making them reliant on the employer for compliance and tax responsibilities. Understanding the classification differences is critical for tax reporting, legal compliance, and determining rights regarding benefits and workplace protections.

Key Differences Between 1099 and W-2 Status

1099 contractors operate as independent businesses, managing their own taxes, benefits, and work schedules, while W-2 employees receive employer-managed tax withholdings, benefits, and structured work hours. Contractors typically file estimated quarterly taxes and are responsible for self-employment tax, whereas employees have income tax, Social Security, and Medicare taxes automatically withheld. The distinction impacts legal protections, with W-2 employees entitled to labor rights like minimum wage and overtime, which 1099 contractors generally do not receive.

Pros and Cons of Being a 1099 Contractor

Being a 1099 contractor offers greater flexibility and control over work schedules, enabling independent decision-making on projects and clients. However, 1099 contractors are responsible for self-employment taxes, health insurance, and retirement savings, lacking employer-provided benefits such as paid leave and unemployment insurance. This classification also requires meticulous record-keeping and quarterly tax payments to avoid penalties.

Advantages and Disadvantages of W-2 Employment

W-2 employment offers advantages such as employer-covered benefits, tax withholdings, and eligibility for unemployment insurance, providing financial security and reduced administrative responsibilities. However, disadvantages include less flexibility in work hours and location, as well as limited control over tax deductions compared to 1099 contractors. Employers also have more control over W-2 employees' schedules and workplace policies, which can restrict independence.

Tax Implications for 1099 Contractors vs. W-2 Employees

1099 contractors are responsible for paying self-employment taxes, including both the employer and employee portions of Social Security and Medicare, which amounts to 15.3% of their net earnings, whereas W-2 employees have these taxes withheld and partially covered by their employer. Unlike W-2 employees, 1099 contractors can deduct business expenses directly against their income, reducing their overall taxable income. However, W-2 employees benefit from employer-paid taxes and often have access to tax-advantaged benefits like retirement plans and health insurance, which are typically not available to 1099 contractors.

Legal Rights and Compliance Considerations

1099 contractors operate as independent businesses responsible for their own tax payments and lack employee benefits such as health insurance and unemployment protection, which are legally required for W-2 employees. W-2 employees receive employer-managed tax withholdings, workers' compensation, and protections under labor laws like minimum wage and overtime regulations, ensuring compliance with federal and state employment standards. Misclassification between 1099 contractors and W-2 employees can lead to legal penalties, tax liabilities, and disputes over benefits, making proper classification critical for regulatory compliance and workers' rights.

How to Decide: 1099 Contractor or W-2 Employee?

Evaluate your work preferences and legal responsibilities to decide between a 1099 contractor and a W-2 employee. Choose 1099 contractor status if you value independence, control over your schedule, and handle your own taxes and benefits. Opt for W-2 employee status if you prefer employer-provided benefits, tax withholding, and workplace protections under federal and state labor laws.

Insurance and Benefits: What’s Offered and What’s Not

1099 contractors typically do not receive employer-sponsored insurance or benefits such as health, dental, vision, or retirement plans, requiring them to secure coverage independently. W-2 employees receive a package of benefits including employer-covered health insurance, paid time off, and contributions to retirement plans, reducing their out-of-pocket expenses. The lack of guaranteed benefits for 1099 contractors necessitates careful budgeting for insurance premiums and retirement savings.

Transitioning from W-2 Employee to 1099 Contractor

Transitioning from a W-2 employee to a 1099 contractor requires understanding the differences in tax obligations, as 1099 contractors must handle self-employment taxes and quarterly estimated payments. Contractors gain control over their work schedule and client relationships but must also manage benefits such as health insurance and retirement savings independently. Properly setting up a business entity and maintaining detailed records are essential for maximizing deductions and compliance with IRS regulations.

Common Mistakes When Classifying Workers

Misclassifying freelancers as W-2 employees or 1099 contractors can lead to costly legal and tax penalties. A frequent mistake is treating workers as independent contractors without considering the degree of control over their work, which the IRS evaluates through behavioral and financial factors. Employers must carefully assess criteria such as autonomy, payment methods, and provision of tools to ensure correct classification and compliance.

1099 Contractor vs W-2 Employee Infographic

bizdif.com

bizdif.com