Escrow payments provide a secure middle ground where funds are held by a third party until project milestones are verified, reducing the risk of non-payment or disputes. Direct transfers offer faster transactions but expose freelancers to higher risks if clients delay or refuse payment. Choosing escrow services enhances trust and guarantees payment but may involve additional fees compared to straightforward direct transfers.

Table of Comparison

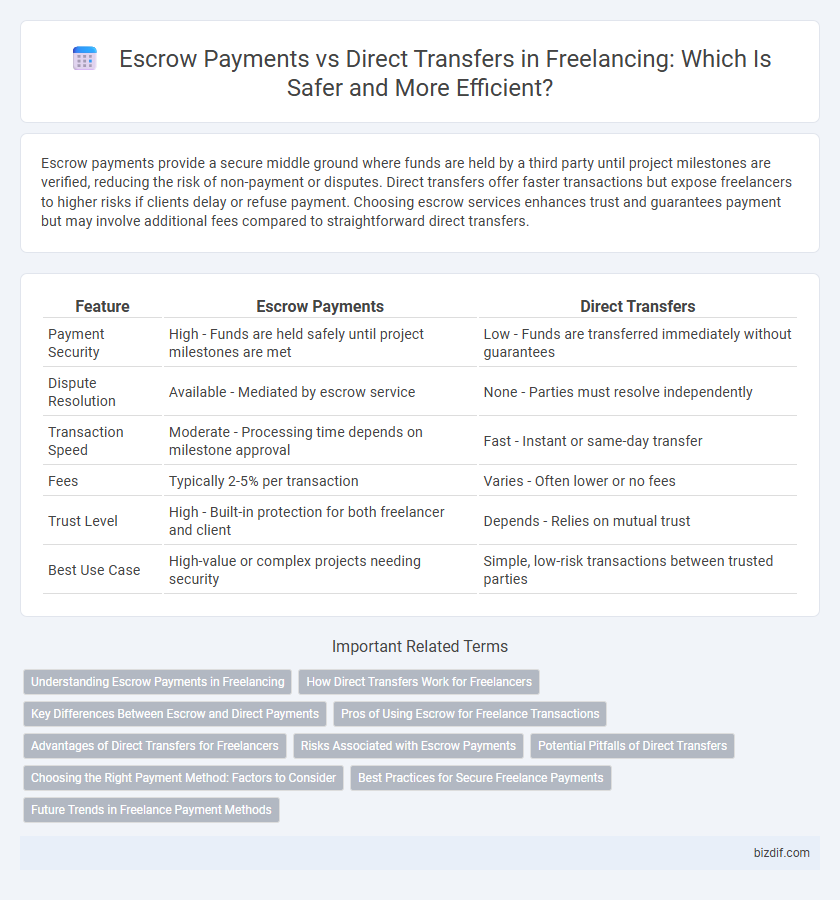

| Feature | Escrow Payments | Direct Transfers |

|---|---|---|

| Payment Security | High - Funds are held safely until project milestones are met | Low - Funds are transferred immediately without guarantees |

| Dispute Resolution | Available - Mediated by escrow service | None - Parties must resolve independently |

| Transaction Speed | Moderate - Processing time depends on milestone approval | Fast - Instant or same-day transfer |

| Fees | Typically 2-5% per transaction | Varies - Often lower or no fees |

| Trust Level | High - Built-in protection for both freelancer and client | Depends - Relies on mutual trust |

| Best Use Case | High-value or complex projects needing security | Simple, low-risk transactions between trusted parties |

Understanding Escrow Payments in Freelancing

Escrow payments in freelancing serve as a secure method where funds are held by a third party until project milestones or complete delivery is met, ensuring protection for both clients and freelancers. This system mitigates risks of non-payment or incomplete work by verifying that agreed-upon terms are fulfilled before releasing funds. Escrow increases trust in online contracts, making it a preferred choice for high-value or long-term freelance projects.

How Direct Transfers Work for Freelancers

Direct transfers for freelancers involve the client sending payments straight to the freelancer's bank account or digital wallet without intermediaries. This method typically offers faster fund access and lower transaction fees compared to escrow payments, but it requires a high level of trust between both parties to avoid disputes or non-payment. Secure platforms and clear contracts help mitigate risks associated with direct transfers, ensuring smooth financial transactions in freelancing projects.

Key Differences Between Escrow and Direct Payments

Escrow payments provide a secure process where funds are held by a neutral third party until project milestones or contract terms are met, ensuring protection for both freelancers and clients. Direct transfers involve immediate payment from client to freelancer, offering speed but less security, which can increase the risk of disputes or non-payment. The key difference lies in risk management: escrow minimizes financial risk by verifying work completion before releasing funds, while direct transfers emphasize simplicity and speed without built-in safeguards.

Pros of Using Escrow for Freelance Transactions

Escrow payments provide a secure method for freelance transactions by holding funds until project milestones or deliverables are met, protecting both clients and freelancers from potential disputes. This system ensures timely payment and builds trust by guaranteeing that funds are available and only released upon satisfactory work completion. Escrow services also reduce the risk of non-payment or fraud, making them a preferred choice for high-value or complex freelance projects.

Advantages of Direct Transfers for Freelancers

Direct transfers offer freelancers faster access to funds by eliminating the waiting periods often associated with escrow payments, improving cash flow and financial flexibility. These payments reduce administrative overhead and fees, maximizing the net income received from clients. Direct transfers also enhance communication transparency and trust, as freelancers can track transactions more easily and negotiate terms without intermediary delays.

Risks Associated with Escrow Payments

Escrow payments in freelancing offer security but carry risks such as delayed fund release which can disrupt cash flow and project timelines. Fraudulent disputes may arise, potentially locking funds indefinitely while resolution processes occur. Dependence on third-party escrow services introduces vulnerability to service outages and non-refundable fees, impacting overall payment reliability.

Potential Pitfalls of Direct Transfers

Direct transfers in freelancing pose risks such as lack of payment security, making it difficult to resolve disputes without a neutral third party. Clients may delay or withhold payments, leaving freelancers vulnerable to financial loss and uncertainty. Unlike escrow payments, direct transfers do not offer built-in protections or structured release of funds upon project milestones.

Choosing the Right Payment Method: Factors to Consider

Choosing between escrow payments and direct transfers depends on factors such as project size, trust level, and risk tolerance. Escrow offers protection by holding funds until project milestones are met, ensuring security for both freelancers and clients. Direct transfers provide faster payments but require a strong trust relationship to minimize potential disputes and payment delays.

Best Practices for Secure Freelance Payments

Escrow payments provide a secure method for freelance transactions by holding funds in a trusted third-party account until both client and freelancer fulfill contract terms, reducing the risk of non-payment or fraud. Direct transfers offer faster payment processing but require clear communication and verified payment methods to ensure security. Utilizing reputable platforms with escrow services and maintaining transparent agreements between parties is essential for protecting freelance payments.

Future Trends in Freelance Payment Methods

Escrow payments provide enhanced security by holding funds until project milestones are met, appealing to both freelancers and clients seeking trust and accountability. Direct transfers offer speed and simplicity, favored in markets with established relationships and lower dispute risks. Future trends indicate a shift toward blockchain-based escrow solutions and real-time payment platforms, combining transparency, reduced transaction fees, and faster fund access in freelance payment methods.

Escrow Payments vs Direct Transfers Infographic

bizdif.com

bizdif.com