Paypal and Stripe are two leading payment gateways widely used in freelancing platforms for seamless transactions. Paypal offers user-friendly interfaces with broad acceptance and instant transfers, making it ideal for quick and straightforward payments. Stripe provides advanced customization options and robust API integrations, allowing freelancers to tailor payment processing to specific business needs.

Table of Comparison

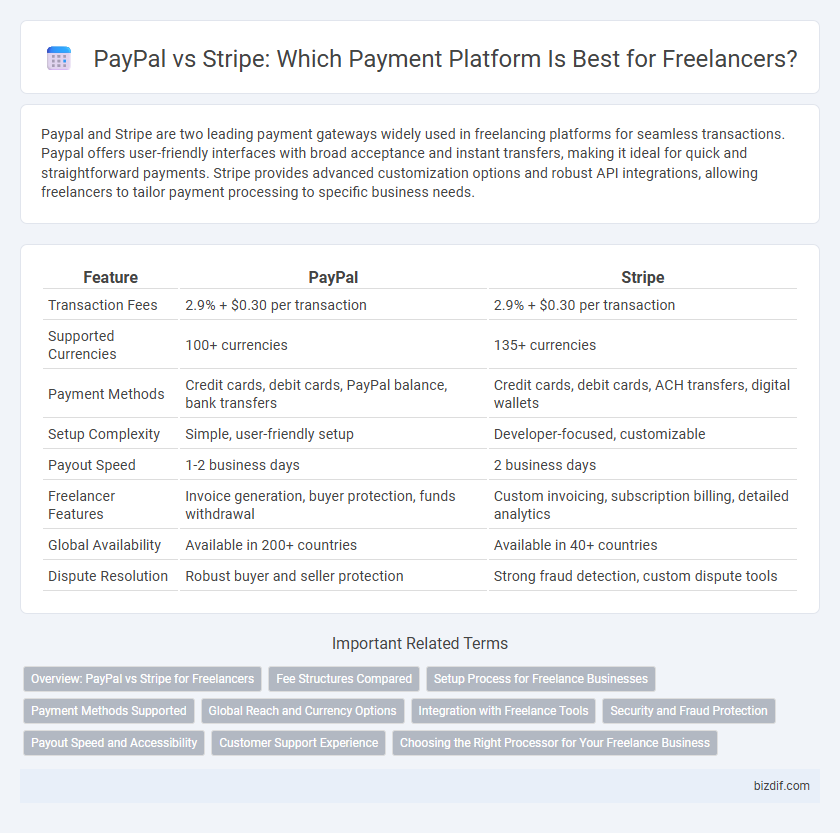

| Feature | PayPal | Stripe |

|---|---|---|

| Transaction Fees | 2.9% + $0.30 per transaction | 2.9% + $0.30 per transaction |

| Supported Currencies | 100+ currencies | 135+ currencies |

| Payment Methods | Credit cards, debit cards, PayPal balance, bank transfers | Credit cards, debit cards, ACH transfers, digital wallets |

| Setup Complexity | Simple, user-friendly setup | Developer-focused, customizable |

| Payout Speed | 1-2 business days | 2 business days |

| Freelancer Features | Invoice generation, buyer protection, funds withdrawal | Custom invoicing, subscription billing, detailed analytics |

| Global Availability | Available in 200+ countries | Available in 40+ countries |

| Dispute Resolution | Robust buyer and seller protection | Strong fraud detection, custom dispute tools |

Overview: PayPal vs Stripe for Freelancers

PayPal offers a widely recognized, user-friendly payment platform with easy setup and broad global acceptance, making it ideal for freelancers needing quick access to funds. Stripe provides advanced customization and seamless integration with online invoicing and e-commerce tools, appealing to freelancers managing complex billing and subscription services. Both platforms support multiple currencies and offer competitive transaction fees, but Stripe's developer-focused features give freelancers greater control over payment workflows and automation.

Fee Structures Compared

PayPal charges 2.9% plus $0.30 per domestic transaction, while Stripe offers a similar fee of 2.9% plus $0.30 but provides more customized pricing for high-volume freelancers. PayPal imposes additional fees for international payments and currency conversions, often making Stripe more cost-effective for cross-border freelancing. Stripe supports seamless integration with invoicing and subscription models, which can reduce hidden costs compared to PayPal's variable dispute and refund fees.

Setup Process for Freelance Businesses

PayPal offers a straightforward setup process for freelance businesses, requiring minimal documentation and enabling quick account activation to start accepting payments immediately. Stripe demands more detailed business verification and technical integration, providing customizable payment solutions ideal for freelancers with developer resources. Both platforms support a global client base, but PayPal's simplicity suits freelancers seeking rapid deployment, while Stripe excels in scalability and tailored payment experiences.

Payment Methods Supported

PayPal supports a wide range of payment methods including credit and debit cards, bank transfers, PayPal balance, and funding through linked bank accounts or cards across more than 200 markets. Stripe offers extensive payment method options such as credit and debit cards, digital wallets like Apple Pay and Google Pay, ACH transfers, and local payment options including Alipay, SEPA Direct Debit, and iDEAL, making it ideal for global freelancers. Both platforms facilitate multi-currency transactions, ensuring seamless international payments for freelancing projects.

Global Reach and Currency Options

PayPal supports transactions in over 200 countries and accepts 25 currencies, making it a versatile option for freelancers working with international clients. Stripe offers powerful multi-currency processing with support for 40+ currencies and localized payment methods, enhancing the global payment experience. Both platforms provide extensive global reach, but PayPal's widespread recognition and Stripe's robust currency adaptability cater to diverse freelancer needs.

Integration with Freelance Tools

PayPal and Stripe offer seamless integration with popular freelance platforms such as Upwork, Fiverr, and QuickBooks, enhancing payment processing efficiency for freelancers. Stripe provides robust APIs that support customizable invoicing and subscription billing, while PayPal excels in widespread acceptance and easy setup with minimal technical expertise. Both platforms enable smooth synchronization with accounting software like Xero and FreshBooks, streamlining financial management for independent professionals.

Security and Fraud Protection

PayPal and Stripe both offer robust security measures tailored for freelancers, with PayPal utilizing advanced encryption protocols and buyer protection policies to safeguard transactions. Stripe employs machine learning fraud detection and two-factor authentication, providing real-time monitoring to minimize chargebacks and unauthorized access. For freelancers, choosing between the two hinges on the specific security features aligned with client payment behaviors and their own risk management preferences.

Payout Speed and Accessibility

Paypal offers faster payout speeds with instant transfers available to eligible users, making it ideal for freelancers requiring quick access to funds. Stripe typically processes payouts on a two-day rolling basis, which may delay payment availability but supports a broad range of currencies and countries. Accessibility-wise, Paypal is widely accepted across 200+ markets and supports 25 currencies, whereas Stripe covers fewer countries but integrates seamlessly with various freelance platforms and e-commerce tools.

Customer Support Experience

Paypal offers 24/7 customer support through phone and live chat, known for quick dispute resolution and extensive self-help resources, which benefits freelancers dealing with urgent payment issues. Stripe's customer support is highly rated for personalized email responses and a comprehensive developer-friendly documentation platform, ideal for freelancers requiring technical integration assistance. Both platforms provide reliable support, but PayPal's direct phone service often leads to faster real-time resolutions compared to Stripe's primarily email-based support.

Choosing the Right Processor for Your Freelance Business

PayPal and Stripe are leading payment processors for freelancers, each offering unique features tailored to different business needs. PayPal excels with widespread recognition and easy integration for international clients, while Stripe provides advanced customization and competitive transaction fees ideal for growing freelance businesses. Evaluate factors like transaction costs, payment flexibility, and client preferences to select the most efficient processor that aligns with your freelance business model.

Paypal vs Stripe Infographic

bizdif.com

bizdif.com