Self-employment tax combines Social Security and Medicare taxes typically withheld by employers from payroll taxes, but freelancers must calculate and pay these taxes themselves. Payroll tax is deducted directly from employees' paychecks and matched by employers, reducing the immediate tax burden on the worker. Understanding the distinction and obligations helps freelancers manage their tax liabilities effectively and avoid penalties.

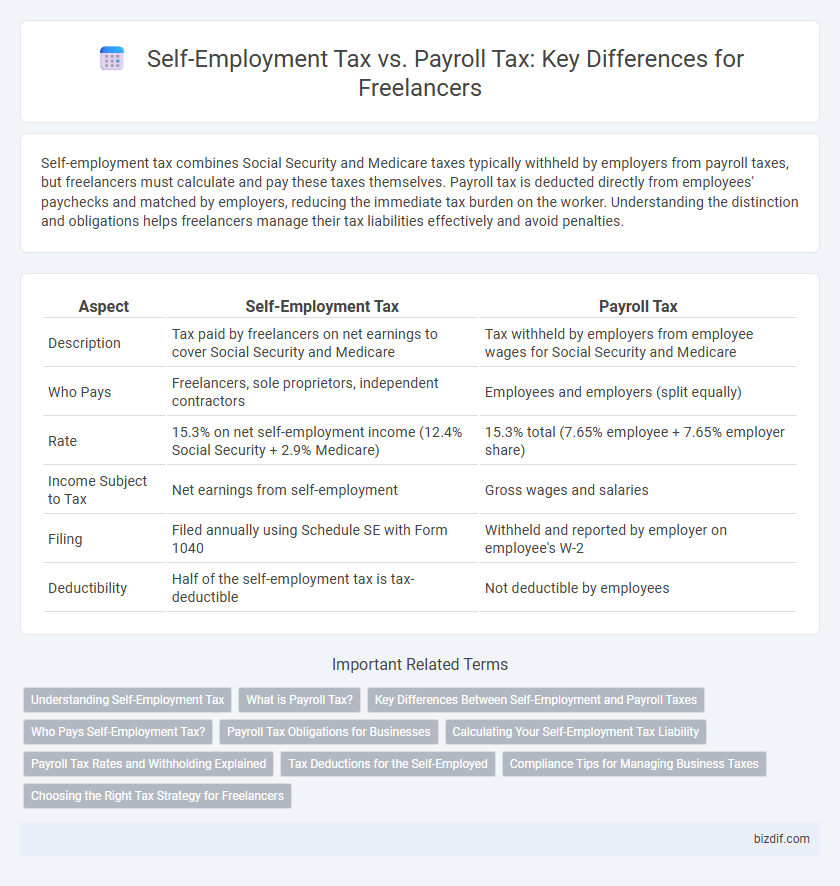

Table of Comparison

| Aspect | Self-Employment Tax | Payroll Tax |

|---|---|---|

| Description | Tax paid by freelancers on net earnings to cover Social Security and Medicare | Tax withheld by employers from employee wages for Social Security and Medicare |

| Who Pays | Freelancers, sole proprietors, independent contractors | Employees and employers (split equally) |

| Rate | 15.3% on net self-employment income (12.4% Social Security + 2.9% Medicare) | 15.3% total (7.65% employee + 7.65% employer share) |

| Income Subject to Tax | Net earnings from self-employment | Gross wages and salaries |

| Filing | Filed annually using Schedule SE with Form 1040 | Withheld and reported by employer on employee's W-2 |

| Deductibility | Half of the self-employment tax is tax-deductible | Not deductible by employees |

Understanding Self-Employment Tax

Self-employment tax encompasses Social Security and Medicare taxes for individuals who work for themselves, unlike payroll tax where employers withhold these taxes from employees' wages. Freelancers must calculate and pay self-employment tax using Schedule SE with their annual tax return, typically amounting to 15.3% on net earnings. Understanding self-employment tax is crucial for accurate financial planning and ensuring compliance with IRS regulations.

What is Payroll Tax?

Payroll tax refers to the taxes employers are legally required to withhold from employees' wages and remit to the government, covering Social Security, Medicare, and unemployment taxes. These taxes fund federal and state programs that provide benefits such as retirement, healthcare, and unemployment insurance. Unlike self-employment tax, payroll tax is typically split between the employer and employee, with the employer responsible for withholding and submitting the employee's portion.

Key Differences Between Self-Employment and Payroll Taxes

Self-employment tax primarily covers Social Security and Medicare contributions for independent contractors, calculated on net earnings, while payroll tax is withheld by employers from employees' wages and combined with employer contributions. Self-employed individuals must pay both the employee and employer portions of these taxes, resulting in a higher overall tax rate compared to payroll tax. Payroll taxes are reported and remitted through employer tax returns, whereas self-employed workers report self-employment taxes via Schedule SE on their personal tax returns.

Who Pays Self-Employment Tax?

Self-employment tax is paid by individuals who work as freelancers, independent contractors, or sole proprietors, covering Social Security and Medicare contributions typically withheld from employees' paychecks. Unlike payroll tax, which employers and employees share, self-employed individuals are responsible for the entire self-employment tax themselves. This tax applies to net earnings from self-employment income, ensuring independent workers contribute to Social Security and Medicare programs.

Payroll Tax Obligations for Businesses

Businesses must comply with payroll tax obligations by withholding federal income tax, Social Security, and Medicare taxes from employee wages and remitting these amounts to the IRS. Employers are responsible for paying the employer portion of Social Security and Medicare taxes, as well as federal and state unemployment taxes, which are not applicable to self-employed individuals. Accurate payroll tax reporting and timely payments are essential to avoid penalties and ensure compliance with federal and state tax regulations.

Calculating Your Self-Employment Tax Liability

Calculating your self-employment tax liability involves determining your net earnings from self-employment, which includes income earned minus business expenses, then applying the current self-employment tax rate of 15.3% covering Social Security and Medicare contributions. Unlike payroll tax withheld by employers on wages, self-employed individuals are responsible for both the employer and employee portions of these taxes, making tax planning essential to avoid unexpected liabilities. Accurate record-keeping of income and deductible expenses ensures precise calculation and timely payment of self-employment taxes using Schedule SE attached to your IRS Form 1040.

Payroll Tax Rates and Withholding Explained

Payroll tax rates typically include Social Security and Medicare contributions, which employers must withhold from employees' wages and match with their own funds. The current combined rate for Social Security is 12.4%, split evenly between employer and employee, while the Medicare tax rate is 2.9%, also shared equally, with an additional 0.9% Medicare surtax on high earners withheld from employees only. Understanding payroll tax withholding is crucial for businesses to ensure compliance with IRS regulations and avoid penalties.

Tax Deductions for the Self-Employed

Self-employed individuals pay self-employment tax, which covers both Social Security and Medicare taxes, unlike payroll tax split between employer and employee. Key tax deductions for the self-employed include business expenses such as home office costs, health insurance premiums, and retirement contributions, reducing taxable income significantly. Understanding these deductions is essential for minimizing tax liability while complying with IRS regulations.

Compliance Tips for Managing Business Taxes

Understanding the difference between self-employment tax and payroll tax is crucial for freelancers to ensure proper tax compliance and avoid penalties. Freelancers must calculate and pay self-employment taxes, which cover Social Security and Medicare, directly to the IRS through quarterly estimated tax payments. Implementing organized bookkeeping, using accounting software, and consulting a tax professional can help manage deductions, track expenses, and stay on top of tax deadlines effectively.

Choosing the Right Tax Strategy for Freelancers

Freelancers should understand that self-employment tax covers Social Security and Medicare contributions, typically totaling 15.3%, while payroll tax is withheld by employers on employees' wages. Choosing the right tax strategy involves evaluating income levels, business structure, and potential deductions to minimize tax liability. Consulting a tax professional helps freelancers optimize payments and remain compliant with IRS regulations.

Self-Employment Tax vs Payroll Tax Infographic

bizdif.com

bizdif.com