Choosing between a sole proprietorship and an LLC impacts legal liability and tax obligations in freelancing. A sole proprietor faces unlimited personal liability but benefits from simpler tax filings, whereas an LLC provides liability protection by separating personal and business assets while allowing flexible tax treatment. Understanding these differences helps freelancers optimize their business structure for risk management and financial efficiency.

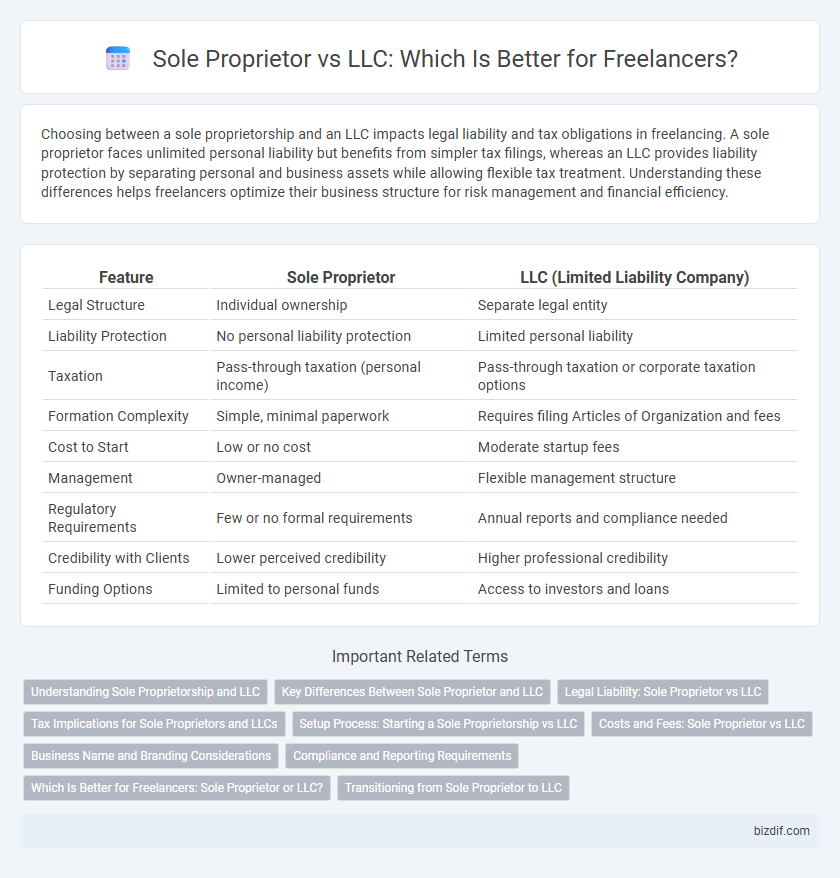

Table of Comparison

| Feature | Sole Proprietor | LLC (Limited Liability Company) |

|---|---|---|

| Legal Structure | Individual ownership | Separate legal entity |

| Liability Protection | No personal liability protection | Limited personal liability |

| Taxation | Pass-through taxation (personal income) | Pass-through taxation or corporate taxation options |

| Formation Complexity | Simple, minimal paperwork | Requires filing Articles of Organization and fees |

| Cost to Start | Low or no cost | Moderate startup fees |

| Management | Owner-managed | Flexible management structure |

| Regulatory Requirements | Few or no formal requirements | Annual reports and compliance needed |

| Credibility with Clients | Lower perceived credibility | Higher professional credibility |

| Funding Options | Limited to personal funds | Access to investors and loans |

Understanding Sole Proprietorship and LLC

A sole proprietorship is the simplest business structure, where the owner has full control and unlimited personal liability for business debts and obligations. An LLC, or Limited Liability Company, provides liability protection by separating personal assets from business liabilities, while offering flexible tax options and management structures. Choosing between these depends on risk tolerance, tax preferences, and long-term business goals in freelancing.

Key Differences Between Sole Proprietor and LLC

A sole proprietor operates under their personal name, bearing unlimited personal liability for business debts and obligations, while an LLC (Limited Liability Company) provides liability protection by separating personal assets from business liabilities. LLCs often require formal registration with the state and may involve higher startup and maintenance costs, whereas sole proprietorships are simpler to establish and manage with fewer regulatory requirements. Tax flexibility differs as well; sole proprietors report business income on personal tax returns, while LLCs can choose to be taxed as sole proprietors, partnerships, or corporations, potentially offering tax advantages.

Legal Liability: Sole Proprietor vs LLC

Sole proprietors face unlimited personal liability, meaning their personal assets are at risk for business debts and legal claims. An LLC (Limited Liability Company) provides liability protection by separating personal assets from business liabilities, shielding owners from most legal and financial obligations of the business. Choosing an LLC structure can significantly reduce legal risk exposure compared to operating as a sole proprietor.

Tax Implications for Sole Proprietors and LLCs

Sole proprietors report business income and expenses on Schedule C of their personal tax return, resulting in profits being taxed at individual income tax rates and subject to self-employment tax. LLCs provide flexibility by allowing income to be taxed as a sole proprietorship, partnership, or corporation, potentially reducing self-employment taxes through an S corporation election. Choosing an LLC can offer tax advantages, such as pass-through taxation and deductible business expenses, while also providing liability protection not available to sole proprietors.

Setup Process: Starting a Sole Proprietorship vs LLC

Starting a sole proprietorship involves minimal paperwork, often requiring just a business license or permit, making it the quickest and most cost-effective option for freelancers. Forming an LLC requires filing Articles of Organization with the state and paying associated fees, which can vary between $50 to $500 depending on the jurisdiction. An LLC also typically involves creating an Operating Agreement and complies with more formalities, offering greater legal protections but demanding a more complex setup process.

Costs and Fees: Sole Proprietor vs LLC

Sole proprietors benefit from minimal startup and ongoing costs, typically limited to basic business licenses or permits, whereas LLCs incur higher initial state filing fees and annual franchise or report fees that vary by state. Sole proprietorships avoid separate tax filings, reducing accounting expenses, while LLCs may require more complex and costly tax preparation due to possible multi-member structures and pass-through taxation compliance. Budget-conscious freelancers often prefer sole proprietorship to minimize costs, but LLCs offer liability protection worth the additional fee investment.

Business Name and Branding Considerations

Choosing between a sole proprietorship and an LLC directly impacts business name registration and branding flexibility. Sole proprietors often operate under their legal name or a registered "Doing Business As" (DBA) name, limiting exclusivity and protection. An LLC provides stronger brand identity through registered business names with state protection, enhancing credibility and preventing competitors from using the same name.

Compliance and Reporting Requirements

Sole proprietors face minimal compliance and reporting requirements, typically only needing to report income on a personal tax return using Schedule C. LLCs are subject to more rigorous compliance, including filing annual reports with the state, maintaining operating agreements, and potentially paying franchise taxes depending on the jurisdiction. LLC members must also adhere to separate tax filings, such as issuing K-1 forms for multi-member LLCs, adding complexity compared to sole proprietorships.

Which Is Better for Freelancers: Sole Proprietor or LLC?

Freelancers benefit from choosing an LLC over a sole proprietorship due to enhanced legal protection and potential tax advantages. While a sole proprietor assumes personal liability for business debts, an LLC separates personal assets from business liabilities, reducing financial risk. LLCs also offer flexible tax options like pass-through taxation, making them a better choice for freelancers aiming to grow and safeguard their freelance business.

Transitioning from Sole Proprietor to LLC

Transitioning from a sole proprietorship to an LLC provides freelancers with enhanced legal protection by separating personal and business liabilities. Forming an LLC can improve credibility with clients and enable potential tax advantages through pass-through taxation or electing corporate tax treatment. This transition requires filing formation documents with the state and updating contracts and financial accounts to reflect the LLC structure.

Sole proprietor vs LLC Infographic

bizdif.com

bizdif.com