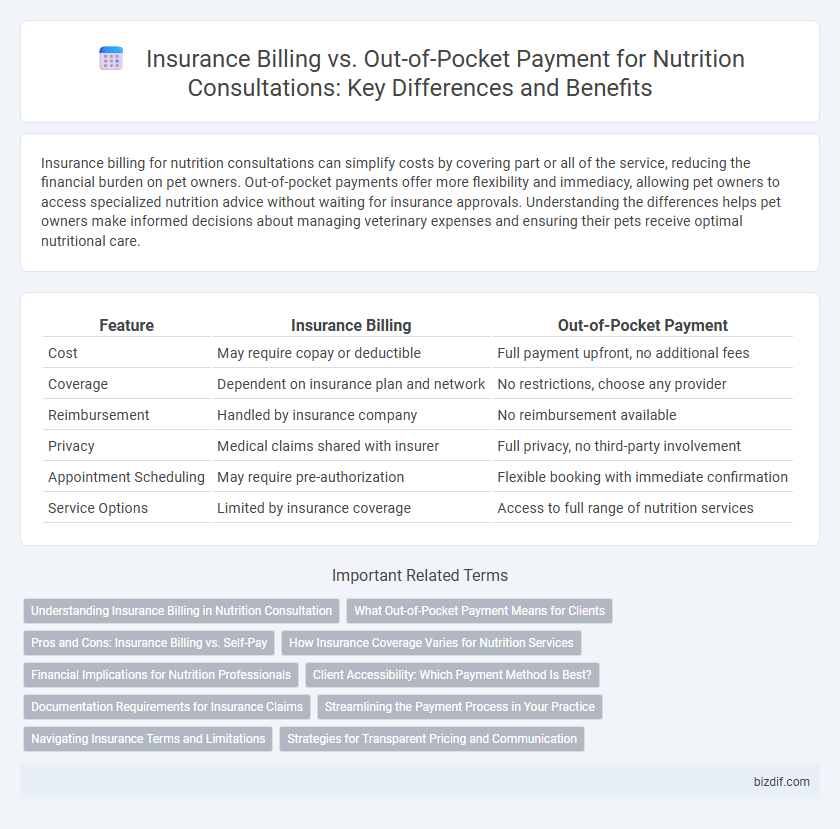

Insurance billing for nutrition consultations can simplify costs by covering part or all of the service, reducing the financial burden on pet owners. Out-of-pocket payments offer more flexibility and immediacy, allowing pet owners to access specialized nutrition advice without waiting for insurance approvals. Understanding the differences helps pet owners make informed decisions about managing veterinary expenses and ensuring their pets receive optimal nutritional care.

Table of Comparison

| Feature | Insurance Billing | Out-of-Pocket Payment |

|---|---|---|

| Cost | May require copay or deductible | Full payment upfront, no additional fees |

| Coverage | Dependent on insurance plan and network | No restrictions, choose any provider |

| Reimbursement | Handled by insurance company | No reimbursement available |

| Privacy | Medical claims shared with insurer | Full privacy, no third-party involvement |

| Appointment Scheduling | May require pre-authorization | Flexible booking with immediate confirmation |

| Service Options | Limited by insurance coverage | Access to full range of nutrition services |

Understanding Insurance Billing in Nutrition Consultation

Understanding insurance billing in nutrition consultation involves knowing which services are covered by your health plan, such as medical nutrition therapy for chronic conditions like diabetes or kidney disease. Insurance claims require precise coding and documentation from the nutritionist to ensure proper reimbursement, which varies by provider and policy. Patients should verify their benefits and potential co-pays to avoid unexpected out-of-pocket expenses during nutrition consultations.

What Out-of-Pocket Payment Means for Clients

Out-of-pocket payment means clients cover the full cost of nutrition consultation services without relying on insurance, allowing for greater flexibility in choosing providers and treatment plans. This payment method often leads to more transparent billing and eliminates the need for insurance claims or approvals. Clients paying out-of-pocket may benefit from quicker appointment scheduling and personalized care, as providers are not constrained by insurance limitations.

Pros and Cons: Insurance Billing vs. Self-Pay

Insurance billing for nutrition consultation often covers a portion of the service cost, reducing immediate out-of-pocket expenses and increasing access to care, but it may involve lengthy claim processes and limited provider choices due to network restrictions. Self-pay ensures direct control over treatment options and privacy without insurance limitations, yet clients bear the full financial burden upfront, which can be a barrier for ongoing nutritional support. Evaluating coverage specifics and personal financial capacity is crucial when deciding between insurance billing and self-pay for nutrition consultation services.

How Insurance Coverage Varies for Nutrition Services

Insurance coverage for nutrition services varies significantly depending on the provider and specific plan, with many policies limiting coverage to medical necessity conditions such as diabetes or obesity. Some insurance plans require referrals from primary care physicians before covering nutrition consultations, while others may impose caps on the number of covered sessions per year. Out-of-pocket payments offer more flexibility and access to a wider range of nutrition services without the constraints of insurance limitations or approval processes.

Financial Implications for Nutrition Professionals

Nutrition professionals face distinct financial implications when managing insurance billing versus out-of-pocket payments. Insurance billing often involves complex coding, delayed reimbursements, and potential claim denials, impacting cash flow and administrative overhead. Out-of-pocket payments provide immediate revenue and reduced billing complexity but may limit patient accessibility and volume.

Client Accessibility: Which Payment Method Is Best?

Insurance billing for nutrition consultation often increases client accessibility by reducing upfront costs and making services more affordable for individuals with coverage. Out-of-pocket payments provide flexibility and faster appointment scheduling but may limit access for clients without sufficient funds. Evaluating insurance coverage, copays, and personal finances helps determine the optimal payment method for maximizing access to nutrition care.

Documentation Requirements for Insurance Claims

Accurate documentation is crucial for insurance billing in nutrition consultation to ensure claims are processed efficiently and fully reimbursed. Essential records include detailed patient assessments, individualized nutrition care plans, and progress notes aligned with insurance coding standards such as ICD-10 and CPT codes. Maintaining comprehensive documentation supports compliance with payer policies and reduces claim denials, contrasting with out-of-pocket payments where extensive documentation requirements are minimal.

Streamlining the Payment Process in Your Practice

Streamlining the payment process in nutrition consultation involves clearly distinguishing between insurance billing and out-of-pocket payment methods to enhance administrative efficiency. Utilizing specialized billing software can automate insurance claims, reduce errors, and accelerate reimbursement times, while transparent communication with clients about out-of-pocket costs ensures smoother transactions. Integrating electronic health records (EHR) with payment systems optimizes workflow, minimizes delays, and improves overall financial management in your practice.

Navigating Insurance Terms and Limitations

Navigating insurance terms and limitations during nutrition consultation involves understanding copayments, deductibles, and coverage restrictions that affect reimbursement rates. Many insurance plans limit the number of nutrition sessions covered annually, requiring clear communication with providers and insurers to maximize benefits. Out-of-pocket payments offer flexibility beyond insurance constraints but demand careful budgeting and verification of service pricing.

Strategies for Transparent Pricing and Communication

Implement clear pricing structures by providing detailed breakdowns of insurance coverage and out-of-pocket costs during nutrition consultations. Use transparent communication tools like pre-visit estimates and written agreements to minimize billing surprises and build client trust. Regular training for staff on insurance terms and effective cost communication enhances accuracy and client satisfaction in financial discussions.

Insurance Billing vs Out-of-Pocket Payment Infographic

bizdif.com

bizdif.com