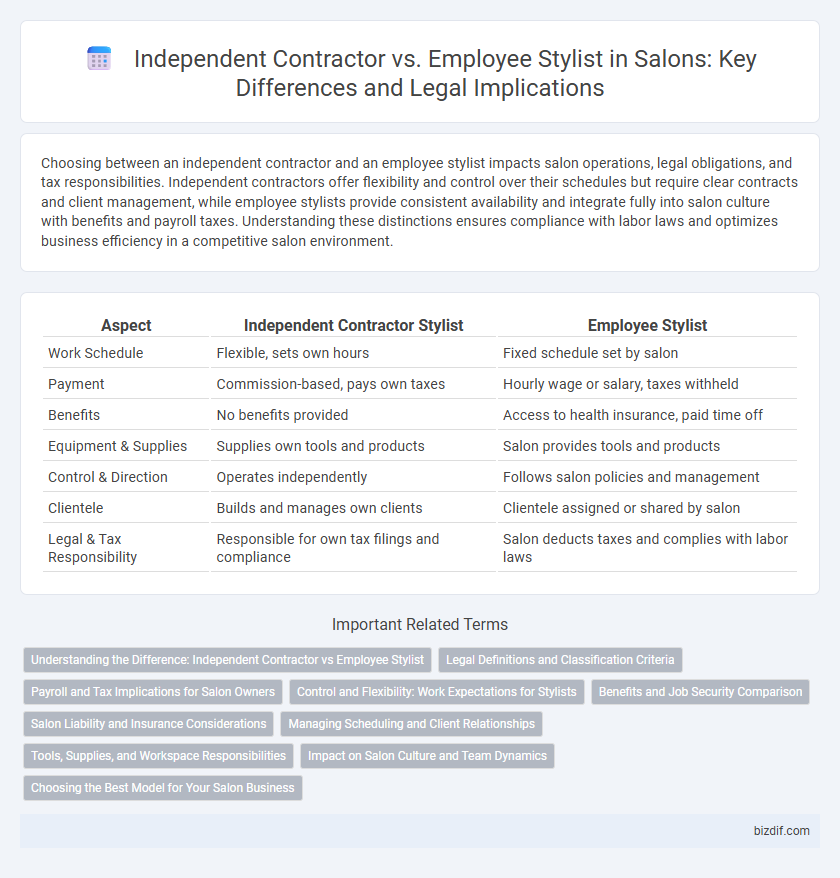

Choosing between an independent contractor and an employee stylist impacts salon operations, legal obligations, and tax responsibilities. Independent contractors offer flexibility and control over their schedules but require clear contracts and client management, while employee stylists provide consistent availability and integrate fully into salon culture with benefits and payroll taxes. Understanding these distinctions ensures compliance with labor laws and optimizes business efficiency in a competitive salon environment.

Table of Comparison

| Aspect | Independent Contractor Stylist | Employee Stylist |

|---|---|---|

| Work Schedule | Flexible, sets own hours | Fixed schedule set by salon |

| Payment | Commission-based, pays own taxes | Hourly wage or salary, taxes withheld |

| Benefits | No benefits provided | Access to health insurance, paid time off |

| Equipment & Supplies | Supplies own tools and products | Salon provides tools and products |

| Control & Direction | Operates independently | Follows salon policies and management |

| Clientele | Builds and manages own clients | Clientele assigned or shared by salon |

| Legal & Tax Responsibility | Responsible for own tax filings and compliance | Salon deducts taxes and complies with labor laws |

Understanding the Difference: Independent Contractor vs Employee Stylist

Understanding the difference between an independent contractor and an employee stylist is crucial for salon owners managing payroll and compliance. Independent contractors manage their own taxes, set flexible schedules, and handle business expenses, while employee stylists receive a steady paycheck, benefits, and have taxes withheld by the salon. Clarifying these roles helps salons optimize financial planning and maintain legal standards under labor laws.

Legal Definitions and Classification Criteria

In the salon industry, legal definitions distinguish independent contractors from employee stylists based on control over work, financial investment, and the nature of the relationship. Independent contractors typically set their schedules, supply their own tools, and bear business risks, while employee stylists operate under employer control with set hours and receive benefits like taxes withheld. Classification criteria, including the IRS's common law rules and state labor laws, determine worker status to ensure compliance with wage, tax, and labor regulations.

Payroll and Tax Implications for Salon Owners

Salon owners must carefully distinguish between independent contractor stylists and employee stylists due to significant payroll and tax implications. Independent contractors handle their own tax filings and are not subject to payroll taxes by the salon, whereas employee stylists require the salon to manage income tax withholding, Social Security, Medicare, and unemployment taxes. Misclassification can result in severe penalties from the IRS and Department of Labor, making accurate categorization crucial for regulatory compliance and financial management.

Control and Flexibility: Work Expectations for Stylists

Independent contractor stylists have the flexibility to set their own schedules and choose clients, allowing greater control over their work-life balance. Employee stylists typically follow salon-set hours and must adhere to specific protocols, limiting their autonomy in daily tasks. This distinction impacts how stylists manage their time and client interactions within the salon environment.

Benefits and Job Security Comparison

Independent contractor stylists enjoy flexible schedules and control over their client base but lack employer-provided benefits like health insurance and paid time off. Employee stylists receive stable wages, access to benefits such as health coverage and retirement plans, and greater job security through employment contracts. Choosing between the two depends on prioritizing control and autonomy versus financial stability and comprehensive benefits.

Salon Liability and Insurance Considerations

Salon owners face different liability risks when hiring independent contractor stylists versus employee stylists, as contractors typically carry their own liability insurance, reducing the salon's financial exposure. Employee stylists require the salon to provide workers' compensation and liability coverage, increasing operational costs and insurance premiums. Understanding these distinctions is essential for salons to ensure proper insurance policies are in place and to mitigate potential legal and financial risks.

Managing Scheduling and Client Relationships

Independent contractor stylists manage their own schedules, allowing greater flexibility to accommodate client preferences, while employee stylists follow salon-set hours and appointment systems. Client relationship management for contractors involves direct communication and personalized service, enhancing client loyalty through autonomy. Employee stylists rely on salon protocols and support staff for scheduling and client coordination, which can streamline operations but limit personalized engagement.

Tools, Supplies, and Workspace Responsibilities

Independent contractor stylists provide their own tools, supplies, and workspace, assuming full responsibility for maintenance and inventory costs. Employee stylists typically use salon-provided equipment and products, with the salon handling upkeep and replenishment. Understanding these distinctions helps stylists manage expenses and operational control effectively within salon environments.

Impact on Salon Culture and Team Dynamics

Independent contractor stylists bring entrepreneurial energy and flexibility, fostering a diverse and dynamic salon culture with varied client bases and work schedules. Employee stylists often contribute to a cohesive team environment by aligning with salon policies, participating in training sessions, and supporting collective goals. Balancing both roles requires strategic management to maintain harmony, motivation, and a unified brand identity within the salon.

Choosing the Best Model for Your Salon Business

Choosing between an independent contractor and an employee stylist significantly impacts your salon's legal compliance and financial structure. Independent contractors offer flexibility and reduced payroll taxes, while employee stylists provide greater control over schedules and consistent brand representation. Analyzing factors such as liability, tax obligations, and stylist commitment ensures the chosen model aligns with your salon's growth and operational goals.

Independent Contractor vs Employee Stylist Infographic

bizdif.com

bizdif.com