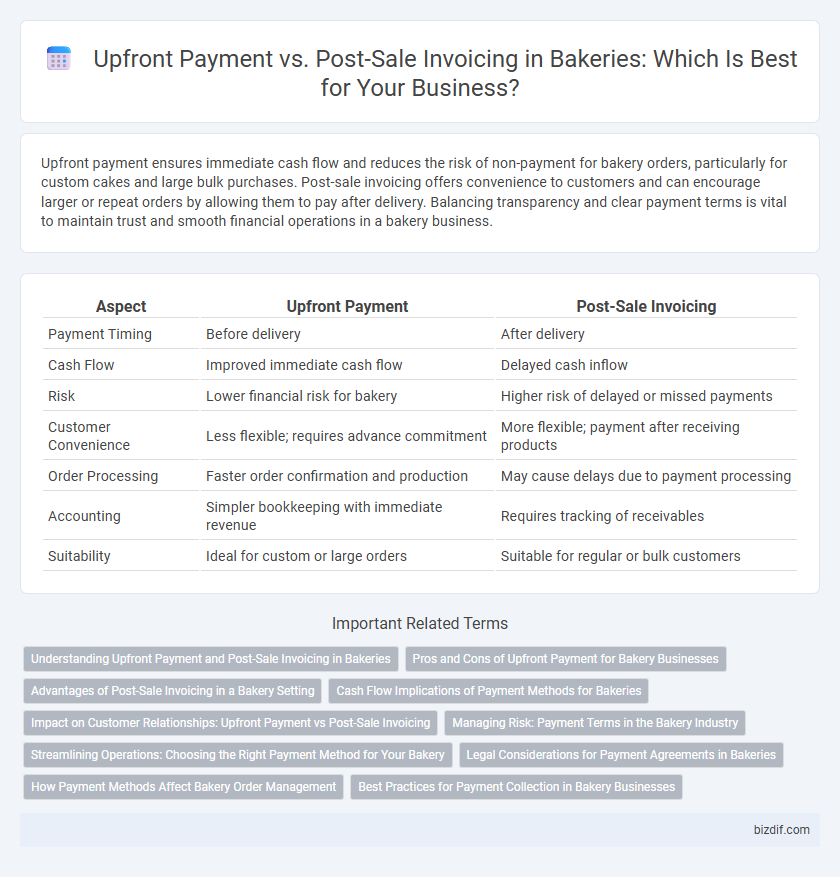

Upfront payment ensures immediate cash flow and reduces the risk of non-payment for bakery orders, particularly for custom cakes and large bulk purchases. Post-sale invoicing offers convenience to customers and can encourage larger or repeat orders by allowing them to pay after delivery. Balancing transparency and clear payment terms is vital to maintain trust and smooth financial operations in a bakery business.

Table of Comparison

| Aspect | Upfront Payment | Post-Sale Invoicing |

|---|---|---|

| Payment Timing | Before delivery | After delivery |

| Cash Flow | Improved immediate cash flow | Delayed cash inflow |

| Risk | Lower financial risk for bakery | Higher risk of delayed or missed payments |

| Customer Convenience | Less flexible; requires advance commitment | More flexible; payment after receiving products |

| Order Processing | Faster order confirmation and production | May cause delays due to payment processing |

| Accounting | Simpler bookkeeping with immediate revenue | Requires tracking of receivables |

| Suitability | Ideal for custom or large orders | Suitable for regular or bulk customers |

Understanding Upfront Payment and Post-Sale Invoicing in Bakeries

In bakeries, upfront payment requires customers to pay before receiving baked goods, ensuring immediate cash flow and reducing the risk of non-payment. Post-sale invoicing allows customers to receive products first and settle payments later, which can enhance customer trust and flexibility but may delay revenue collection. Choosing between these methods depends on the bakery's cash flow needs, customer relationships, and sales volume.

Pros and Cons of Upfront Payment for Bakery Businesses

Upfront payment for bakery businesses ensures immediate cash flow, reducing the risk of late or unpaid invoices and supporting ingredient purchasing and labor costs. However, it may deter customers hesitant to pay before receiving fresh, perishable goods, potentially limiting sales and customer trust. Balancing upfront payments with customer preferences boosts financial stability while maintaining a loyal customer base.

Advantages of Post-Sale Invoicing in a Bakery Setting

Post-sale invoicing in a bakery setting enhances customer trust by allowing clients to inspect products before payment, reducing the risk of dissatisfaction. It improves cash flow management by aligning payment collection with delivery and consumption, minimizing upfront financial strain on customers. This approach also streamlines order tracking and financial record-keeping, facilitating accurate sales analysis and inventory control.

Cash Flow Implications of Payment Methods for Bakeries

Upfront payment methods enhance bakery cash flow by ensuring immediate capital for ingredient procurement and operational costs, reducing reliance on short-term credit. Post-sale invoicing can delay revenue realization, potentially straining cash reserves during peak production periods or seasonal fluctuations. Strategic selection between these payment approaches critically impacts bakery liquidity management and financial stability.

Impact on Customer Relationships: Upfront Payment vs Post-Sale Invoicing

Upfront payment builds trust with bakery customers by securing commitment and reducing cancellations, fostering stronger relationships through clear expectations and immediate transaction closure. Post-sale invoicing offers flexibility, enhancing customer satisfaction by allowing payment after product delivery, which can improve loyalty but risk delayed payments and added administrative efforts. Choosing between these payment methods directly impacts customer trust, retention, and overall experience in the bakery business.

Managing Risk: Payment Terms in the Bakery Industry

Upfront payment in the bakery industry minimizes financial risk by securing funds before production begins, ensuring cash flow is stable and reducing the chance of non-payment. Post-sale invoicing can enhance customer relationships but requires strong credit management and clear payment terms to mitigate potential losses from delayed or defaulted payments. Establishing precise payment policies tailored to order size and client reliability is essential for effective risk management in bakery operations.

Streamlining Operations: Choosing the Right Payment Method for Your Bakery

Upfront payment ensures immediate cash flow, simplifying inventory management and reducing the risk of unpaid orders in bakery operations. Post-sale invoicing offers flexibility for wholesale clients or large orders, enhancing customer relationships but requiring robust tracking systems to avoid delays in revenue collection. Selecting the right payment method streamlines bakery workflows, balances cash flow, and aligns with customer preferences to optimize operational efficiency.

Legal Considerations for Payment Agreements in Bakeries

Legal considerations for payment agreements in bakeries require clear documentation whether opting for upfront payment or post-sale invoicing, ensuring compliance with consumer protection laws and local business regulations. Upfront payments minimize credit risk but must include terms about refunds and cancellations to avoid disputes, while post-sale invoicing demands precise invoicing timelines and default payment penalties under contract law. Bakeries should also adhere to tax reporting obligations linked to payment timing to maintain transparency and legal compliance.

How Payment Methods Affect Bakery Order Management

Upfront payment streamlines bakery order management by ensuring immediate cash flow and reducing order cancellations, allowing for accurate inventory allocation and production scheduling. Post-sale invoicing offers flexibility for regular or corporate clients but requires robust tracking systems to manage outstanding payments and avoid disruptions in ingredient procurement. Selecting the appropriate payment method directly impacts cash flow, resource planning, and customer relationship management in bakery operations.

Best Practices for Payment Collection in Bakery Businesses

Implementing upfront payment in bakery businesses secures cash flow and reduces the risk of non-payment, especially for custom orders or large events. Post-sale invoicing works well for regular customers with established trust but requires clear payment terms and timely reminders to ensure collections. Combining both methods with transparent communication and digital payment options enhances overall payment efficiency and customer satisfaction.

Upfront payment vs Post-sale invoicing Infographic

bizdif.com

bizdif.com