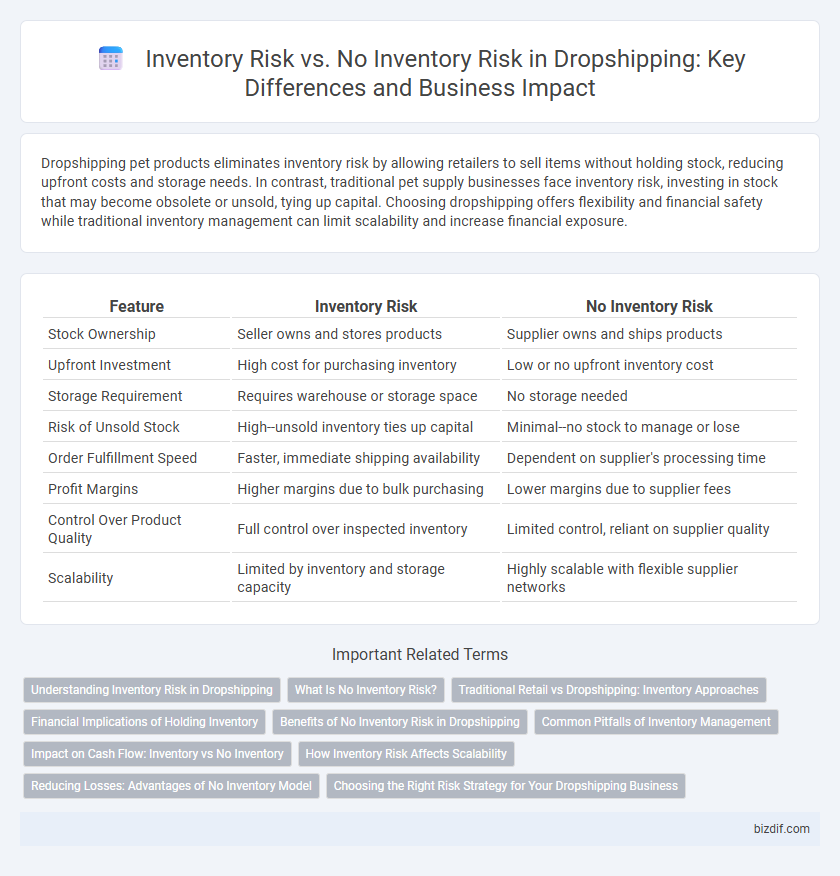

Dropshipping pet products eliminates inventory risk by allowing retailers to sell items without holding stock, reducing upfront costs and storage needs. In contrast, traditional pet supply businesses face inventory risk, investing in stock that may become obsolete or unsold, tying up capital. Choosing dropshipping offers flexibility and financial safety while traditional inventory management can limit scalability and increase financial exposure.

Table of Comparison

| Feature | Inventory Risk | No Inventory Risk |

|---|---|---|

| Stock Ownership | Seller owns and stores products | Supplier owns and ships products |

| Upfront Investment | High cost for purchasing inventory | Low or no upfront inventory cost |

| Storage Requirement | Requires warehouse or storage space | No storage needed |

| Risk of Unsold Stock | High--unsold inventory ties up capital | Minimal--no stock to manage or lose |

| Order Fulfillment Speed | Faster, immediate shipping availability | Dependent on supplier's processing time |

| Profit Margins | Higher margins due to bulk purchasing | Lower margins due to supplier fees |

| Control Over Product Quality | Full control over inspected inventory | Limited control, reliant on supplier quality |

| Scalability | Limited by inventory and storage capacity | Highly scalable with flexible supplier networks |

Understanding Inventory Risk in Dropshipping

Inventory risk in dropshipping refers to the potential financial losses experienced when unsold products remain in stock, tying up capital and increasing storage costs. Unlike traditional retail, dropshipping eliminates this risk by allowing sellers to list products without purchasing or storing inventory upfront, transferring the responsibility of inventory management to suppliers. Understanding this distinction helps businesses minimize overhead expenses and improve cash flow by avoiding excess inventory and unsold stock complications.

What Is No Inventory Risk?

No inventory risk in dropshipping means sellers do not purchase or store products upfront, eliminating costs tied to unsold stock and reducing financial exposure. Instead, items are purchased from suppliers only after customer orders are received, ensuring inventory levels match demand precisely. This model enhances cash flow management and minimizes losses from obsolete or excess inventory.

Traditional Retail vs Dropshipping: Inventory Approaches

Traditional retail involves significant inventory risk as businesses purchase and stock products upfront, tying up capital and facing potential losses from unsold items. Dropshipping eliminates inventory risk by allowing retailers to fulfill orders directly from suppliers only after customers make purchases, reducing overhead costs and minimizing financial exposure. This inventory approach in dropshipping supports greater flexibility and scalability compared to traditional retail's fixed inventory model.

Financial Implications of Holding Inventory

Holding inventory in dropshipping ties up capital in stock that may not sell quickly, increasing financial risk through storage costs and potential obsolescence. No inventory risk models eliminate upfront purchasing costs, improving cash flow and reducing losses from unsold products. This financial difference impacts profitability, with inventory holders facing possible markdowns and write-offs, while no inventory businesses rely on supplier reliability and efficient order fulfillment.

Benefits of No Inventory Risk in Dropshipping

No inventory risk in dropshipping eliminates upfront investment in stock, reducing financial exposure and allowing entrepreneurs to scale without costly inventory management. This model enhances cash flow efficiency since products are purchased only after a customer places an order, minimizing storage and unsold goods expenses. Retailers benefit from flexible product offerings and easy adaptation to market trends without the burden of obsolete inventory.

Common Pitfalls of Inventory Management

Inventory risk in dropshipping involves holding stock, which can lead to overstocking, dead inventory, and high storage costs, whereas no inventory risk models eliminate upfront purchasing but depend heavily on supplier reliability and shipping times. Common pitfalls in inventory management include inaccurate demand forecasting, leading to stockouts or excess inventory, and lack of real-time stock updates, causing order fulfillment errors. Efficient dropshipping requires balancing inventory visibility with supplier coordination to minimize risks and maintain customer satisfaction.

Impact on Cash Flow: Inventory vs No Inventory

Holding inventory in dropshipping requires upfront capital investment, leading to tied-up cash flow and potential losses from unsold stock. Conversely, no inventory risk models enable more flexible cash flow management by only paying suppliers after receiving customer orders. This approach optimizes liquidity, reduces financial strain, and supports scalable growth in dropshipping businesses.

How Inventory Risk Affects Scalability

Inventory risk in dropshipping limits scalability due to potential overstock or stockouts, causing cash flow constraints and lost sales opportunities. No inventory risk enables seamless scaling by eliminating upfront inventory costs, allowing businesses to adapt quickly to changing demand without financial burden. Efficient inventory management directly impacts the ability to expand operations and maintain customer satisfaction.

Reducing Losses: Advantages of No Inventory Model

The no inventory risk model in dropshipping significantly reduces losses by eliminating upfront investment in stock, minimizing financial exposure if products don't sell. This model allows sellers to test multiple products without committing capital, thereby enhancing flexibility and responsiveness to market trends. By avoiding excess inventory, businesses mitigate the risk of unsold goods, streamlining operations and improving cash flow management.

Choosing the Right Risk Strategy for Your Dropshipping Business

Choosing the right risk strategy in dropshipping involves balancing inventory risk and no inventory risk models. Inventory risk strategies require upfront investment and stock management but offer faster shipping and better control over product availability. Conversely, no inventory risk models reduce capital exposure and eliminate storage costs, yet may result in longer delivery times and less control over stock levels.

Inventory Risk vs No Inventory Risk Infographic

bizdif.com

bizdif.com