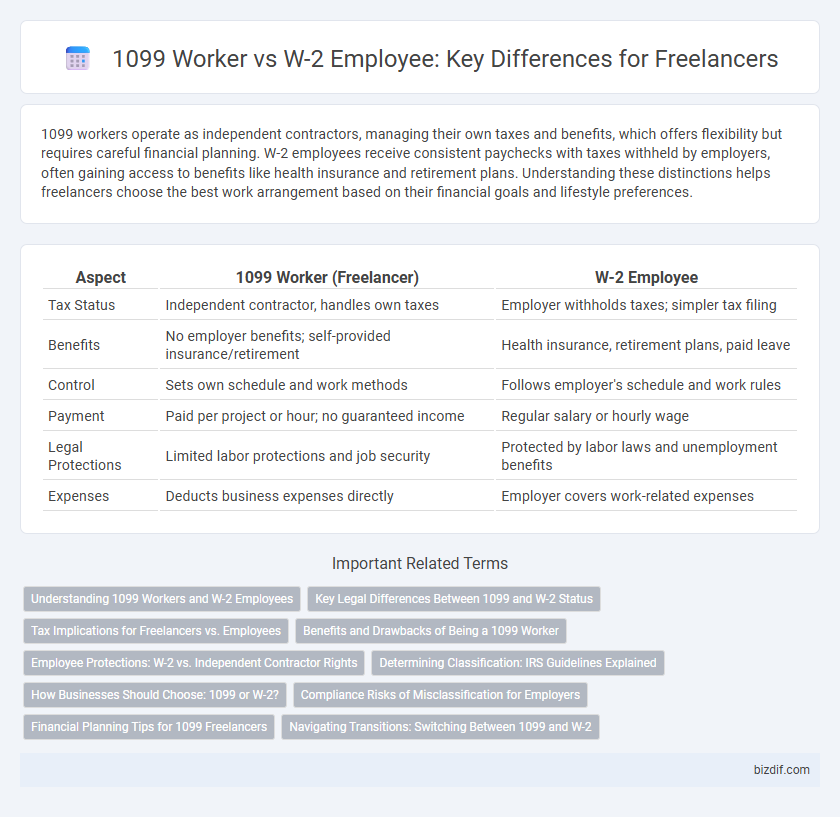

1099 workers operate as independent contractors, managing their own taxes and benefits, which offers flexibility but requires careful financial planning. W-2 employees receive consistent paychecks with taxes withheld by employers, often gaining access to benefits like health insurance and retirement plans. Understanding these distinctions helps freelancers choose the best work arrangement based on their financial goals and lifestyle preferences.

Table of Comparison

| Aspect | 1099 Worker (Freelancer) | W-2 Employee |

|---|---|---|

| Tax Status | Independent contractor, handles own taxes | Employer withholds taxes; simpler tax filing |

| Benefits | No employer benefits; self-provided insurance/retirement | Health insurance, retirement plans, paid leave |

| Control | Sets own schedule and work methods | Follows employer's schedule and work rules |

| Payment | Paid per project or hour; no guaranteed income | Regular salary or hourly wage |

| Legal Protections | Limited labor protections and job security | Protected by labor laws and unemployment benefits |

| Expenses | Deducts business expenses directly | Employer covers work-related expenses |

Understanding 1099 Workers and W-2 Employees

1099 workers operate as independent contractors, managing their taxes, benefits, and business expenses independently, offering flexibility but less job security. W-2 employees receive regular paychecks with taxes withheld by the employer, along with benefits like health insurance and retirement plans, ensuring stability and employer-covered compliance. Understanding these classifications helps freelancers navigate tax obligations, legal rights, and financial planning effectively.

Key Legal Differences Between 1099 and W-2 Status

1099 workers operate as independent contractors, responsible for their own taxes, including self-employment tax, and do not receive employee benefits or protections under labor laws. W-2 employees have taxes withheld by employers, qualify for benefits such as unemployment insurance and workers' compensation, and are covered by minimum wage and overtime regulations. Misclassification between 1099 and W-2 status can lead to legal penalties and liability for employers under IRS and Department of Labor guidelines.

Tax Implications for Freelancers vs. Employees

Freelancers classified as 1099 workers are responsible for paying self-employment taxes, including both the employer and employee portions of Social Security and Medicare, often totaling approximately 15.3%, which significantly impacts their overall tax liability. W-2 employees have taxes withheld by their employers, including income tax, Social Security, and Medicare, reducing their immediate tax burden and simplifying filing, but they do not deduct business expenses directly on their personal tax returns. Understanding the differences in tax deductions, filing requirements, and quarterly estimated tax payments is crucial for freelancers to optimize tax savings and comply with IRS regulations.

Benefits and Drawbacks of Being a 1099 Worker

1099 workers enjoy flexible schedules and the ability to deduct business expenses, which can reduce taxable income, but lack employer-sponsored benefits such as health insurance, retirement plans, and paid leave. They shoulder the responsibility of self-employment taxes and income tax withholding, often leading to a more complex financial management process. The independent nature of 1099 work offers autonomy and diverse project opportunities but comes with unpredictability in income and job security compared to W-2 employees.

Employee Protections: W-2 vs. Independent Contractor Rights

W-2 employees receive comprehensive protections including minimum wage, overtime pay, unemployment insurance, and workers' compensation, ensuring financial security and workplace rights. Independent contractors classified under IRS Form 1099 do not benefit from these employee protections and are responsible for managing their own taxes, benefits, and insurance coverage. The distinction impacts legal rights, tax obligations, and eligibility for employer-provided benefits, influencing job stability and worker protections.

Determining Classification: IRS Guidelines Explained

The IRS uses specific criteria to determine whether a worker is classified as a 1099 contractor or a W-2 employee, focusing on behavioral control, financial control, and the nature of the relationship. Behavioral control examines if the company directs or controls how the worker performs tasks, while financial control considers aspects like unreimbursed expenses and the opportunity for profit or loss. Proper classification impacts tax responsibilities, benefits eligibility, and legal protections, making compliance with IRS guidelines essential for both freelancers and employers.

How Businesses Should Choose: 1099 or W-2?

Businesses should evaluate factors like control over work schedules, tax responsibilities, and benefits when choosing between 1099 workers and W-2 employees. Hiring 1099 contractors offers flexibility and lower payroll tax obligations, while W-2 employees provide greater legal protections and eligibility for company benefits. Careful consideration of IRS classification guidelines and long-term business needs ensures compliance and optimizes workforce management.

Compliance Risks of Misclassification for Employers

Misclassifying a 1099 worker as a W-2 employee exposes employers to significant compliance risks, including penalties for failing to withhold payroll taxes and provide employee benefits. The IRS and Department of Labor scrutinize misclassification cases, potentially resulting in back taxes, fines, and legal disputes that can damage a company's financial health. Properly distinguishing between 1099 contractors and W-2 employees is essential to ensure adherence to federal and state labor laws, avoiding costly audits and litigation.

Financial Planning Tips for 1099 Freelancers

1099 freelancers must prioritize setting aside approximately 25-30% of their income for federal, state, and self-employment taxes due to lack of withholding. Establishing a separate business account and using accounting software helps track expenses and maximize deductible business costs like home office, equipment, and travel. Planning for quarterly estimated tax payments and saving consistently for retirement using options like SEP IRAs or Solo 401(k)s supports long-term financial stability for independent contractors.

Navigating Transitions: Switching Between 1099 and W-2

Navigating transitions between 1099 worker and W-2 employee status requires careful consideration of tax implications, benefits eligibility, and legal responsibilities. 1099 contractors manage their own taxes and lack employer-provided benefits, while W-2 employees receive tax withholding and access to health insurance, retirement plans, and unemployment protections. Understanding these differences helps freelancers and employers align work arrangements with financial goals and compliance requirements during transitions.

1099 Worker vs W-2 Employee Infographic

bizdif.com

bizdif.com