Dropshipping pet supplies requires minimal upfront investment since inventory and storage costs are eliminated, allowing entrepreneurs to launch businesses with limited capital. The pay-as-you-go model enables flexible cash flow management by only purchasing products after receiving customer orders, reducing financial risk. This approach fosters scalability and adaptability in the competitive pet market without burdening sellers with large inventory expenses.

Table of Comparison

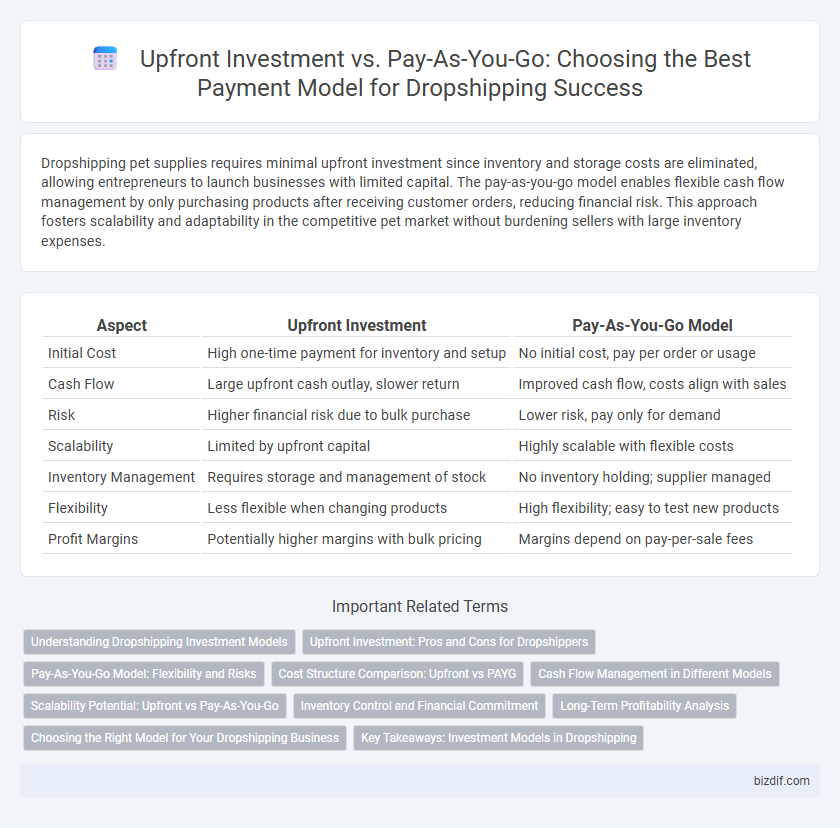

| Aspect | Upfront Investment | Pay-As-You-Go Model |

|---|---|---|

| Initial Cost | High one-time payment for inventory and setup | No initial cost, pay per order or usage |

| Cash Flow | Large upfront cash outlay, slower return | Improved cash flow, costs align with sales |

| Risk | Higher financial risk due to bulk purchase | Lower risk, pay only for demand |

| Scalability | Limited by upfront capital | Highly scalable with flexible costs |

| Inventory Management | Requires storage and management of stock | No inventory holding; supplier managed |

| Flexibility | Less flexible when changing products | High flexibility; easy to test new products |

| Profit Margins | Potentially higher margins with bulk pricing | Margins depend on pay-per-sale fees |

Understanding Dropshipping Investment Models

Dropshipping investment models primarily include upfront investment and pay-as-you-go options, each impacting cash flow and risk differently. Upfront investment requires purchasing inventory or platform access fees before sales, enabling bulk discounts but higher initial costs. Pay-as-you-go models eliminate large initial expenses by charging fees based on sales volume or usage, offering flexibility but potentially higher long-term costs.

Upfront Investment: Pros and Cons for Dropshippers

Upfront investment in dropshipping requires initial capital for inventory, marketing, and platform setup, enabling control over product quality and faster order fulfillment. This model reduces dependency on supplier stock fluctuations but increases financial risk due to unsold inventory and higher upfront costs. Dropshippers with sufficient capital can leverage upfront investment to build brand credibility and customer loyalty through consistent product availability.

Pay-As-You-Go Model: Flexibility and Risks

The Pay-As-You-Go model in dropshipping offers unmatched flexibility by allowing sellers to scale their business without heavy upfront investments in inventory or warehousing. This model minimizes financial risk by aligning costs with actual sales volume, reducing potential losses from unsold stock. However, reliance on supplier availability and shipping delays can introduce variability in customer satisfaction and order fulfillment efficiency.

Cost Structure Comparison: Upfront vs PAYG

Upfront investment in dropshipping requires significant capital for inventory, warehousing, and initial marketing, leading to higher fixed costs but potentially lower long-term expenses. In contrast, the pay-as-you-go (PAYG) model minimizes initial financial risk by charging fees based on actual sales or usage, converting fixed costs into variable costs. This cost structure comparison highlights that upfront investment demands substantial financial commitment, while PAYG offers scalability and flexibility, aligning expenses directly with business performance.

Cash Flow Management in Different Models

Upfront investment models in dropshipping require significant initial capital for inventory purchase, which can strain cash flow but ensure product availability and potentially lower costs per unit. Pay-as-you-go models reduce financial risk by only paying for goods upon customer order, improving cash flow flexibility and minimizing inventory holding costs. Effective cash flow management depends on balancing inventory commitment with order fulfillment speed to maintain operational efficiency and customer satisfaction.

Scalability Potential: Upfront vs Pay-As-You-Go

The Pay-As-You-Go model offers higher scalability potential in dropshipping by minimizing initial costs and allowing gradual investment aligned with sales growth. Upfront investment requires significant capital before scaling, limiting flexibility and increasing financial risk. Pay-As-You-Go enables dynamic scaling, adapting quickly to market demand without tied-up funds.

Inventory Control and Financial Commitment

The upfront investment model in dropshipping requires purchasing inventory in bulk, granting greater control over stock levels and pricing but demanding significant financial commitment and increased risk. In contrast, the pay-as-you-go model eliminates the need for large initial capital by sourcing products only after receiving orders, reducing financial exposure while sacrificing some control over inventory availability and fulfillment speed. Choosing between these models depends on balancing budget constraints with the desired level of inventory management and operational flexibility.

Long-Term Profitability Analysis

Evaluating long-term profitability in dropshipping involves contrasting upfront investment with pay-as-you-go models, where upfront investment requires significant capital allocation for inventory procurement and infrastructure, potentially increasing margin control. In contrast, the pay-as-you-go model minimizes initial expenses by purchasing products post-sale, reducing financial risk but often resulting in lower profit margins due to supplier pricing structures. Strategic analysis of cash flow, supplier reliability, and market demand forecasting is essential to determine which model maximizes sustainable profitability in fluctuating e-commerce environments.

Choosing the Right Model for Your Dropshipping Business

Selecting the optimal financial model for your dropshipping business hinges on evaluating upfront investment against pay-as-you-go structures. Upfront investment demands a significant initial capital outlay for inventory and platform setup, offering greater control and potentially higher margins, while the pay-as-you-go model minimizes initial costs by charging based on sales volume or usage, enhancing flexibility and reducing financial risk. Careful assessment of cash flow, business scale, and growth projections guides entrepreneurs in adopting the model that aligns with their operational capacity and long-term goals.

Key Takeaways: Investment Models in Dropshipping

The upfront investment model in dropshipping requires significant initial capital for inventory and marketing, offering greater control and potentially higher margins. The pay-as-you-go model minimizes financial risk by charging fees only when sales occur, making it ideal for beginners or those testing niches. Choosing the right investment approach depends on business goals, cash flow capacity, and risk tolerance.

Upfront Investment vs Pay-As-You-Go Model Infographic

bizdif.com

bizdif.com