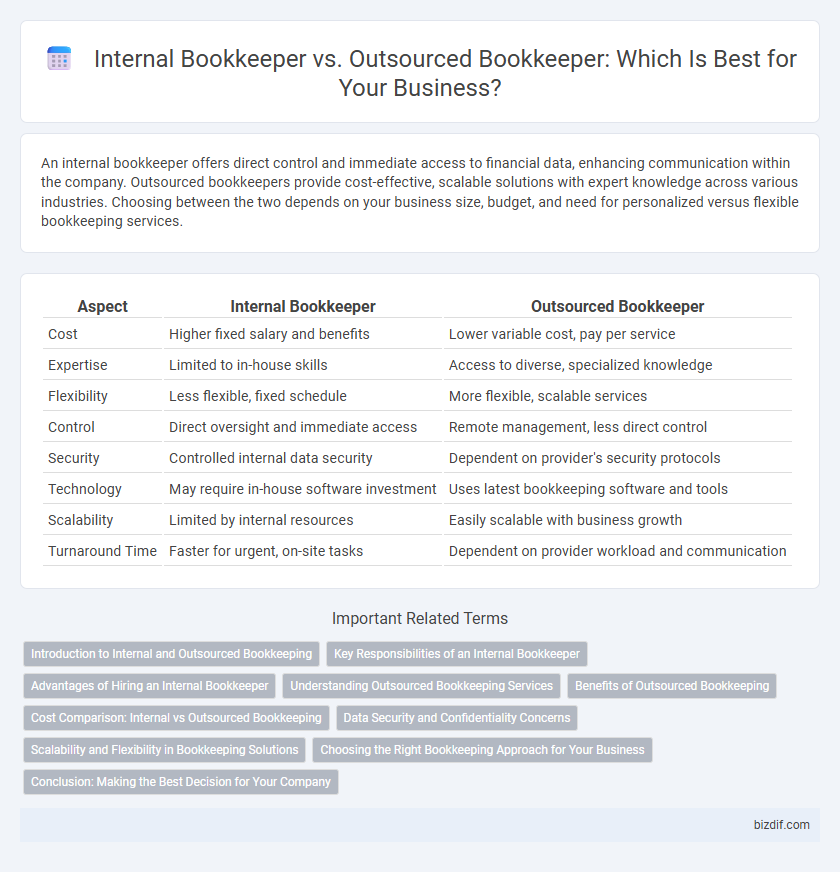

An internal bookkeeper offers direct control and immediate access to financial data, enhancing communication within the company. Outsourced bookkeepers provide cost-effective, scalable solutions with expert knowledge across various industries. Choosing between the two depends on your business size, budget, and need for personalized versus flexible bookkeeping services.

Table of Comparison

| Aspect | Internal Bookkeeper | Outsourced Bookkeeper |

|---|---|---|

| Cost | Higher fixed salary and benefits | Lower variable cost, pay per service |

| Expertise | Limited to in-house skills | Access to diverse, specialized knowledge |

| Flexibility | Less flexible, fixed schedule | More flexible, scalable services |

| Control | Direct oversight and immediate access | Remote management, less direct control |

| Security | Controlled internal data security | Dependent on provider's security protocols |

| Technology | May require in-house software investment | Uses latest bookkeeping software and tools |

| Scalability | Limited by internal resources | Easily scalable with business growth |

| Turnaround Time | Faster for urgent, on-site tasks | Dependent on provider workload and communication |

Introduction to Internal and Outsourced Bookkeeping

Internal bookkeeping involves hiring an in-house professional dedicated to managing financial records, ensuring real-time data accuracy and immediate issue resolution. Outsourced bookkeeping delegates these tasks to third-party specialists, often providing cost-effective solutions with access to diverse expertise and scalable services. Both approaches play crucial roles in maintaining accurate financial statements, controlling expenses, and supporting strategic business decisions.

Key Responsibilities of an Internal Bookkeeper

An internal bookkeeper manages daily financial transactions, maintains accurate ledgers, and prepares regular financial reports within the organization. They handle payroll processing, reconcile bank statements, and ensure compliance with tax regulations. Their close proximity allows real-time data management and seamless communication with other departments for effective financial oversight.

Advantages of Hiring an Internal Bookkeeper

Hiring an internal bookkeeper ensures immediate access to financial data, allowing for real-time updates and quicker issue resolution within the company. This arrangement fosters a deep understanding of the business's unique financial processes and culture, enhancing accuracy and tailored reporting. Maintaining an in-house bookkeeper strengthens confidentiality and control over sensitive financial information, reducing the risk of data breaches.

Understanding Outsourced Bookkeeping Services

Outsourced bookkeeping services provide businesses with access to specialized financial expertise without the overhead costs of hiring full-time staff. These services often include real-time data entry, bank reconciliations, payroll processing, and financial reporting, ensuring accurate and up-to-date records. Leveraging cloud-based accounting software, outsourced bookkeepers offer scalable solutions that enhance efficiency and compliance while allowing companies to focus on core operations.

Benefits of Outsourced Bookkeeping

Outsourced bookkeeping offers cost savings by eliminating expenses related to full-time salaries, benefits, and office space. Professional firms provide access to a team of experts with the latest accounting technology, ensuring accurate and timely financial records. This flexibility allows businesses to scale services according to their needs, improving efficiency and cash flow management.

Cost Comparison: Internal vs Outsourced Bookkeeping

Internal bookkeeping typically involves higher fixed costs, including employee salaries, benefits, and workspace expenses, whereas outsourced bookkeeping offers variable pricing models that can reduce overall costs by charging only for services rendered. Small to mid-sized businesses often find outsourced bookkeeping more cost-effective due to lower overhead and scalable service options. However, large enterprises may benefit from internal bookkeepers who provide immediate access and deeper integration despite increased expenses.

Data Security and Confidentiality Concerns

Internal bookkeepers offer direct control over sensitive financial data, reducing risks related to external breaches and enabling immediate response to security incidents. Outsourced bookkeepers rely on third-party systems, increasing exposure to potential data leaks or unauthorized access but often implement advanced cybersecurity measures and compliance protocols. Ensuring strong data encryption, regular access audits, and strict confidentiality agreements is critical regardless of whether bookkeeping is managed internally or outsourced.

Scalability and Flexibility in Bookkeeping Solutions

Internal bookkeepers offer limited scalability due to fixed staffing and resource constraints, making it challenging for growing businesses to adapt quickly. Outsourced bookkeeping provides greater flexibility by allowing companies to scale services up or down based on fluctuating financial needs and business cycles. This adaptability ensures optimized cash flow management and timely financial reporting without the burden of permanent payroll expenses.

Choosing the Right Bookkeeping Approach for Your Business

Selecting the right bookkeeping approach hinges on your business size, budget, and specific financial needs. An internal bookkeeper offers direct control and immediate access to financial data, ideal for companies with complex transactions and a need for close supervision. Outsourced bookkeeping provides cost savings and access to specialized expertise, making it suitable for small businesses aiming to optimize operational efficiency without the overhead of a full-time employee.

Conclusion: Making the Best Decision for Your Company

Choosing between an internal bookkeeper and an outsourced bookkeeper depends on the company's size, budget, and need for direct control over financial data. Internal bookkeepers provide immediate access and deep organizational understanding, while outsourced bookkeepers offer cost-effective scalability and access to specialized expertise. Evaluating the balance between control, cost, and flexibility ensures a tailored bookkeeping approach that supports accurate financial management and business growth.

Internal bookkeeper vs Outsourced bookkeeper Infographic

bizdif.com

bizdif.com