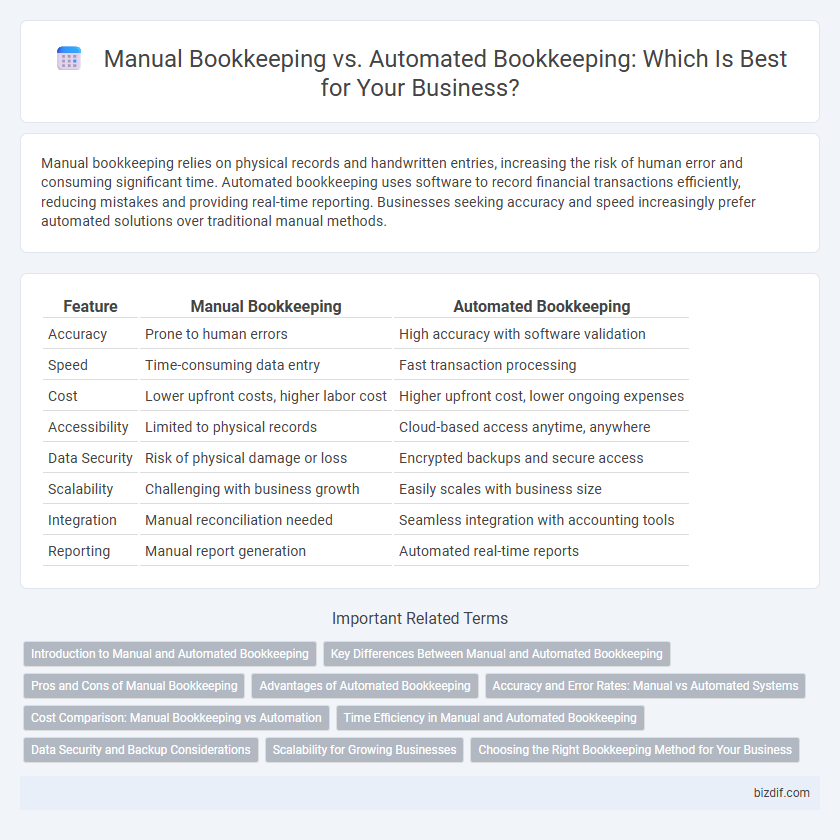

Manual bookkeeping relies on physical records and handwritten entries, increasing the risk of human error and consuming significant time. Automated bookkeeping uses software to record financial transactions efficiently, reducing mistakes and providing real-time reporting. Businesses seeking accuracy and speed increasingly prefer automated solutions over traditional manual methods.

Table of Comparison

| Feature | Manual Bookkeeping | Automated Bookkeeping |

|---|---|---|

| Accuracy | Prone to human errors | High accuracy with software validation |

| Speed | Time-consuming data entry | Fast transaction processing |

| Cost | Lower upfront costs, higher labor cost | Higher upfront cost, lower ongoing expenses |

| Accessibility | Limited to physical records | Cloud-based access anytime, anywhere |

| Data Security | Risk of physical damage or loss | Encrypted backups and secure access |

| Scalability | Challenging with business growth | Easily scales with business size |

| Integration | Manual reconciliation needed | Seamless integration with accounting tools |

| Reporting | Manual report generation | Automated real-time reports |

Introduction to Manual and Automated Bookkeeping

Manual bookkeeping involves recording financial transactions by hand in ledgers or journals, which can be time-consuming and prone to human error. Automated bookkeeping utilizes specialized software to input, process, and organize financial data quickly and accurately, enhancing efficiency and reducing mistakes. Small businesses often start with manual bookkeeping but transition to automated systems as transaction volume increases.

Key Differences Between Manual and Automated Bookkeeping

Manual bookkeeping involves recording financial transactions by hand, relying heavily on physical ledgers and spreadsheets, which increases the risk of human error and time consumption. Automated bookkeeping utilizes accounting software to record, categorize, and reconcile transactions, offering real-time data accuracy, faster processing, and enhanced reporting capabilities. Key differences include efficiency, error reduction, scalability, and integration with other financial systems, making automated bookkeeping more suitable for growing businesses.

Pros and Cons of Manual Bookkeeping

Manual bookkeeping offers greater control and customization, allowing businesses to tailor their accounting processes to specific needs without relying on software limitations. It reduces dependence on technology, minimizing risks related to system failures and cyber security threats. However, manual bookkeeping is time-consuming, prone to human error, and less efficient for managing large volumes of transactions compared to automated alternatives.

Advantages of Automated Bookkeeping

Automated bookkeeping significantly reduces human error by utilizing software that accurately records and categorizes financial transactions in real-time. It enhances efficiency through faster data processing and seamless integration with other financial tools, enabling businesses to maintain up-to-date and organized financial records. Automated systems also provide advanced reporting capabilities, facilitating better financial analysis and informed decision-making for business growth.

Accuracy and Error Rates: Manual vs Automated Systems

Automated bookkeeping systems significantly reduce error rates by minimizing human input errors through advanced algorithms and real-time data validation. Manual bookkeeping, while flexible, is prone to higher inaccuracies due to human mistakes in data entry and calculation, leading to increased risk of financial discrepancies. Enhanced accuracy in automated bookkeeping improves financial reliability and compliance, streamlining audit processes and reporting precision.

Cost Comparison: Manual Bookkeeping vs Automation

Manual bookkeeping involves significant labor costs due to the time-intensive nature of data entry and error correction, often requiring dedicated personnel. Automated bookkeeping leverages software to reduce labor expenses, offering faster processing and minimizing human error, which translates to lower operational costs. Over time, automation demonstrates cost efficiency by decreasing reliance on manual intervention and improving accuracy in financial records.

Time Efficiency in Manual and Automated Bookkeeping

Manual bookkeeping requires significant time investment due to repetitive data entry and error correction, often slowing financial processes. Automated bookkeeping streamlines these tasks by integrating software solutions that quickly process transactions, reducing time spent on routine activities. Businesses leveraging automation experience faster financial reporting and improved time management, enhancing overall operational efficiency.

Data Security and Backup Considerations

Manual bookkeeping relies on physical records and paper-based ledgers, which are vulnerable to loss, theft, and damage, making data security and backup a significant concern. Automated bookkeeping systems offer encrypted cloud storage and automatic backups, significantly reducing the risk of data loss and enhancing data protection. Businesses implementing digital bookkeeping benefit from regular security updates and disaster recovery protocols that safeguard financial information against cyber threats.

Scalability for Growing Businesses

Manual bookkeeping limits scalability for growing businesses due to time-consuming data entry and higher risk of errors, which can impede efficient financial management. Automated bookkeeping systems enhance scalability by streamlining transaction processing, providing real-time financial insights, and integrating with other business tools to support expanding operations. Utilizing cloud-based accounting software enables seamless data access and collaboration, crucial for businesses scaling their financial processes efficiently.

Choosing the Right Bookkeeping Method for Your Business

Manual bookkeeping offers personalized control and detailed insight, ideal for small businesses with limited transactions, but it is time-consuming and prone to human error. Automated bookkeeping leverages software like QuickBooks or Xero to streamline transaction recording, improve accuracy, and save time, making it suitable for growing businesses with higher transaction volumes. Selecting the right bookkeeping method depends on factors such as business size, volume of financial data, budget, and the need for real-time reporting and scalability.

Manual Bookkeeping vs Automated Bookkeeping Infographic

bizdif.com

bizdif.com