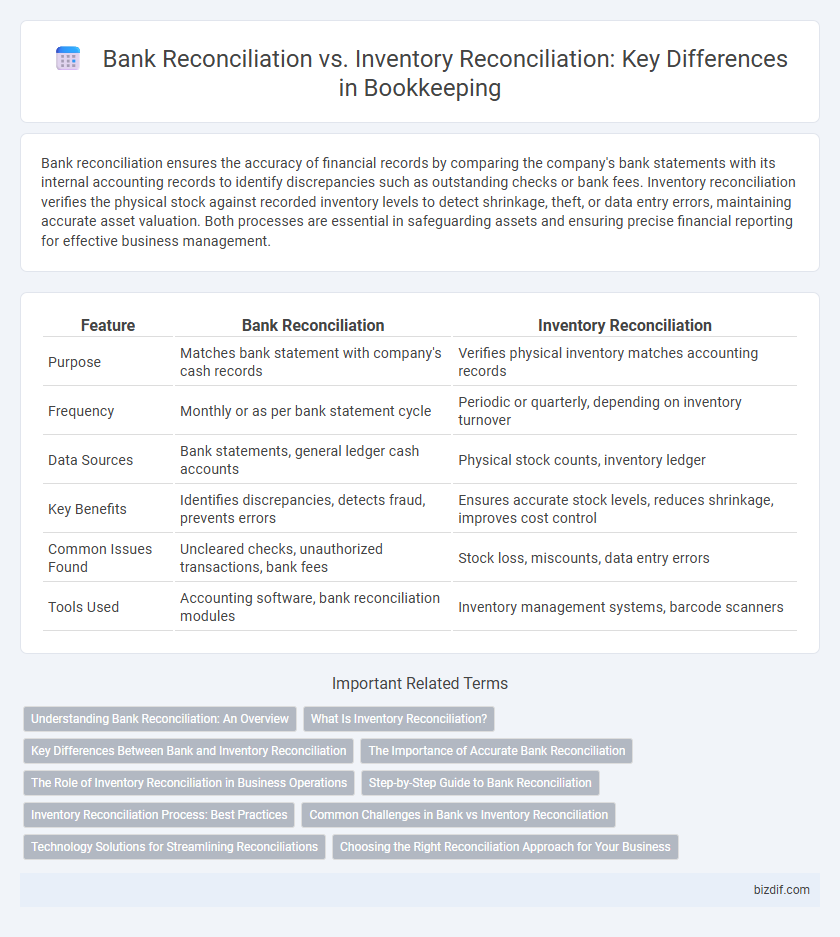

Bank reconciliation ensures the accuracy of financial records by comparing the company's bank statements with its internal accounting records to identify discrepancies such as outstanding checks or bank fees. Inventory reconciliation verifies the physical stock against recorded inventory levels to detect shrinkage, theft, or data entry errors, maintaining accurate asset valuation. Both processes are essential in safeguarding assets and ensuring precise financial reporting for effective business management.

Table of Comparison

| Feature | Bank Reconciliation | Inventory Reconciliation |

|---|---|---|

| Purpose | Matches bank statement with company's cash records | Verifies physical inventory matches accounting records |

| Frequency | Monthly or as per bank statement cycle | Periodic or quarterly, depending on inventory turnover |

| Data Sources | Bank statements, general ledger cash accounts | Physical stock counts, inventory ledger |

| Key Benefits | Identifies discrepancies, detects fraud, prevents errors | Ensures accurate stock levels, reduces shrinkage, improves cost control |

| Common Issues Found | Uncleared checks, unauthorized transactions, bank fees | Stock loss, miscounts, data entry errors |

| Tools Used | Accounting software, bank reconciliation modules | Inventory management systems, barcode scanners |

Understanding Bank Reconciliation: An Overview

Bank reconciliation involves comparing and matching figures from a company's accounting records to those on a bank statement, ensuring accuracy and identifying discrepancies. It helps detect errors, unauthorized transactions, or fraud by verifying deposits, withdrawals, and balances. Unlike inventory reconciliation, which focuses on physical stock counts versus records, bank reconciliation centers on cash flow and financial statement integrity.

What Is Inventory Reconciliation?

Inventory reconciliation is the process of matching the physical stock count with inventory records in the accounting system to identify discrepancies caused by errors, theft, or data entry mistakes. It ensures accurate reporting of inventory levels, which is critical for cost of goods sold calculations and financial statements. Unlike bank reconciliation, which compares bank statements with accounting records, inventory reconciliation focuses specifically on verifying the accuracy of stock quantities and values.

Key Differences Between Bank and Inventory Reconciliation

Bank reconciliation involves matching the company's bank statements with its internal financial records to ensure accuracy in cash transactions, while inventory reconciliation compares physical stock counts to recorded inventory levels to verify quantity and value. Key differences include the focus area--financial accounts for banks versus physical goods for inventory--and the frequency, with bank reconciliations often performed monthly and inventory reconciliations conducted quarterly or annually. The reconciliation methods also vary, as bank reconciliation addresses discrepancies caused by timing differences and transaction errors, whereas inventory reconciliation resolves issues like stock shrinkage, miscounts, or data entry mistakes.

The Importance of Accurate Bank Reconciliation

Accurate bank reconciliation ensures financial statements reflect true cash positions by matching bank records with company ledgers, preventing discrepancies and fraud. It enables timely detection of errors such as unauthorized transactions or recording mistakes, which is critical for maintaining trust with stakeholders. Unlike inventory reconciliation, which verifies stock levels, bank reconciliation focuses solely on cash flow accuracy, making it essential for effective cash management and decision-making.

The Role of Inventory Reconciliation in Business Operations

Inventory reconciliation plays a critical role in business operations by ensuring the accuracy of stock records, which directly impacts sales forecasting and financial reporting. Unlike bank reconciliation that verifies cash transactions against bank statements, inventory reconciliation matches physical stock counts with accounting records to identify discrepancies like theft, damage, or recording errors. Effective inventory reconciliation enhances supply chain management, minimizes stockouts or overstock situations, and improves overall operational efficiency and profitability.

Step-by-Step Guide to Bank Reconciliation

Bank reconciliation is a critical bookkeeping process that involves comparing the company's internal financial records with the bank statement to identify and resolve discrepancies such as outstanding checks or deposits in transit. The step-by-step guide to bank reconciliation includes collecting the bank statement, matching transactions against the ledger, identifying differences, and adjusting the books for errors or bank fees. Unlike inventory reconciliation, which focuses on physical stock counts and matching inventory records, bank reconciliation ensures the accuracy of cash flow and financial reporting.

Inventory Reconciliation Process: Best Practices

Inventory reconciliation process involves systematically comparing physical stock counts with recorded inventory to identify and resolve discrepancies, ensuring accurate financial reporting and optimized stock management. Best practices include conducting regular cycle counts, utilizing inventory management software, and implementing strict documentation procedures to enhance accuracy and traceability. Maintaining clear communication between warehouse and accounting teams minimizes errors and supports efficient inventory control.

Common Challenges in Bank vs Inventory Reconciliation

Bank reconciliation and inventory reconciliation often face common challenges such as data discrepancies, timing differences, and human errors in record-keeping. Mismatched transaction dates and unrecorded adjustments frequently complicate bank reconciliations, while inventory reconciliation struggles with inaccurate stock counts and mistaken entries in inventory management systems. Effective bookkeeping requires systematic verification and regular audits to minimize errors and ensure accurate financial reporting for both bank and inventory accounts.

Technology Solutions for Streamlining Reconciliations

Technology solutions for streamlining bank reconciliation leverage automated data imports, AI-driven transaction matching, and real-time error detection to enhance accuracy and reduce manual workload. Inventory reconciliation benefits from integrated barcode scanning, RFID technology, and inventory management software that syncs with accounting systems to maintain precise stock levels and minimize discrepancies. Both processes increasingly rely on cloud-based platforms and machine learning algorithms to improve efficiency, ensure compliance, and provide actionable financial insights.

Choosing the Right Reconciliation Approach for Your Business

Bank reconciliation ensures that your financial records align with your bank statements, helping detect discrepancies like unauthorized transactions or bank errors, which is essential for accurate cash flow management. Inventory reconciliation verifies the physical stock against recorded inventory levels, preventing stockouts or overstock situations that impact sales and storage costs. Selecting the right reconciliation approach depends on your business's operational priorities, where cash management requires bank reconciliation and product-focused companies benefit significantly from inventory reconciliation.

Bank Reconciliation vs Inventory Reconciliation Infographic

bizdif.com

bizdif.com