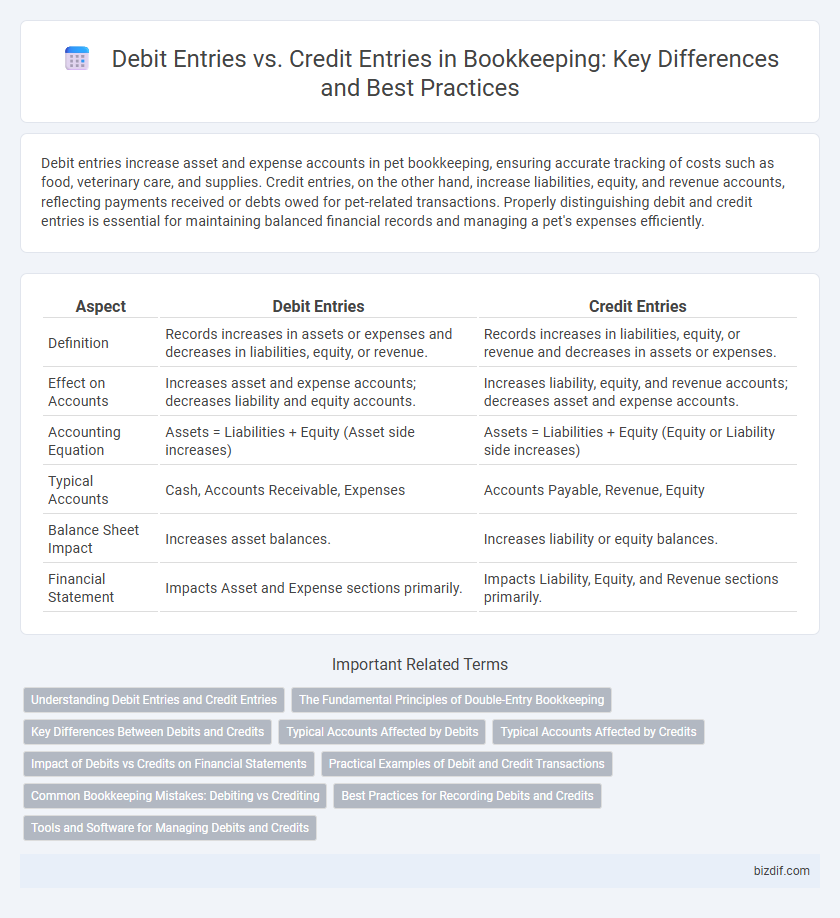

Debit entries increase asset and expense accounts in pet bookkeeping, ensuring accurate tracking of costs such as food, veterinary care, and supplies. Credit entries, on the other hand, increase liabilities, equity, and revenue accounts, reflecting payments received or debts owed for pet-related transactions. Properly distinguishing debit and credit entries is essential for maintaining balanced financial records and managing a pet's expenses efficiently.

Table of Comparison

| Aspect | Debit Entries | Credit Entries |

|---|---|---|

| Definition | Records increases in assets or expenses and decreases in liabilities, equity, or revenue. | Records increases in liabilities, equity, or revenue and decreases in assets or expenses. |

| Effect on Accounts | Increases asset and expense accounts; decreases liability and equity accounts. | Increases liability, equity, and revenue accounts; decreases asset and expense accounts. |

| Accounting Equation | Assets = Liabilities + Equity (Asset side increases) | Assets = Liabilities + Equity (Equity or Liability side increases) |

| Typical Accounts | Cash, Accounts Receivable, Expenses | Accounts Payable, Revenue, Equity |

| Balance Sheet Impact | Increases asset balances. | Increases liability or equity balances. |

| Financial Statement | Impacts Asset and Expense sections primarily. | Impacts Liability, Equity, and Revenue sections primarily. |

Understanding Debit Entries and Credit Entries

Debit entries increase asset and expense accounts, reflecting the inflow of value or resources within bookkeeping records. Credit entries, conversely, increase liability, equity, and revenue accounts, representing an outflow or obligations owed by the business. Accurate differentiation between debit and credit entries ensures balanced financial statements and precise accounting records.

The Fundamental Principles of Double-Entry Bookkeeping

Debit entries record increases in asset or expense accounts and decreases in liability, equity, or revenue accounts, while credit entries do the opposite. The fundamental principle of double-entry bookkeeping requires that every financial transaction affects at least two accounts, maintaining the accounting equation: Assets = Liabilities + Equity. This ensures that total debits always equal total credits, providing accuracy and balance in financial records.

Key Differences Between Debits and Credits

Debit entries increase asset or expense accounts and decrease liabilities, equity, or revenue accounts, while credit entries do the opposite by increasing liabilities, equity, or revenue and decreasing assets or expenses. In double-entry bookkeeping, every transaction requires at least one debit and one credit entry to maintain the accounting equation balance: Assets = Liabilities + Equity. Understanding these key differences ensures accurate financial recording and reporting, crucial for effective bookkeeping and financial management.

Typical Accounts Affected by Debits

Debit entries typically increase asset and expense accounts while decreasing liability, equity, and revenue accounts in bookkeeping. Common accounts affected by debits include cash, accounts receivable, inventory, and various expense accounts such as rent or utilities. Properly recording debits ensures accurate tracking of resource inflows and cost allocations within financial statements.

Typical Accounts Affected by Credits

Credit entries typically affect liability, equity, and revenue accounts by increasing their balances, reflecting obligations, ownership stakes, or income generated. Common accounts impacted include accounts payable, retained earnings, and sales revenue, indicating funds owed, accumulated profits, and earned income respectively. Accurately recording credit entries ensures precise financial reporting and compliance with accounting principles.

Impact of Debits vs Credits on Financial Statements

Debit entries increase asset and expense accounts, directly enhancing the company's financial position by reflecting higher resource values and incurred costs on the balance sheet and income statement. Credit entries increase liabilities, equity, and revenue accounts, indicating obligations owed or earned income, which impacts the financial statements by showing increased sources of funds or profitability. Understanding the contrasting effects of debits and credits is essential for accurate financial reporting and maintaining balanced accounting records.

Practical Examples of Debit and Credit Transactions

Debit entries increase asset and expense accounts, such as when a company purchases office supplies for $500, debiting the Office Supplies account. Credit entries increase liability, equity, and revenue accounts, exemplified by a $1,000 bank loan credited to the Loans Payable account. Recording a $200 cash sale involves debiting Cash and crediting Sales Revenue, illustrating the dual impact of debit and credit transactions in bookkeeping.

Common Bookkeeping Mistakes: Debiting vs Crediting

Misclassifying debit entries as credit entries or vice versa is a prevalent bookkeeping mistake that disrupts account balances and financial reporting accuracy. Debit entries increase asset and expense accounts but decrease liabilities, equity, and revenue accounts, whereas credit entries have the opposite effect. Ensuring correct classification of these entries mitigates errors in trial balances and financial statements, essential for reliable accounting records.

Best Practices for Recording Debits and Credits

Accurate bookkeeping requires a clear understanding of debit and credit entries, ensuring each transaction is recorded on the appropriate side of the ledger to maintain balance. Best practices include consistently applying the double-entry accounting system, verifying account types to classify debits and credits correctly, and regularly reconciling accounts to detect discrepancies early. Implementing standardized templates for journal entries and using accounting software further enhances accuracy and efficiency in recording financial data.

Tools and Software for Managing Debits and Credits

Bookkeeping tools such as QuickBooks, Xero, and FreshBooks automate debit and credit entries, ensuring accurate financial records and reducing manual errors. These software solutions provide real-time transaction tracking, reconcile accounts, and generate detailed reports that simplify financial analysis. Integration with bank feeds and customizable ledger categories optimize the management of debits and credits for small to medium-sized businesses.

Debit Entries vs Credit Entries Infographic

bizdif.com

bizdif.com