Ledger posting organizes financial data by categorizing transactions into individual accounts, providing a clear view of account balances over time. Journal entries serve as the initial record of all financial transactions, capturing detailed information such as date, amount, and description before being posted to the ledger. Accurate ledger posting depends on precise journal entries to maintain the integrity of the accounting records and ensure reliable financial reporting.

Table of Comparison

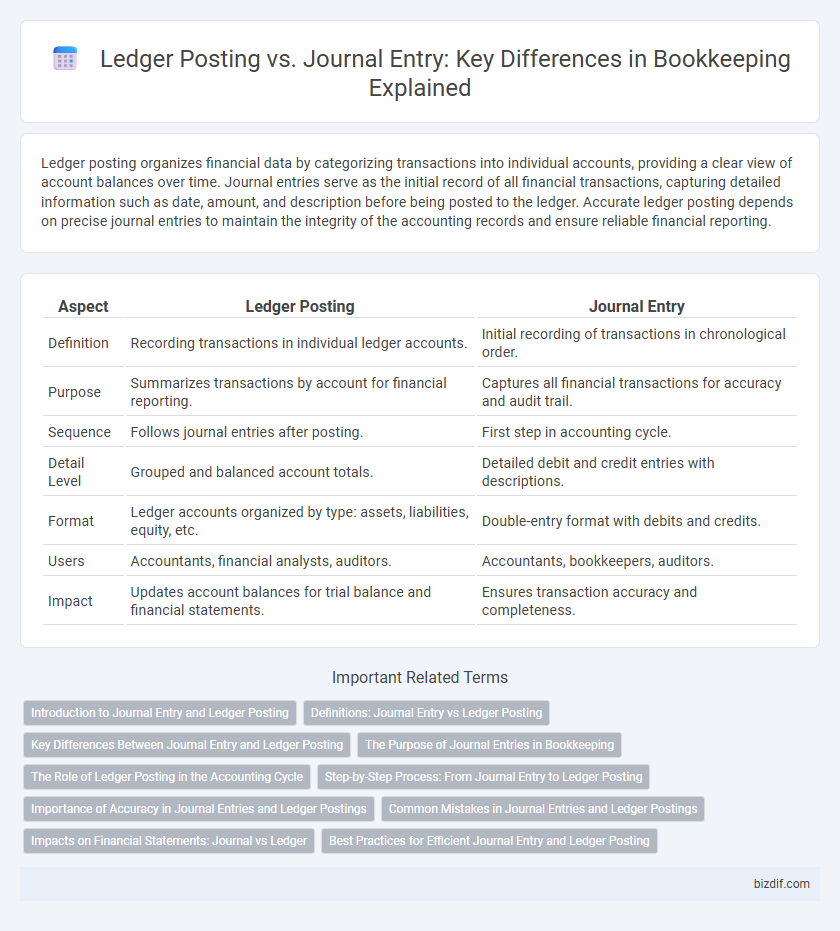

| Aspect | Ledger Posting | Journal Entry |

|---|---|---|

| Definition | Recording transactions in individual ledger accounts. | Initial recording of transactions in chronological order. |

| Purpose | Summarizes transactions by account for financial reporting. | Captures all financial transactions for accuracy and audit trail. |

| Sequence | Follows journal entries after posting. | First step in accounting cycle. |

| Detail Level | Grouped and balanced account totals. | Detailed debit and credit entries with descriptions. |

| Format | Ledger accounts organized by type: assets, liabilities, equity, etc. | Double-entry format with debits and credits. |

| Users | Accountants, financial analysts, auditors. | Accountants, bookkeepers, auditors. |

| Impact | Updates account balances for trial balance and financial statements. | Ensures transaction accuracy and completeness. |

Introduction to Journal Entry and Ledger Posting

Journal entry serves as the initial record of financial transactions, capturing details such as date, accounts affected, debit and credit amounts, and transaction description. Ledger posting involves transferring these recorded journal entries into individual ledger accounts to organize and summarize financial data for reporting. Efficient ledger posting ensures accurate account balances and supports the preparation of financial statements.

Definitions: Journal Entry vs Ledger Posting

A journal entry records individual financial transactions in chronological order, capturing details such as date, accounts affected, amounts, and descriptions. Ledger posting involves transferring these recorded journal entries into specific accounts within the ledger to summarize and categorize financial data effectively. This process organizes transactions by account, facilitating accurate financial reporting and analysis.

Key Differences Between Journal Entry and Ledger Posting

Journal entry records the initial financial transactions in chronological order within the journal, capturing details like date, accounts involved, and amounts. Ledger posting transfers these recorded entries into individual ledger accounts, organizing data by account to summarize balances. Journal entries focus on transaction documentation, whereas ledger postings emphasize account-wise organization for financial statement preparation.

The Purpose of Journal Entries in Bookkeeping

Journal entries in bookkeeping serve as the foundational records of financial transactions, ensuring accurate and chronological documentation within the accounting system. Each journal entry systematically captures details such as accounts affected, amounts debited or credited, and transaction dates, facilitating precise financial reporting. These entries provide the essential data needed for subsequent ledger posting, where aggregated information is organized into individual accounts for comprehensive financial analysis.

The Role of Ledger Posting in the Accounting Cycle

Ledger posting serves as a critical step in the accounting cycle by transferring journal entries into individual accounts, enabling accurate tracking of financial transactions. This process consolidates data from various journal entries, ensuring that each account reflects the cumulative effect of all recorded activities. Proper ledger posting facilitates the preparation of trial balances and financial statements, supporting precise financial analysis and reporting.

Step-by-Step Process: From Journal Entry to Ledger Posting

The step-by-step process begins with recording business transactions as journal entries in the general journal, capturing details such as date, accounts affected, debit and credit amounts, and descriptions. Next, each journal entry is systematically posted to the respective accounts in the general ledger, ensuring that debits and credits are correctly transferred to maintain balanced books. This process provides a clear audit trail by organizing financial data, facilitating accurate financial statements and efficient bookkeeping.

Importance of Accuracy in Journal Entries and Ledger Postings

Accuracy in journal entries and ledger postings is critical to maintaining reliable financial records and ensuring compliance with accounting standards. Precise recording of transactions prevents errors that can lead to misstatements in financial statements, impacting business decisions and audits. Consistent accuracy supports transparent financial reporting and helps in effective tracking of a company's financial health.

Common Mistakes in Journal Entries and Ledger Postings

Common mistakes in journal entries include incorrect date recording, misclassification of accounts, and omission of supporting details, which lead to errors in the general ledger. Ledger posting errors often result from transposing figures, posting entries to wrong accounts, and failing to update subsidiary ledgers, causing imbalances in trial balances. Accurate cross-verification between journal entries and ledger postings is essential to maintain financial accuracy and ensure compliance with accounting standards.

Impacts on Financial Statements: Journal vs Ledger

Journal entries record financial transactions chronologically with detailed descriptions, directly impacting the accuracy of financial statements through precise initial data capture. Ledger posting organizes these transactions by accounts, enabling the aggregation of balances that form the basis of trial balances and financial reports. Accurate ledger postings ensure the integrity of financial statements by summarizing journal entries into meaningful account summaries, which support reliable balance sheets and income statements.

Best Practices for Efficient Journal Entry and Ledger Posting

Accurate ledger posting depends on well-organized journal entries, which should detail transaction dates, amounts, and accounts involved to ensure clarity. Implementing standardized templates and regular reconciliation helps maintain consistency and minimizes errors during ledger updates. Leveraging accounting software can streamline posting processes, enhance audit trails, and improve overall bookkeeping efficiency.

Ledger posting vs Journal entry Infographic

bizdif.com

bizdif.com