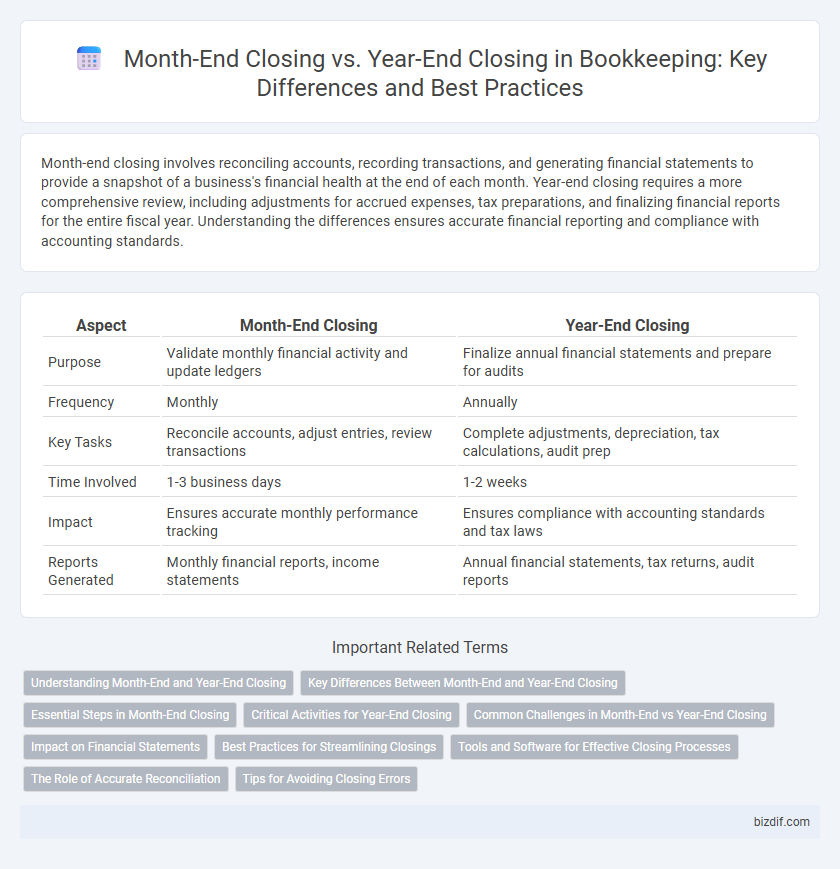

Month-end closing involves reconciling accounts, recording transactions, and generating financial statements to provide a snapshot of a business's financial health at the end of each month. Year-end closing requires a more comprehensive review, including adjustments for accrued expenses, tax preparations, and finalizing financial reports for the entire fiscal year. Understanding the differences ensures accurate financial reporting and compliance with accounting standards.

Table of Comparison

| Aspect | Month-End Closing | Year-End Closing |

|---|---|---|

| Purpose | Validate monthly financial activity and update ledgers | Finalize annual financial statements and prepare for audits |

| Frequency | Monthly | Annually |

| Key Tasks | Reconcile accounts, adjust entries, review transactions | Complete adjustments, depreciation, tax calculations, audit prep |

| Time Involved | 1-3 business days | 1-2 weeks |

| Impact | Ensures accurate monthly performance tracking | Ensures compliance with accounting standards and tax laws |

| Reports Generated | Monthly financial reports, income statements | Annual financial statements, tax returns, audit reports |

Understanding Month-End and Year-End Closing

Month-end closing involves reconciling accounts, verifying transactions, and preparing financial statements to ensure accurate monthly reporting and cash flow management. Year-end closing requires a comprehensive review of the entire fiscal year's financial records, including adjustments for depreciation, accruals, and tax provisions, to finalize annual financial statements and comply with regulatory reporting standards. Both processes are critical for maintaining accurate financial data, but year-end closing demands more extensive analysis and documentation to support audits and tax filings.

Key Differences Between Month-End and Year-End Closing

Month-end closing involves reconciling accounts, verifying transactions, and preparing financial statements for a single month to ensure accurate reporting and cash flow management. Year-end closing is a more comprehensive process that includes finalizing all financial records, performing audits, calculating tax liabilities, and generating annual reports crucial for regulatory compliance and strategic planning. The key differences lie in the scope, detail level, and compliance requirements, with month-end focusing on routine operational accuracy and year-end addressing broader financial performance and statutory obligations.

Essential Steps in Month-End Closing

Month-end closing involves reconciling all financial transactions, verifying account balances, and preparing financial statements to ensure accurate monthly reporting. Key activities include posting all journal entries, adjusting accruals, and reviewing accounts receivable and payable for completeness. Timely completion of these essential steps is critical for maintaining up-to-date financial records and facilitating smooth year-end closing processes.

Critical Activities for Year-End Closing

Year-end closing involves critical activities such as reconciling all accounts, verifying the accuracy of financial statements, and performing comprehensive inventory counts to ensure precise reporting. Adjusting entries for depreciation, accruals, and tax provisions are essential to comply with accounting standards and regulatory requirements. Additionally, preparing detailed audit schedules and coordinating with external auditors solidify the integrity and completeness of annual financial records.

Common Challenges in Month-End vs Year-End Closing

Month-end closing often struggles with time constraints and data accuracy due to frequent transaction volume, while year-end closing faces complexities like comprehensive financial statement preparation and regulatory compliance. Reconciling accounts is a recurring challenge in both processes; however, year-end closing demands more detailed audit readiness and tax reporting. Efficient coordination across departments and robust accounting software can mitigate errors and streamline both month-end and year-end closing tasks.

Impact on Financial Statements

Month-end closing ensures accurate and timely financial statements by recording all transactions within the month, providing management with up-to-date financial performance data. Year-end closing involves comprehensive adjustments and reconciliations, such as depreciation, inventory valuation, and tax provisions, to finalize the annual financial statements in compliance with accounting standards. These processes significantly impact the accuracy, completeness, and reliability of financial statements, influencing decision-making and regulatory reporting.

Best Practices for Streamlining Closings

Implementing a structured checklist and leveraging accounting software automation significantly enhances efficiency during month-end and year-end closings. Accurate reconciliation of accounts payable, receivable, and bank statements early in the process prevents bottlenecks and errors. Consistent communication across finance teams ensures timely submission of documents and alignment on outstanding issues, streamlining the entire closing cycle.

Tools and Software for Effective Closing Processes

Month-end closing and year-end closing require specialized bookkeeping tools to streamline data reconciliation and financial reporting. Cloud-based accounting software like QuickBooks, Xero, and Sage Intacct automate transaction matching and generate detailed closing reports, ensuring accuracy and compliance during both periods. Advanced features such as automated journal entries, real-time financial dashboards, and audit trail capabilities optimize efficiency and reduce errors in closing processes.

The Role of Accurate Reconciliation

Accurate reconciliation is essential in both month-end closing and year-end closing processes to ensure financial statements reflect true account balances. During month-end closing, reconciliation detects discrepancies early, facilitating timely adjustments and preventing errors from accumulating over time. In year-end closing, thorough reconciliation guarantees compliance with accounting standards and supports reliable audit trails, critical for financial reporting and tax purposes.

Tips for Avoiding Closing Errors

Accurate reconciliations and timely data entry are essential for avoiding errors during both month-end and year-end closing processes. Implementing a checklist that includes verifying account balances, reviewing journal entries, and confirming inventory counts minimizes discrepancies. Regular internal audits and using accounting software with error-checking features further reduce the risk of closing mistakes.

Month-End Closing vs Year-End Closing Infographic

bizdif.com

bizdif.com