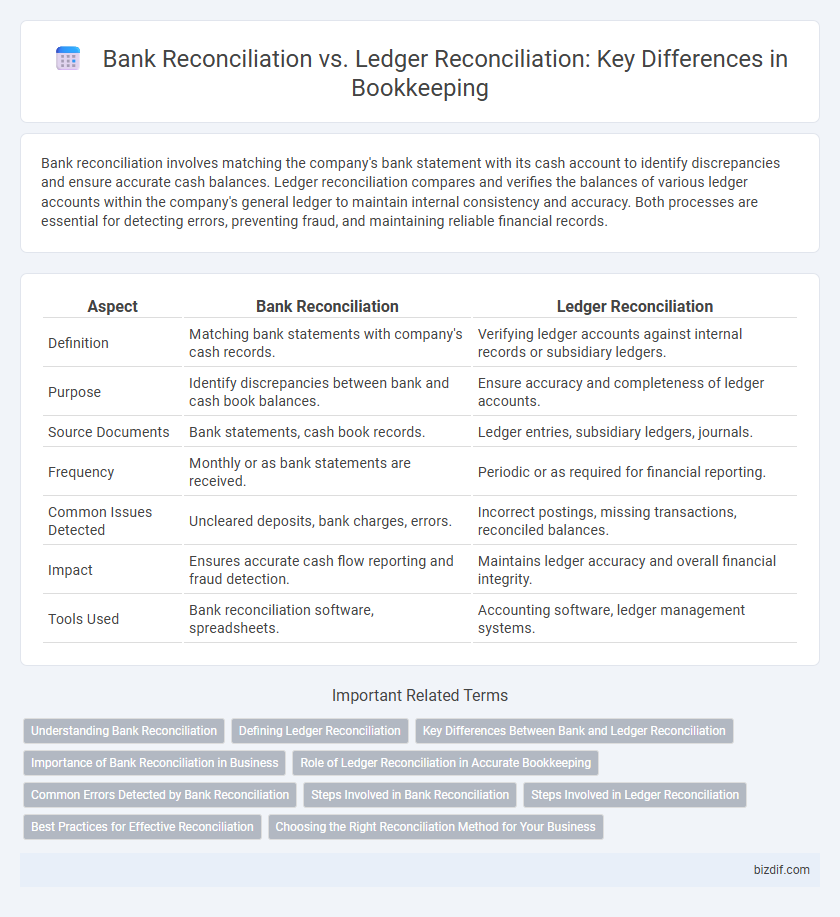

Bank reconciliation involves matching the company's bank statement with its cash account to identify discrepancies and ensure accurate cash balances. Ledger reconciliation compares and verifies the balances of various ledger accounts within the company's general ledger to maintain internal consistency and accuracy. Both processes are essential for detecting errors, preventing fraud, and maintaining reliable financial records.

Table of Comparison

| Aspect | Bank Reconciliation | Ledger Reconciliation |

|---|---|---|

| Definition | Matching bank statements with company's cash records. | Verifying ledger accounts against internal records or subsidiary ledgers. |

| Purpose | Identify discrepancies between bank and cash book balances. | Ensure accuracy and completeness of ledger accounts. |

| Source Documents | Bank statements, cash book records. | Ledger entries, subsidiary ledgers, journals. |

| Frequency | Monthly or as bank statements are received. | Periodic or as required for financial reporting. |

| Common Issues Detected | Uncleared deposits, bank charges, errors. | Incorrect postings, missing transactions, reconciled balances. |

| Impact | Ensures accurate cash flow reporting and fraud detection. | Maintains ledger accuracy and overall financial integrity. |

| Tools Used | Bank reconciliation software, spreadsheets. | Accounting software, ledger management systems. |

Understanding Bank Reconciliation

Bank reconciliation involves comparing the company's internal financial records against the bank statement to identify discrepancies and ensure accuracy in cash balances. It helps detect errors, unauthorized transactions, or timing differences such as outstanding checks and deposits in transit. Understanding bank reconciliation is crucial for maintaining reliable financial reporting and preventing fraud in bookkeeping processes.

Defining Ledger Reconciliation

Ledger reconciliation involves verifying and matching entries within an organization's general ledger to ensure accuracy and consistency of financial records. This process helps identify discrepancies, such as errors or missing transactions, by comparing ledger accounts against supporting documentation or sub-ledgers. Unlike bank reconciliation, which specifically aligns bank statements with the cash account, ledger reconciliation covers a broader range of accounts to maintain overall financial integrity.

Key Differences Between Bank and Ledger Reconciliation

Bank reconciliation involves comparing the company's bank statement with its cash book to identify discrepancies such as outstanding checks or bank fees. Ledger reconciliation, on the other hand, focuses on verifying the accuracy and completeness of all ledger accounts by matching internal transactions against supporting documentation. The key difference lies in bank reconciliation reconciling external bank records with internal cash records, while ledger reconciliation ensures the correctness of all ledger entries within the accounting system.

Importance of Bank Reconciliation in Business

Bank reconciliation is crucial for businesses to ensure the accuracy of cash records by comparing the company's ledger with bank statements, which helps identify discrepancies such as errors, unauthorized transactions, or timing differences. This process minimizes the risk of fraud, prevents overdrafts, and enhances financial control by providing a clear view of actual cash flow. While ledger reconciliation verifies internal transaction records, bank reconciliation directly confirms the alignment of these records with the bank's data, making it essential for maintaining trustworthy financial statements.

Role of Ledger Reconciliation in Accurate Bookkeeping

Ledger reconciliation plays a critical role in accurate bookkeeping by ensuring that all ledger entries align with source documents and internal records, thereby identifying discrepancies early. Unlike bank reconciliation, which matches bank statements with company records, ledger reconciliation verifies the integrity of accounts within the ledger itself. This process supports precise financial reporting and helps maintain the reliability of financial statements.

Common Errors Detected by Bank Reconciliation

Bank reconciliation commonly detects errors such as missed bank fees, unrecorded deposits, and timing differences between ledger entries and bank statements. These discrepancies often include outstanding checks that have not cleared, duplication of transactions, or misposted amounts in the cash book. Identifying these errors ensures accuracy in financial records, prevents fraud, and improves cash flow management.

Steps Involved in Bank Reconciliation

Bank reconciliation involves matching the company's cash records with the bank statement to identify discrepancies, starting with verifying deposits, withdrawals, and bank charges. The process includes adjusting entries for outstanding checks, deposits in transit, and any bank errors to ensure the ledger reflects accurate cash balances. Accurate bank reconciliation improves financial accuracy and helps in detecting fraud or accounting errors promptly.

Steps Involved in Ledger Reconciliation

Ledger reconciliation involves systematically comparing ledger entries with supporting documents and subsidiary accounts to identify discrepancies. The process includes verifying transaction dates, amounts, and descriptions against source records, adjusting ledger balances for errors or omissions, and ensuring that all entries comply with accounting standards. Completing these steps enhances accuracy in financial reporting and supports effective internal controls.

Best Practices for Effective Reconciliation

Bank reconciliation involves comparing the bank statement with the cash book to identify discrepancies, while ledger reconciliation matches internal ledger accounts for accuracy. Best practices include maintaining detailed transaction records, conducting reconciliations regularly, and promptly investigating any discrepancies to ensure accurate financial reporting. Utilizing accounting software with automated reconciliation features enhances efficiency and reduces human error in both bank and ledger reconciliation processes.

Choosing the Right Reconciliation Method for Your Business

Selecting the appropriate reconciliation method depends on the size and complexity of your business transactions; bank reconciliation is vital for verifying that bank statements align with internal records, ensuring accuracy in cash flow management. Ledger reconciliation expands this verification to include all ledger accounts, providing a comprehensive financial overview essential for larger operations with multiple account types. Businesses with frequent transactions or multiple financial accounts benefit from combining both methods to maintain precise, error-free financial statements.

Bank Reconciliation vs Ledger Reconciliation Infographic

bizdif.com

bizdif.com