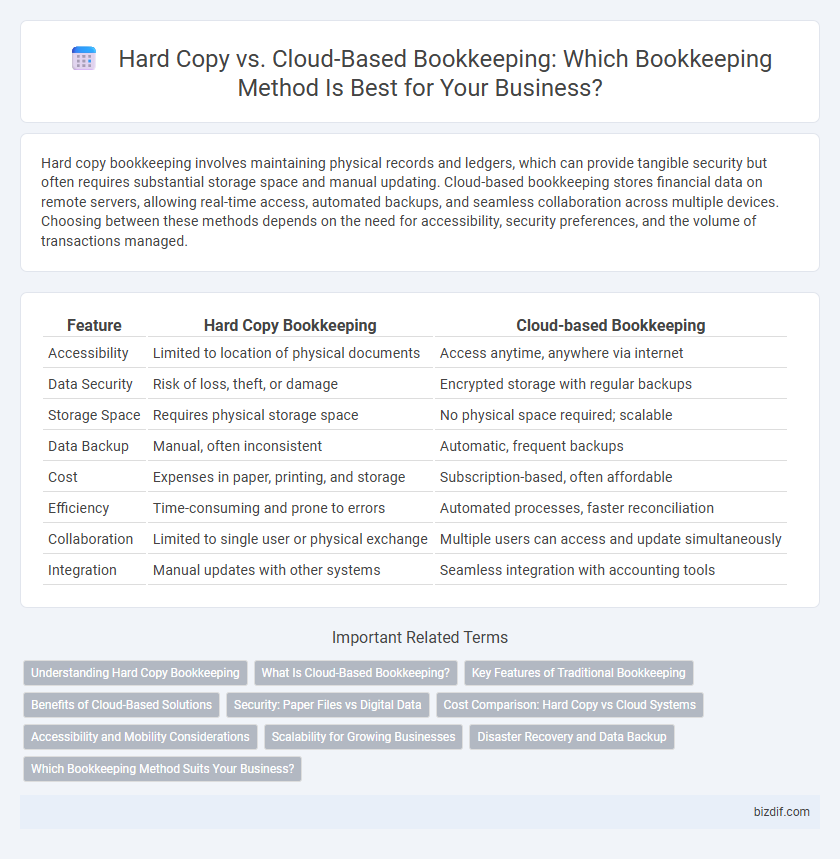

Hard copy bookkeeping involves maintaining physical records and ledgers, which can provide tangible security but often requires substantial storage space and manual updating. Cloud-based bookkeeping stores financial data on remote servers, allowing real-time access, automated backups, and seamless collaboration across multiple devices. Choosing between these methods depends on the need for accessibility, security preferences, and the volume of transactions managed.

Table of Comparison

| Feature | Hard Copy Bookkeeping | Cloud-based Bookkeeping |

|---|---|---|

| Accessibility | Limited to location of physical documents | Access anytime, anywhere via internet |

| Data Security | Risk of loss, theft, or damage | Encrypted storage with regular backups |

| Storage Space | Requires physical storage space | No physical space required; scalable |

| Data Backup | Manual, often inconsistent | Automatic, frequent backups |

| Cost | Expenses in paper, printing, and storage | Subscription-based, often affordable |

| Efficiency | Time-consuming and prone to errors | Automated processes, faster reconciliation |

| Collaboration | Limited to single user or physical exchange | Multiple users can access and update simultaneously |

| Integration | Manual updates with other systems | Seamless integration with accounting tools |

Understanding Hard Copy Bookkeeping

Hard copy bookkeeping involves maintaining physical records such as ledgers, invoices, and receipts organized in filing systems or binders. This traditional method provides a tangible backup but requires significant storage space and manual effort for data retrieval and reconciliation. Understanding hard copy bookkeeping highlights its reliance on meticulous record-keeping and vulnerability to loss or damage compared to cloud-based solutions.

What Is Cloud-Based Bookkeeping?

Cloud-based bookkeeping refers to the practice of managing financial records and transactions through internet-connected software platforms, allowing real-time access and automatic data backups. This method eliminates the need for physical storage of documents and offers enhanced collaboration between accountants and business owners. Cloud-based bookkeeping improves accuracy and efficiency by integrating with bank feeds and financial apps.

Key Features of Traditional Bookkeeping

Traditional bookkeeping relies on physical ledgers and paper documents to record financial transactions, ensuring tangible records and secure storage. It involves manual entry and reconciliation processes, allowing for detailed audit trails and historical record-keeping. This method provides direct control over data but requires significant time and effort for organization and retrieval.

Benefits of Cloud-Based Solutions

Cloud-based bookkeeping offers real-time access to financial data from any device with internet connectivity, enhancing flexibility and collaboration among team members. Automated backups and strong encryption ensure data security and prevent loss, surpassing the risks associated with hard copy records. Integration with other business software streamlines workflows and improves accuracy, reducing manual entry errors common in traditional bookkeeping methods.

Security: Paper Files vs Digital Data

Paper files in bookkeeping offer physical control but are vulnerable to risks like theft, fire, and natural disasters, which can result in permanent data loss. Cloud-based bookkeeping enhances security with encryption, multi-factor authentication, and automated backups, reducing the risk of unauthorized access and data corruption. Businesses leveraging cloud solutions benefit from real-time monitoring, disaster recovery protocols, and compliance with data protection regulations.

Cost Comparison: Hard Copy vs Cloud Systems

Hard copy bookkeeping incurs ongoing expenses for physical storage, paper, and printing supplies, often leading to higher long-term costs compared to cloud-based systems. Cloud-based bookkeeping solutions typically operate on subscription models with minimal upfront investment and reduce costs related to physical materials and manual data entry. Businesses can achieve significant savings through automated processes, scalability, and remote accessibility offered by cloud platforms, making them a cost-effective alternative to traditional hard copy methods.

Accessibility and Mobility Considerations

Hard copy bookkeeping limits accessibility, requiring physical presence to manage and review financial records, which reduces mobility and slows decision-making processes. Cloud-based bookkeeping systems offer real-time access from any device with internet connectivity, enhancing flexibility for remote teams and on-the-go financial management. This mobility advantage supports faster collaboration and more timely updates, making cloud solutions indispensable for modern businesses.

Scalability for Growing Businesses

Hard copy bookkeeping limits scalability due to physical storage constraints and time-consuming manual processes, making it challenging for growing businesses to manage increasing volumes of financial data efficiently. Cloud-based bookkeeping offers scalable solutions with automated data entry, real-time updates, and secure digital storage, enabling businesses to easily expand their bookkeeping capabilities without significant additional costs. The flexibility of cloud platforms supports seamless integration with other business systems, enhancing overall financial management and growth potential.

Disaster Recovery and Data Backup

Hard copy bookkeeping relies on physical documents vulnerable to loss or damage from fire, flood, or theft, making disaster recovery difficult and time-consuming. Cloud-based bookkeeping offers automatic data backup and real-time recovery options, ensuring business continuity even during unexpected events. Cloud solutions often include encrypted storage and redundant servers, enhancing data security and minimizing downtime.

Which Bookkeeping Method Suits Your Business?

Hard copy bookkeeping involves maintaining physical records such as ledgers and receipts, offering tangible backups but requiring considerable storage and manual organization. Cloud-based bookkeeping utilizes online platforms like QuickBooks Online or Xero, providing real-time access, automated data syncing, and enhanced security features suitable for businesses prioritizing mobility and scalability. Small businesses with minimal transactions might prefer hard copy methods for simplicity, while rapidly growing or remote businesses benefit from the efficiency and collaboration capabilities of cloud-based bookkeeping.

Hard Copy vs Cloud-based Bookkeeping Infographic

bizdif.com

bizdif.com