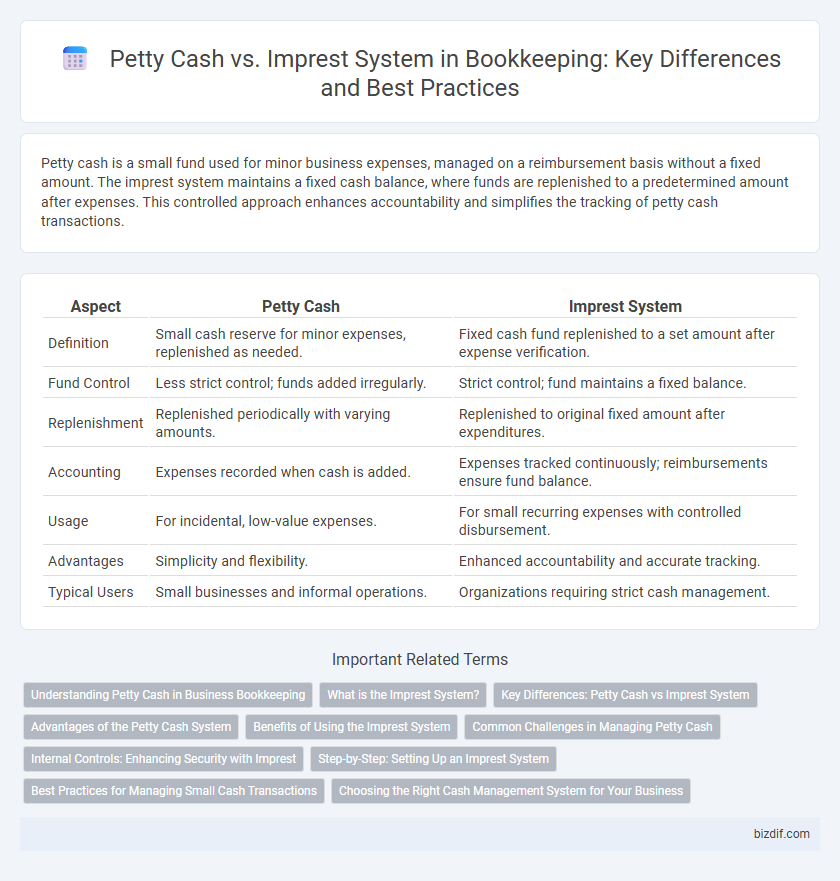

Petty cash is a small fund used for minor business expenses, managed on a reimbursement basis without a fixed amount. The imprest system maintains a fixed cash balance, where funds are replenished to a predetermined amount after expenses. This controlled approach enhances accountability and simplifies the tracking of petty cash transactions.

Table of Comparison

| Aspect | Petty Cash | Imprest System |

|---|---|---|

| Definition | Small cash reserve for minor expenses, replenished as needed. | Fixed cash fund replenished to a set amount after expense verification. |

| Fund Control | Less strict control; funds added irregularly. | Strict control; fund maintains a fixed balance. |

| Replenishment | Replenished periodically with varying amounts. | Replenished to original fixed amount after expenditures. |

| Accounting | Expenses recorded when cash is added. | Expenses tracked continuously; reimbursements ensure fund balance. |

| Usage | For incidental, low-value expenses. | For small recurring expenses with controlled disbursement. |

| Advantages | Simplicity and flexibility. | Enhanced accountability and accurate tracking. |

| Typical Users | Small businesses and informal operations. | Organizations requiring strict cash management. |

Understanding Petty Cash in Business Bookkeeping

Petty cash in business bookkeeping refers to a small amount of cash kept on hand to cover minor expenses, enabling quick and efficient transactions without formal approval processes. It operates on the imprest system, where a fixed amount is maintained, and receipts are used to replenish funds periodically, ensuring accurate tracking and control. Effective management of petty cash reduces administrative burden and enhances financial transparency by documenting small expenditures systematically.

What is the Imprest System?

The Imprest System is a cash management method where a fixed amount of money is allocated for petty expenses, and replenishments are made only for the exact amount spent, ensuring accurate tracking and control. This system improves accountability by requiring detailed records of expenditures before funds are restored. Unlike simple petty cash, the imprest system maintains a constant balance, facilitating precise reconciliation and minimizing errors in bookkeeping.

Key Differences: Petty Cash vs Imprest System

Petty cash is a small fund used for minor, everyday expenses, while the imprest system is a controlled cash management method ensuring the petty cash fund is replenished to a fixed amount after expenses. The key difference lies in accountability; the imprest system requires detailed documentation and periodic reconciliation, promoting accuracy and fraud prevention. Petty cash alone may lack strict controls, whereas the imprest system enforces disciplined tracking and reporting for small cash disbursements.

Advantages of the Petty Cash System

The Petty Cash system offers enhanced flexibility by allowing employees to quickly access small amounts of cash for minor expenses without complex approval processes. It simplifies record-keeping through a physical cash fund tracked with vouchers, reducing the risk of errors compared to electronic systems. Furthermore, the Petty Cash system boosts operational efficiency by streamlining the handling of incidental transactions and minimizing the need for frequent reimbursements.

Benefits of Using the Imprest System

The imprest system ensures accurate control and accountability of petty cash by maintaining a fixed advance amount that is periodically replenished based on actual expenses incurred. This method reduces the risk of misappropriation and simplifies reconciliation, allowing businesses to efficiently monitor and manage small cash transactions. Enhanced transparency and systematic record-keeping under the imprest system support improved financial reporting and audit readiness.

Common Challenges in Managing Petty Cash

Managing petty cash often involves challenges such as maintaining accurate records, preventing theft or misappropriation, and reconciling discrepancies between the cash on hand and recorded transactions. Frequent small transactions create difficulties in tracking expenses, leading to potential errors or lost receipts. Implementing strict controls and regular audits is essential to minimize these risks and ensure transparency in petty cash handling.

Internal Controls: Enhancing Security with Imprest

Imprest systems strengthen internal controls by maintaining a fixed cash balance, ensuring all disbursements are supported by receipts and replenishments match total expenditures. This structure limits opportunities for fraud or errors by requiring detailed documentation and regular reconciliation of petty cash funds. Enhanced security in imprest systems provides accurate tracking of small expenses while promoting accountability among employees handling cash.

Step-by-Step: Setting Up an Imprest System

Setting up an imprest system involves establishing a fixed petty cash fund with a predetermined amount, ensuring consistent cash availability for small expenses. The custodian is responsible for disbursing funds and submitting receipts to maintain accurate records, which are regularly reconciled with the fixed fund balance. Periodic replenishment restores the fund to its original amount, maintaining strict control and improving transparency in petty cash management.

Best Practices for Managing Small Cash Transactions

Effective management of petty cash requires clear documentation, regular reconciliation, and strict authorization protocols to prevent discrepancies. Implementing an imprest system standardizes the petty cash fund, maintaining a fixed amount that is replenished only upon submission of valid expense receipts. Regular auditing and employee training on cash handling procedures enhance accountability and minimize the risk of misappropriation in small cash transactions.

Choosing the Right Cash Management System for Your Business

Selecting the appropriate cash management system between Petty Cash and the Imprest System hinges on your business's transaction volume and control needs. Petty Cash suits small, infrequent expenses with straightforward tracking, while the Imprest System offers a fixed fund replenished to a set amount, enhancing accountability and minimizing errors. Evaluating cost efficiency, transparency, and ease of reconciliation helps ensure optimal financial oversight tailored to your operational scale.

Petty Cash vs Imprest System Infographic

bizdif.com

bizdif.com