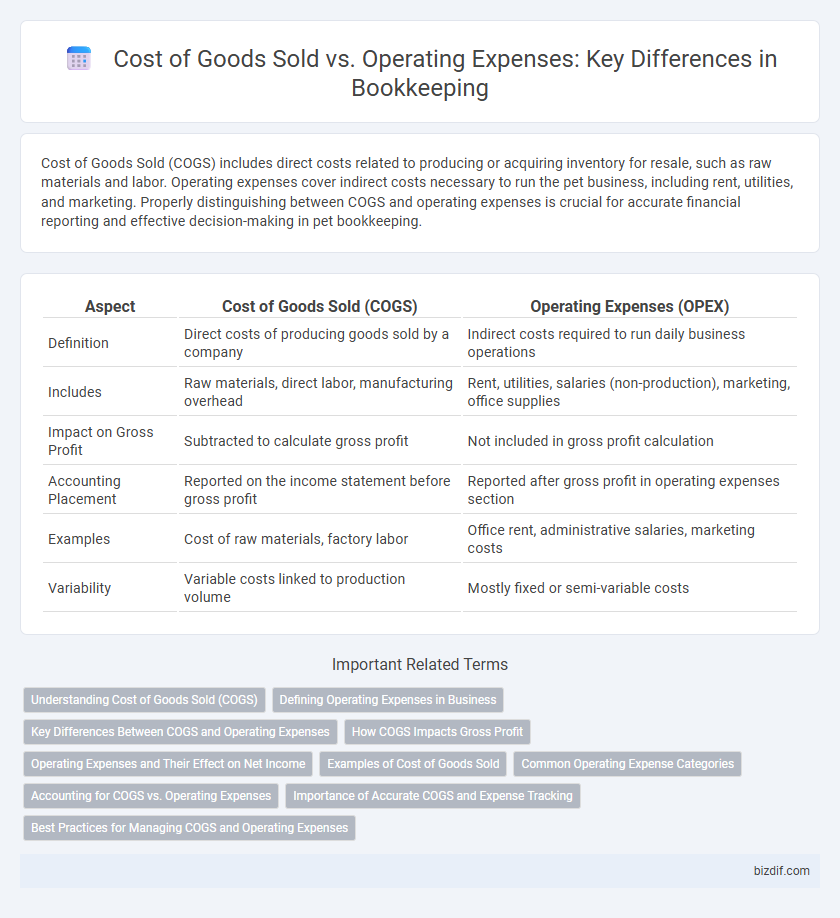

Cost of Goods Sold (COGS) includes direct costs related to producing or acquiring inventory for resale, such as raw materials and labor. Operating expenses cover indirect costs necessary to run the pet business, including rent, utilities, and marketing. Properly distinguishing between COGS and operating expenses is crucial for accurate financial reporting and effective decision-making in pet bookkeeping.

Table of Comparison

| Aspect | Cost of Goods Sold (COGS) | Operating Expenses (OPEX) |

|---|---|---|

| Definition | Direct costs of producing goods sold by a company | Indirect costs required to run daily business operations |

| Includes | Raw materials, direct labor, manufacturing overhead | Rent, utilities, salaries (non-production), marketing, office supplies |

| Impact on Gross Profit | Subtracted to calculate gross profit | Not included in gross profit calculation |

| Accounting Placement | Reported on the income statement before gross profit | Reported after gross profit in operating expenses section |

| Examples | Cost of raw materials, factory labor | Office rent, administrative salaries, marketing costs |

| Variability | Variable costs linked to production volume | Mostly fixed or semi-variable costs |

Understanding Cost of Goods Sold (COGS)

Cost of Goods Sold (COGS) represents the direct costs attributable to the production of goods sold by a business, including raw materials, labor, and manufacturing overhead. COGS is essential for accurately calculating gross profit, which is revenue minus COGS, providing insight into production efficiency and pricing strategy. Properly distinguishing COGS from operating expenses allows for clearer financial analysis and improved budgeting decisions.

Defining Operating Expenses in Business

Operating expenses in business refer to the ongoing costs required to run daily operations, excluding the cost of goods sold (COGS). These expenses include rent, utilities, salaries, marketing, and administrative costs that support business functions without directly tying to product manufacturing or service delivery. Accurately distinguishing operating expenses from COGS helps businesses manage profitability and optimize financial reporting.

Key Differences Between COGS and Operating Expenses

Cost of Goods Sold (COGS) represents the direct costs associated with producing or purchasing the products sold by a business, including materials and labor directly tied to production. Operating expenses encompass the broader day-to-day expenses required to run the business, such as rent, utilities, salaries for administrative staff, and marketing costs. Distinguishing between COGS and operating expenses is crucial for accurate financial reporting, inventory management, and profit calculation, as COGS affects gross profit while operating expenses impact net profit.

How COGS Impacts Gross Profit

Cost of Goods Sold (COGS) directly affects gross profit by representing the direct costs tied to producing goods sold during a period, such as materials and labor. Lower COGS results in higher gross profit, enhancing a company's core profitability before accounting for operating expenses like rent and salaries. Accurate tracking of COGS is essential for financial analysis, pricing strategies, and inventory management to maintain healthy profit margins.

Operating Expenses and Their Effect on Net Income

Operating expenses, including rent, utilities, salaries, and marketing costs, directly impact a company's net income by reducing the total profit after deducting the cost of goods sold. These expenses are necessary for daily business operations but do not fluctuate with production levels, distinguishing them from the cost of goods sold. Effectively managing operating expenses can enhance profitability by controlling overhead and improving overall financial performance.

Examples of Cost of Goods Sold

Cost of Goods Sold (COGS) includes direct expenses such as raw materials, direct labor costs, and manufacturing supplies needed to produce goods sold by a business. Examples of COGS are the purchase price of inventory, freight-in charges, and factory utilities directly tied to production. These costs are distinct from operating expenses, which cover broader business functions like marketing, rent, and administrative salaries.

Common Operating Expense Categories

Common operating expense categories in bookkeeping include rent, utilities, salaries, marketing, and office supplies, which are essential for daily business functions but not directly tied to production. Cost of Goods Sold (COGS) encompasses expenses like raw materials, direct labor, and manufacturing overhead that are directly involved in creating a product or service. Understanding the distinction between COGS and operating expenses aids in accurate financial reporting and effective cost management.

Accounting for COGS vs. Operating Expenses

Accounting for Cost of Goods Sold (COGS) involves tracking direct expenses tied to product production, such as raw materials and labor, which impact gross profit calculations. Operating expenses encompass indirect costs like rent, utilities, and marketing, affecting net profit and overall business operations. Accurate differentiation between COGS and operating expenses is critical for financial reporting, tax compliance, and informed decision-making in bookkeeping.

Importance of Accurate COGS and Expense Tracking

Accurate tracking of Cost of Goods Sold (COGS) and operating expenses is crucial for precise financial reporting and profitability analysis. Correctly categorizing COGS ensures accurate gross profit calculation, while detailed expense tracking helps control operational costs and supports strategic decision-making. Misclassification between COGS and operating expenses can lead to skewed financial statements, affecting tax calculations and business valuation.

Best Practices for Managing COGS and Operating Expenses

Effectively managing Cost of Goods Sold (COGS) and Operating Expenses requires meticulous tracking and categorization to ensure accurate financial reporting and profitability analysis. Employing automated bookkeeping software can streamline the recording of inventory costs and operational expenditures, reducing errors and enabling timely decision-making. Regularly reviewing supplier contracts and operational workflows helps identify cost-saving opportunities and maintain optimal cash flow management.

Cost of Goods Sold vs Operating Expenses Infographic

bizdif.com

bizdif.com