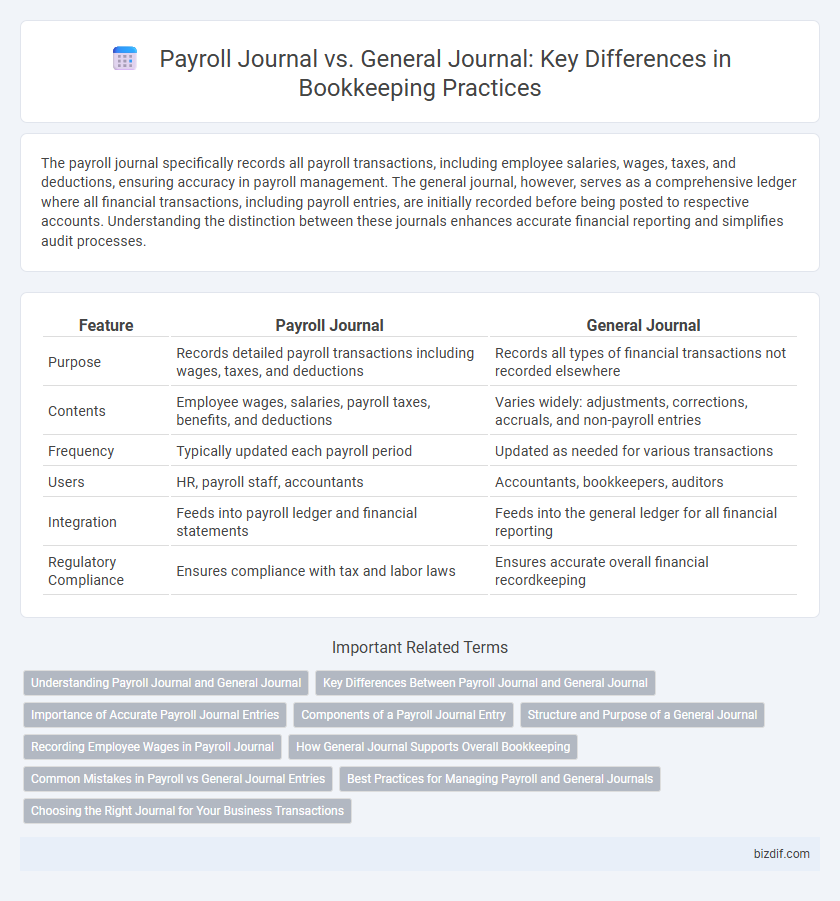

The payroll journal specifically records all payroll transactions, including employee salaries, wages, taxes, and deductions, ensuring accuracy in payroll management. The general journal, however, serves as a comprehensive ledger where all financial transactions, including payroll entries, are initially recorded before being posted to respective accounts. Understanding the distinction between these journals enhances accurate financial reporting and simplifies audit processes.

Table of Comparison

| Feature | Payroll Journal | General Journal |

|---|---|---|

| Purpose | Records detailed payroll transactions including wages, taxes, and deductions | Records all types of financial transactions not recorded elsewhere |

| Contents | Employee wages, salaries, payroll taxes, benefits, and deductions | Varies widely: adjustments, corrections, accruals, and non-payroll entries |

| Frequency | Typically updated each payroll period | Updated as needed for various transactions |

| Users | HR, payroll staff, accountants | Accountants, bookkeepers, auditors |

| Integration | Feeds into payroll ledger and financial statements | Feeds into the general ledger for all financial reporting |

| Regulatory Compliance | Ensures compliance with tax and labor laws | Ensures accurate overall financial recordkeeping |

Understanding Payroll Journal and General Journal

The Payroll Journal records all employee compensation transactions, including wages, taxes, and deductions, providing a detailed account of payroll expenses. The General Journal serves as the primary ledger for recording all financial transactions, capturing broader entries beyond payroll, such as sales, purchases, and adjusting entries. Understanding the distinction helps accurately track payroll costs and maintain comprehensive financial records.

Key Differences Between Payroll Journal and General Journal

Payroll journals specifically record wage-related transactions, including employee salaries, tax withholdings, and benefits, while general journals capture all financial transactions across various accounts. Payroll journals provide detailed tracking of payroll expenses and liabilities, facilitating accurate tax reporting and compliance, whereas general journals offer a broader overview of company-wide financial activities. The specificity of payroll journals aids payroll processing efficiency, contrasting with the general journal's role in comprehensive financial record-keeping for audits and financial statements.

Importance of Accurate Payroll Journal Entries

Accurate payroll journal entries are essential for maintaining precise financial records and ensuring compliance with tax regulations. Payroll journals detail employee compensation, deductions, and tax withholdings, providing a clear audit trail that supports payroll tax filings and financial reporting. Errors in these entries can lead to misstated financial statements and costly penalties during audits.

Components of a Payroll Journal Entry

A payroll journal entry records employee compensation details, including gross wages, payroll taxes, deductions, and net pay, ensuring accurate tracking of salary expenses and liabilities. Key components include debit entries for wage expenses, credit entries for payroll tax liabilities, employee tax withholdings, and cash or bank payments representing net wages paid. This specialized journal contrasts with the general journal by focusing exclusively on payroll transactions and related deductions.

Structure and Purpose of a General Journal

The structure of a general journal includes columns for the date, account titles, debit and credit amounts, and a description, allowing businesses to record all financial transactions in chronological order. Its primary purpose is to provide a detailed and comprehensive record of all accounting entries before they are posted to the general ledger, ensuring accuracy and completeness. Unlike a payroll journal, which specifically tracks payroll-related transactions, the general journal captures a wide range of financial activities across the entire organization.

Recording Employee Wages in Payroll Journal

Payroll journals specifically record employee wages, tax withholdings, and benefits, offering a detailed breakdown of payroll transactions for each pay period. Unlike the general journal, which captures all types of business transactions, the payroll journal provides focused data essential for payroll tax reporting and compliance. Accurate entries in the payroll journal ensure proper tracking of gross pay, deductions, and net pay, facilitating efficient payroll processing and financial auditing.

How General Journal Supports Overall Bookkeeping

The General Journal records all financial transactions, including payroll entries, with detailed information such as date, accounts affected, and amounts, ensuring comprehensive documentation for auditing and financial analysis. This holistic record supports overall bookkeeping by maintaining accuracy and consistency across accounts, enabling seamless integration with subsidiary journals like the Payroll Journal. Efficient use of the General Journal facilitates error detection and financial reporting, streamlining the organization's accounting processes.

Common Mistakes in Payroll vs General Journal Entries

Common mistakes in payroll journal entries include misclassifying employee wages as expenses instead of liabilities and failing to account for tax withholdings accurately, leading to inaccurate payroll tax reporting. In general journal entries, errors often involve improper posting of payroll transactions to non-payroll accounts or omission of payroll-related adjustments, which can distort financial statements. Ensuring precise account coding and thorough reconciliation between payroll reports and journal entries minimizes discrepancies and supports compliance with accounting standards.

Best Practices for Managing Payroll and General Journals

Payroll journals should accurately record employee compensation, tax withholdings, and benefit deductions to ensure compliance with labor laws and tax regulations. General journals must systematically capture all financial transactions with detailed descriptions and consistent account classifications for accurate financial reporting. Implementing regular reconciliation, automated entries, and secure access controls enhances accuracy and reduces errors in managing both payroll and general journals.

Choosing the Right Journal for Your Business Transactions

Selecting the appropriate journal depends on transaction specificity and business needs; payroll journals track detailed employee compensation entries, ensuring compliance with tax regulations. General journals offer flexibility for recording all types of financial transactions not covered by specialized journals, supporting comprehensive financial analysis. Utilizing the correct journal enhances accuracy in financial records and streamlines the auditing process.

Payroll Journal vs General Journal Infographic

bizdif.com

bizdif.com