Bookkeeping software offers automated features, error reduction, and real-time financial reporting that spreadsheets lack, making it ideal for managing pet-related expenses efficiently. Spreadsheets require manual entry and are prone to human error, increasing the risk of inaccurate financial tracking in pet businesses. Choosing bookkeeping software enhances accuracy, saves time, and provides scalable solutions for pet care professionals seeking organized financial management.

Table of Comparison

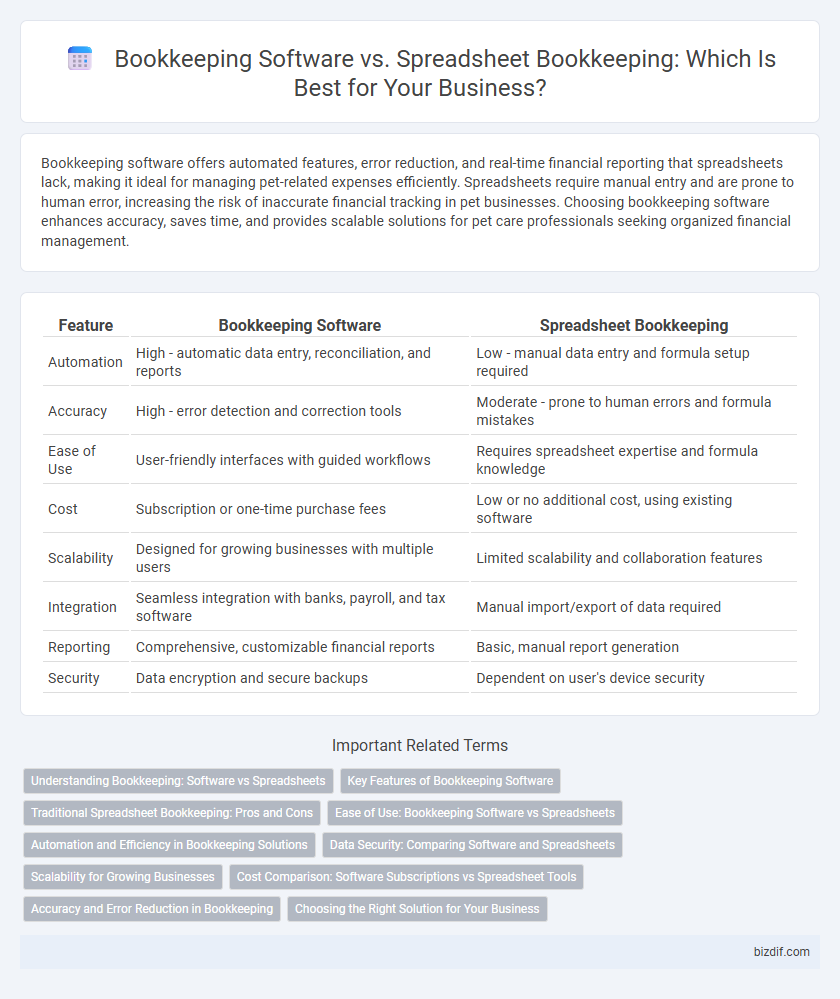

| Feature | Bookkeeping Software | Spreadsheet Bookkeeping |

|---|---|---|

| Automation | High - automatic data entry, reconciliation, and reports | Low - manual data entry and formula setup required |

| Accuracy | High - error detection and correction tools | Moderate - prone to human errors and formula mistakes |

| Ease of Use | User-friendly interfaces with guided workflows | Requires spreadsheet expertise and formula knowledge |

| Cost | Subscription or one-time purchase fees | Low or no additional cost, using existing software |

| Scalability | Designed for growing businesses with multiple users | Limited scalability and collaboration features |

| Integration | Seamless integration with banks, payroll, and tax software | Manual import/export of data required |

| Reporting | Comprehensive, customizable financial reports | Basic, manual report generation |

| Security | Data encryption and secure backups | Dependent on user's device security |

Understanding Bookkeeping: Software vs Spreadsheets

Bookkeeping software offers automated transaction categorization, real-time financial reporting, and integration with banking systems, enhancing accuracy and efficiency compared to manual spreadsheet bookkeeping. Spreadsheets, while customizable and cost-effective for small-scale record-keeping, lack built-in error detection and scalability, increasing the risk of data inconsistencies. Choosing between software and spreadsheets depends on business complexity, with software best suited for dynamic financial management and spreadsheets more appropriate for basic, low-volume bookkeeping tasks.

Key Features of Bookkeeping Software

Bookkeeping software offers automated transaction categorization, real-time financial reporting, and integration with bank accounts, which significantly reduce manual errors compared to spreadsheet bookkeeping. Features like invoicing, payroll management, and tax calculation streamline financial workflows and improve accuracy. Cloud-based solutions provide secure data storage and multi-user access, enhancing collaboration and data integrity.

Traditional Spreadsheet Bookkeeping: Pros and Cons

Traditional spreadsheet bookkeeping offers affordability and customization, allowing businesses to tailor financial tracking without additional software costs. However, it presents limitations in scalability, data security, and error susceptibility due to manual entry and lack of automated reconciliation. Spreadsheets also lack real-time collaboration and integration features common in dedicated bookkeeping software, potentially hindering efficiency for growing enterprises.

Ease of Use: Bookkeeping Software vs Spreadsheets

Bookkeeping software offers an intuitive interface designed specifically for financial management, streamlining data entry and automating complex calculations, which significantly reduces manual errors compared to spreadsheets. Spreadsheets require advanced knowledge of formulas and formatting, making them less user-friendly and more time-consuming for accurate bookkeeping. The ease of use provided by bookkeeping software enhances efficiency and accuracy, especially for small business owners with limited accounting experience.

Automation and Efficiency in Bookkeeping Solutions

Bookkeeping software offers advanced automation features such as real-time data syncing, automatic transaction categorization, and integrated tax calculations, significantly enhancing efficiency compared to manual spreadsheet bookkeeping. Spreadsheets require manual data entry and formula setup, increasing the risk of human error and time consumption. Leveraging specialized software streamlines financial processes, reduces administrative overhead, and ensures more accurate, up-to-date financial records.

Data Security: Comparing Software and Spreadsheets

Bookkeeping software offers advanced data security features such as encryption, automatic backups, and restricted access controls, significantly reducing the risk of data breaches compared to spreadsheet bookkeeping. Spreadsheets, while flexible, often lack robust security mechanisms and depend heavily on manual management, increasing vulnerability to unauthorized access and accidental data loss. Investing in specialized bookkeeping software enhances protection of sensitive financial information and ensures compliance with data security regulations.

Scalability for Growing Businesses

Bookkeeping software offers greater scalability for growing businesses by automating data entry, generating real-time financial reports, and integrating with other business tools, which spreadsheets lack. Unlike spreadsheet bookkeeping that becomes cumbersome and error-prone as transaction volumes increase, dedicated software ensures accuracy and streamlines workflows. Investing in robust bookkeeping software supports efficient handling of expanding financial data and regulatory compliance.

Cost Comparison: Software Subscriptions vs Spreadsheet Tools

Bookkeeping software subscriptions typically range from $10 to $70 per month, offering automated features that reduce manual entry and errors, while spreadsheet tools like Microsoft Excel or Google Sheets incur a one-time or minimal ongoing cost but require more time and expertise to manage financial data accurately. Software subscriptions often include regular updates, customer support, and integrations with other financial tools, justifying higher costs compared to spreadsheets, which lack these benefits but offer flexibility and complete control over customization. Choosing between software and spreadsheets depends on budget constraints, the complexity of bookkeeping needs, and the value placed on automation versus manual control.

Accuracy and Error Reduction in Bookkeeping

Bookkeeping software significantly enhances accuracy by automating calculations and minimizing human errors commonly found in spreadsheet bookkeeping. Advanced algorithms and real-time data validation features in bookkeeping software reduce discrepancies and streamline error detection. In contrast, spreadsheets rely on manual data entry and formula application, increasing the risk of mistakes and inconsistencies in financial records.

Choosing the Right Solution for Your Business

Bookkeeping software offers automated features, real-time financial tracking, and integration with other business tools, making it ideal for businesses seeking efficiency and scalability. Spreadsheet bookkeeping provides customizable, low-cost solutions but requires manual data entry and is prone to human error, better suited for small businesses with simple financial needs. Choosing the right solution depends on the business size, complexity of transactions, and resource availability for managing financial records.

Bookkeeping Software vs Spreadsheet Bookkeeping Infographic

bizdif.com

bizdif.com