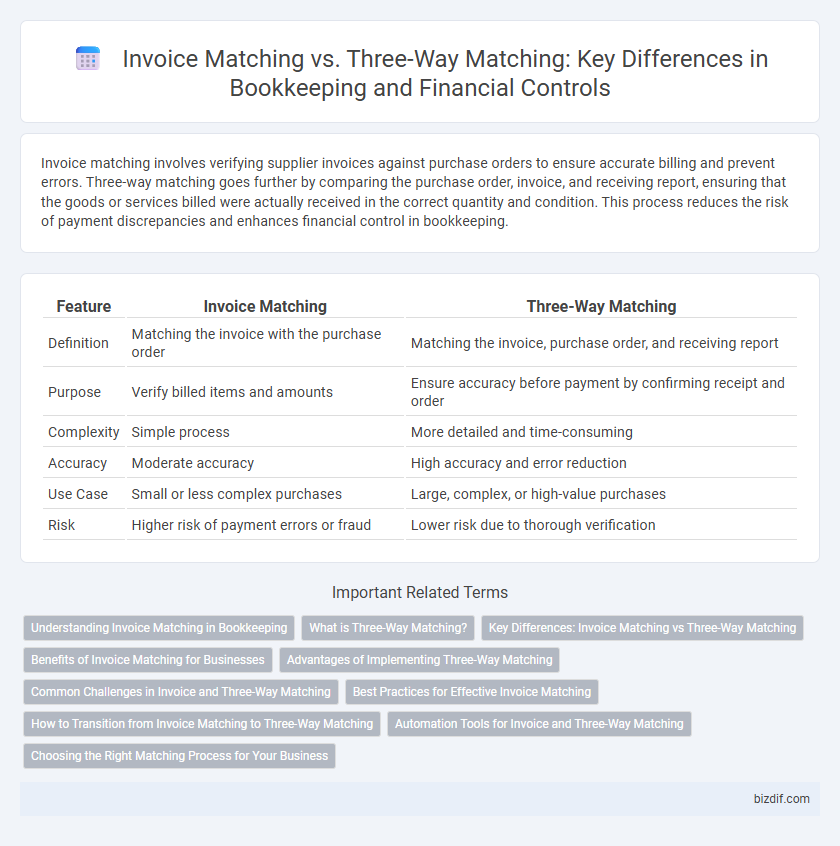

Invoice matching involves verifying supplier invoices against purchase orders to ensure accurate billing and prevent errors. Three-way matching goes further by comparing the purchase order, invoice, and receiving report, ensuring that the goods or services billed were actually received in the correct quantity and condition. This process reduces the risk of payment discrepancies and enhances financial control in bookkeeping.

Table of Comparison

| Feature | Invoice Matching | Three-Way Matching |

|---|---|---|

| Definition | Matching the invoice with the purchase order | Matching the invoice, purchase order, and receiving report |

| Purpose | Verify billed items and amounts | Ensure accuracy before payment by confirming receipt and order |

| Complexity | Simple process | More detailed and time-consuming |

| Accuracy | Moderate accuracy | High accuracy and error reduction |

| Use Case | Small or less complex purchases | Large, complex, or high-value purchases |

| Risk | Higher risk of payment errors or fraud | Lower risk due to thorough verification |

Understanding Invoice Matching in Bookkeeping

Invoice matching in bookkeeping involves comparing purchase orders and supplier invoices to verify accuracy before payment approval, ensuring all billed items correspond to ordered goods or services. This process helps prevent errors and fraud by confirming quantities, prices, and terms align between documents. Unlike three-way matching, which includes receiving reports, invoice matching focuses primarily on validating invoices against purchase orders.

What is Three-Way Matching?

Three-Way Matching is a critical accounting control process that involves comparing three key documents: the purchase order, the invoice, and the receiving report. This method ensures that the goods or services billed by the vendor have been ordered and received as specified, preventing errors and fraud in accounts payable. By verifying quantities, prices, and terms across these documents, Three-Way Matching enhances accuracy and accountability in financial record-keeping.

Key Differences: Invoice Matching vs Three-Way Matching

Invoice Matching involves verifying purchase orders against invoices to ensure items and prices align, streamlining accounts payable processes. Three-Way Matching extends this by cross-referencing purchase orders, invoices, and receiving reports, adding a layer of verification for goods receipt to prevent payment errors and fraud. The key difference lies in Three-Way Matching's inclusion of delivery confirmation, enhancing accuracy in financial record-keeping and vendor payment validation.

Benefits of Invoice Matching for Businesses

Invoice matching streamlines accounts payable by verifying purchase orders against supplier invoices, reducing errors and preventing duplicate payments. This process accelerates payment cycles and improves cash flow management for businesses. By minimizing discrepancies early, invoice matching enhances financial accuracy and strengthens vendor relationships.

Advantages of Implementing Three-Way Matching

Implementing three-way matching in bookkeeping enhances accuracy by verifying the purchase order, invoice, and goods receipt, significantly reducing invoice fraud and payment errors. This process streamlines financial auditing and improves internal controls by ensuring all transactions are consistent across documents. Increased compliance with company policies and regulatory standards results in stronger financial governance and risk management.

Common Challenges in Invoice and Three-Way Matching

Invoice matching often faces challenges such as discrepancies in purchase order numbers, inaccurate quantities, and timing differences between invoice receipt and goods delivery records. Three-way matching adds complexity by requiring verification across the purchase order, receiving report, and invoice, increasing the risk of mismatches due to errors in any of these documents. Ensuring data accuracy, handling exceptions efficiently, and maintaining synchronized records are critical hurdles in both invoice and three-way matching processes.

Best Practices for Effective Invoice Matching

Effective invoice matching requires verifying that the invoice details align with purchase orders and receiving reports to prevent discrepancies and payment errors. Implementing automated matching systems enhances accuracy and efficiency by cross-referencing invoice data against procurement records. Maintaining clear audit trails and regularly updating matching criteria ensures compliance and streamlined accounts payable processes.

How to Transition from Invoice Matching to Three-Way Matching

Transitioning from invoice matching to three-way matching involves integrating purchase orders, receiving reports, and invoices into a unified verification process to enhance accuracy and fraud prevention. Implementing automated accounting software streamlines data capture and cross-referencing, reducing manual errors and improving compliance. Training staff on recognizing discrepancies across all three documents ensures a smoother adoption and maximizes the benefits of three-way matching in bookkeeping.

Automation Tools for Invoice and Three-Way Matching

Automation tools for invoice matching streamline the verification process by comparing purchase orders and invoices using advanced algorithms, reducing manual errors and accelerating payment cycles. Three-way matching automation integrates purchase orders, invoices, and receipts to ensure accuracy and prevent fraud, leveraging machine learning to flag discrepancies in real-time. Leading software platforms such as SAP Ariba, Coupa, and Oracle NetSuite incorporate AI-driven features that enhance compliance and optimize accounts payable workflows.

Choosing the Right Matching Process for Your Business

Selecting the right matching process for your business depends on transaction complexity and control requirements; invoice matching verifies purchase orders against invoices, ensuring basic accuracy, while three-way matching adds receipt verification for higher fraud prevention and error reduction. Businesses with straightforward purchases may benefit from the efficiency of invoice matching, whereas industries handling high-value or regulated goods require three-way matching for enhanced accountability. Evaluating your operational workflow and risk tolerance helps optimize financial accuracy and supplier management through the appropriate matching method.

Invoice Matching vs Three-Way Matching Infographic

bizdif.com

bizdif.com