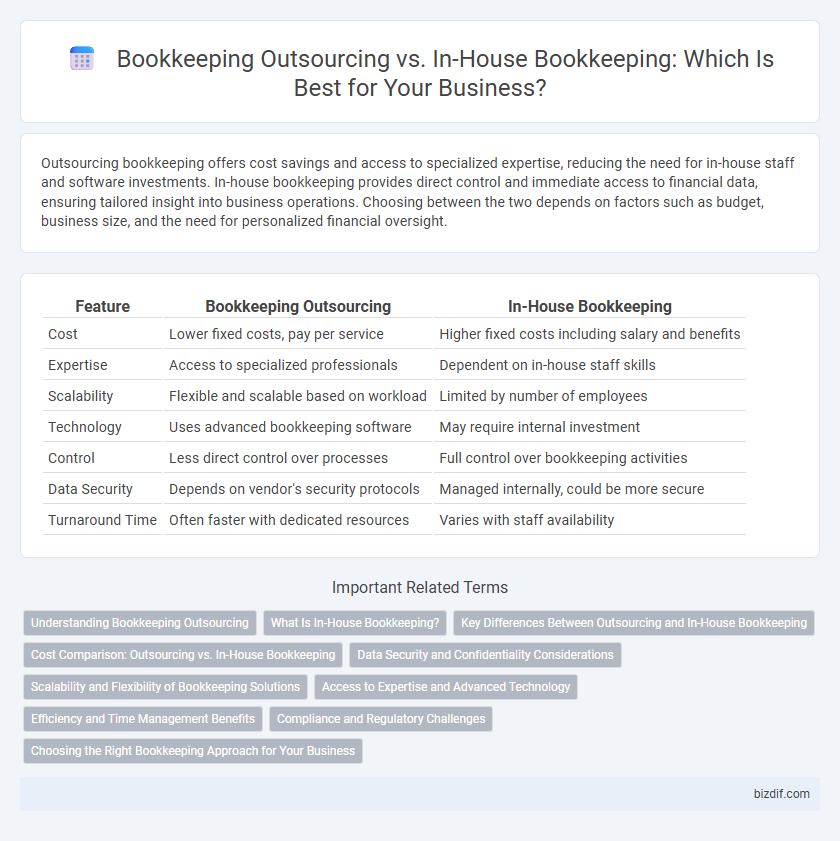

Outsourcing bookkeeping offers cost savings and access to specialized expertise, reducing the need for in-house staff and software investments. In-house bookkeeping provides direct control and immediate access to financial data, ensuring tailored insight into business operations. Choosing between the two depends on factors such as budget, business size, and the need for personalized financial oversight.

Table of Comparison

| Feature | Bookkeeping Outsourcing | In-House Bookkeeping |

|---|---|---|

| Cost | Lower fixed costs, pay per service | Higher fixed costs including salary and benefits |

| Expertise | Access to specialized professionals | Dependent on in-house staff skills |

| Scalability | Flexible and scalable based on workload | Limited by number of employees |

| Technology | Uses advanced bookkeeping software | May require internal investment |

| Control | Less direct control over processes | Full control over bookkeeping activities |

| Data Security | Depends on vendor's security protocols | Managed internally, could be more secure |

| Turnaround Time | Often faster with dedicated resources | Varies with staff availability |

Understanding Bookkeeping Outsourcing

Bookkeeping outsourcing involves delegating financial record-keeping tasks to specialized third-party providers, offering cost efficiency and access to expert knowledge. Outsourced services utilize advanced accounting software and ensure compliance with the latest tax regulations, reducing the risk of errors and audits. This approach allows businesses to focus on core activities while maintaining accurate, up-to-date financial records.

What Is In-House Bookkeeping?

In-house bookkeeping involves maintaining a dedicated team or individual within the company to manage financial records, transactions, and compliance on a daily basis. This approach allows for direct control over bookkeeping processes, real-time data access, and immediate communication with other departments. Companies with complex financial activities or specific customization needs often prefer in-house bookkeeping to ensure accuracy and confidentiality.

Key Differences Between Outsourcing and In-House Bookkeeping

Outsourcing bookkeeping offers access to specialized expertise, scalability, and cost savings by eliminating the need for full-time staff and office resources, while in-house bookkeeping provides direct control, immediate communication, and deeper familiarity with company-specific financial processes. Data security and confidentiality concerns differ, with in-house teams maintaining data internally, whereas outsourced services implement stringent protocols to safeguard sensitive information. Decision-making depends on business size, budget, required expertise, and preference for control over financial management.

Cost Comparison: Outsourcing vs. In-House Bookkeeping

Outsourcing bookkeeping typically reduces costs associated with salaries, benefits, and employee training compared to maintaining an in-house team. In-house bookkeeping demands ongoing expenses, including software licenses, office space, and payroll taxes, which can increase overhead significantly. Outsourcing services often offer scalable pricing models, allowing businesses to pay only for the volume of work required, optimizing cost efficiency.

Data Security and Confidentiality Considerations

Outsourcing bookkeeping introduces risks related to data security and confidentiality due to third-party access to sensitive financial information, requiring robust encryption and compliance with data protection regulations like GDPR or HIPAA. In-house bookkeeping allows tighter control over confidential data, reducing vulnerabilities through direct oversight and internal security protocols. Businesses must weigh the trade-offs between external service security measures and internal data protection capabilities when deciding on bookkeeping solutions.

Scalability and Flexibility of Bookkeeping Solutions

Bookkeeping outsourcing offers scalable solutions that adapt easily to fluctuating business demands, enabling companies to manage workload spikes without the need for permanent staff increases. In-house bookkeeping provides direct control but often lacks the flexibility to quickly adjust to growth or seasonal variances, potentially leading to underutilized resources or staffing shortages. Outsourced bookkeeping services leverage advanced technology and expert teams to deliver flexible, cost-efficient financial management that scales with business expansion.

Access to Expertise and Advanced Technology

Outsourcing bookkeeping grants businesses access to specialized expertise and cutting-edge accounting software often unavailable with in-house teams. Professional firms employ certified accountants and utilize advanced cloud-based platforms that enhance accuracy and streamline financial reporting. In-house bookkeeping may lack these technological advancements and the breadth of experience found in outsourced services.

Efficiency and Time Management Benefits

Outsourcing bookkeeping enhances efficiency by leveraging specialized professionals equipped with advanced accounting software, reducing errors and accelerating financial data processing. In-house bookkeeping allows for direct control and immediate access to records but often incurs higher costs and diverts time from core business activities. Businesses experience significant time management benefits by outsourcing, freeing internal resources to focus on strategic initiatives while ensuring accurate and timely financial reporting.

Compliance and Regulatory Challenges

Bookkeeping outsourcing offers specialized expertise in navigating complex tax codes and regulatory requirements, reducing the risk of non-compliance. In-house bookkeeping teams may struggle to stay updated with constantly changing compliance standards, increasing potential for errors and penalties. Leveraging outsourced services ensures adherence to local and international financial regulations, enhancing accuracy and reducing audit risks.

Choosing the Right Bookkeeping Approach for Your Business

Choosing the right bookkeeping approach depends on your business size, budget, and control needs. Outsourcing bookkeeping offers access to specialized expertise and scalability, reducing overhead costs and minimizing errors. In-house bookkeeping provides direct supervision and immediate data access, ideal for companies wanting hands-on financial management and customized internal processes.

Bookkeeping Outsourcing vs In-House Bookkeeping Infographic

bizdif.com

bizdif.com