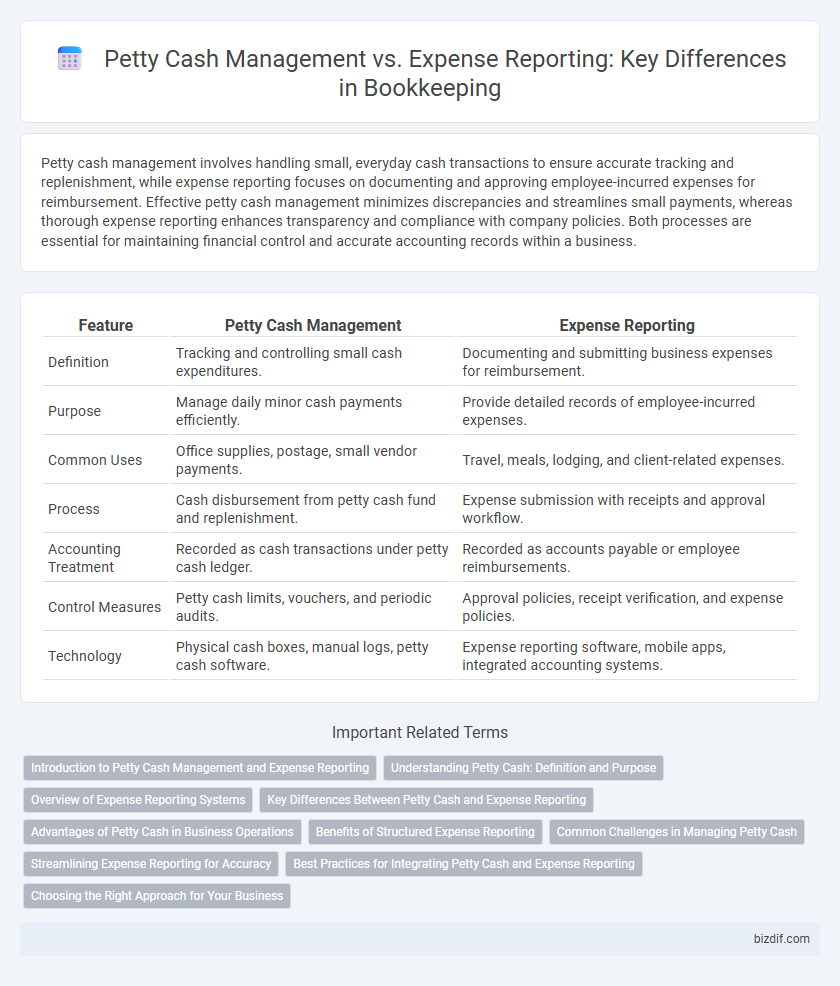

Petty cash management involves handling small, everyday cash transactions to ensure accurate tracking and replenishment, while expense reporting focuses on documenting and approving employee-incurred expenses for reimbursement. Effective petty cash management minimizes discrepancies and streamlines small payments, whereas thorough expense reporting enhances transparency and compliance with company policies. Both processes are essential for maintaining financial control and accurate accounting records within a business.

Table of Comparison

| Feature | Petty Cash Management | Expense Reporting |

|---|---|---|

| Definition | Tracking and controlling small cash expenditures. | Documenting and submitting business expenses for reimbursement. |

| Purpose | Manage daily minor cash payments efficiently. | Provide detailed records of employee-incurred expenses. |

| Common Uses | Office supplies, postage, small vendor payments. | Travel, meals, lodging, and client-related expenses. |

| Process | Cash disbursement from petty cash fund and replenishment. | Expense submission with receipts and approval workflow. |

| Accounting Treatment | Recorded as cash transactions under petty cash ledger. | Recorded as accounts payable or employee reimbursements. |

| Control Measures | Petty cash limits, vouchers, and periodic audits. | Approval policies, receipt verification, and expense policies. |

| Technology | Physical cash boxes, manual logs, petty cash software. | Expense reporting software, mobile apps, integrated accounting systems. |

Introduction to Petty Cash Management and Expense Reporting

Petty cash management involves handling a small amount of cash on hand to cover minor business expenses, ensuring timely payment without the need for formal approval processes. Expense reporting tracks and documents employee-incurred expenses, providing detailed records for reimbursement and financial auditing. Both systems streamline financial operations by maintaining accurate records and supporting internal controls in business bookkeeping.

Understanding Petty Cash: Definition and Purpose

Petty cash management involves handling a small amount of cash on hand for minor business expenses, ensuring quick access without lengthy approval processes. Its purpose is to facilitate petty purchases such as office supplies or travel fares, maintaining operational efficiency while tracking expenditures. Expense reporting, in contrast, records and reimburses expenses made by employees, often supported by petty cash disbursements but requiring detailed documentation for transparency and audit compliance.

Overview of Expense Reporting Systems

Expense reporting systems streamline the tracking, submission, and approval of employee expenses, providing detailed records that enhance financial transparency and control. These systems typically integrate with accounting software to automate data entry, reduce errors, and facilitate timely reimbursement processes. Effective expense reporting tools support compliance with company policies and tax regulations by maintaining organized and accurate expense documentation.

Key Differences Between Petty Cash and Expense Reporting

Petty cash management involves handling a small amount of cash on hand for minor business expenses, ensuring accurate tracking and replenishment through physical cash disbursements. Expense reporting requires employees to document and submit receipts for reimbursable expenditures, typically recorded in accounting systems without immediate cash handling. Key differences include the nature of transactions--cash-based for petty cash versus claim-based for expense reports--and the control mechanisms, where petty cash demands stricter physical oversight compared to formalized digital or paper submission processes in expense reporting.

Advantages of Petty Cash in Business Operations

Petty cash management streamlines small, everyday business transactions by providing immediate access to funds, reducing the need for formal expense approvals and minimizing administrative delays. This system enhances operational efficiency by allowing quick reimbursement for minor expenses without interrupting workflow. Maintaining a controlled petty cash fund also improves tracking of incidental expenditures, supporting accurate financial records and easier audit trails.

Benefits of Structured Expense Reporting

Structured expense reporting enhances financial transparency by systematically categorizing and documenting expenditures, reducing errors and discrepancies in bookkeeping. It streamlines audit processes through standardized records, facilitating quicker identification of fraudulent or unauthorized expenses. Improved accountability and data accuracy from structured reports support better budget management and informed decision-making within an organization.

Common Challenges in Managing Petty Cash

Common challenges in managing petty cash include maintaining accurate records, preventing misappropriation, and ensuring timely reconciliation with expense reports. Lack of standardized procedures often leads to discrepancies and audit difficulties, while improper documentation can result in incomplete or inaccurate expense tracking. Implementing robust controls and regular reviews are essential to reduce errors and improve transparency in petty cash management.

Streamlining Expense Reporting for Accuracy

Streamlining expense reporting enhances accuracy by automating data capture and integrating digital receipts directly into accounting systems, reducing manual errors common in petty cash management. Utilizing expense management software provides real-time tracking and categorization, ensuring compliance with company policies and simplifying audit processes. This approach minimizes discrepancies and accelerates financial reconciliation, promoting transparency and control over organizational spending.

Best Practices for Integrating Petty Cash and Expense Reporting

Effective petty cash management and expense reporting require seamless integration through standardized documentation and real-time tracking systems. Implementing digital tools that synchronize petty cash transactions with expense reports enhances accuracy, reduces errors, and ensures compliance with internal controls. Regular reconciliation and clear policies on allowable expenses support transparency and streamlined financial management.

Choosing the Right Approach for Your Business

Petty cash management offers a practical solution for small, frequent transactions by maintaining a dedicated fund for minor expenses, enhancing cash control and reducing reimbursement delays. Expense reporting, however, provides detailed tracking and accountability, suitable for businesses with higher-volume or employee-incurred expenses requiring robust documentation and auditing. Selecting the right approach depends on transaction volume, business size, and the need for real-time monitoring versus comprehensive expense validation.

Petty Cash Management vs Expense Reporting Infographic

bizdif.com

bizdif.com