Deferred revenue represents payments received for goods or services that have not yet been delivered or rendered, creating a liability on the balance sheet until the obligation is fulfilled. Earned revenue reflects income that has been recognized after the company has provided the goods or services, marking it as actual revenue on the income statement. Accurate distinction between deferred and earned revenue ensures compliance with revenue recognition principles and maintains transparent financial reporting.

Table of Comparison

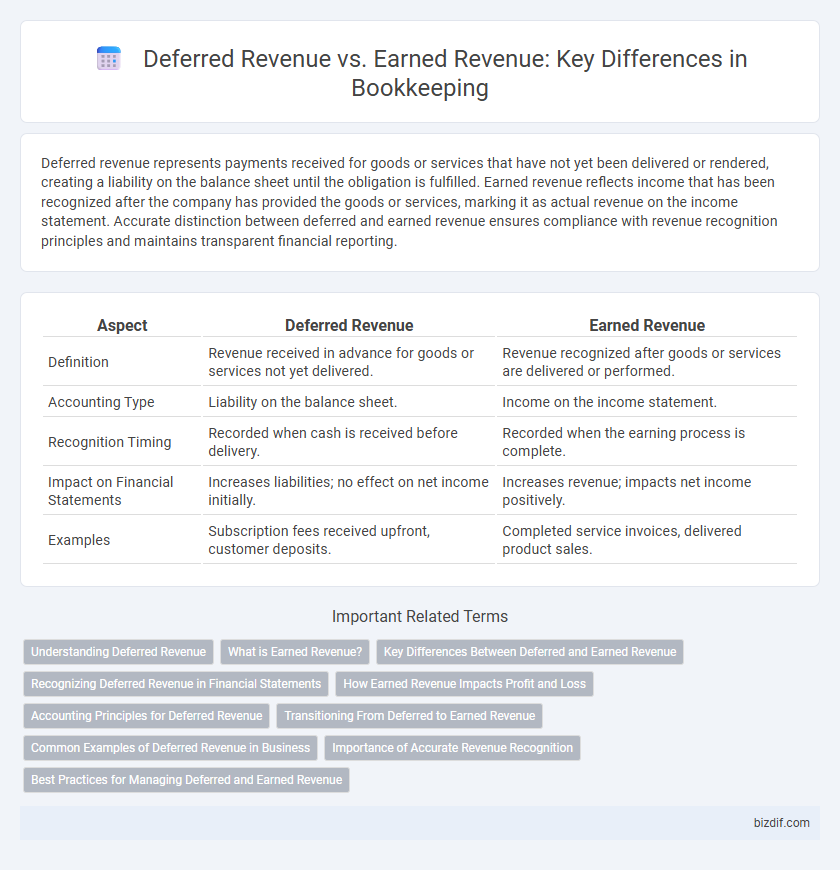

| Aspect | Deferred Revenue | Earned Revenue |

|---|---|---|

| Definition | Revenue received in advance for goods or services not yet delivered. | Revenue recognized after goods or services are delivered or performed. |

| Accounting Type | Liability on the balance sheet. | Income on the income statement. |

| Recognition Timing | Recorded when cash is received before delivery. | Recorded when the earning process is complete. |

| Impact on Financial Statements | Increases liabilities; no effect on net income initially. | Increases revenue; impacts net income positively. |

| Examples | Subscription fees received upfront, customer deposits. | Completed service invoices, delivered product sales. |

Understanding Deferred Revenue

Deferred revenue represents payments received by a business before delivering goods or services, creating a liability on the balance sheet. This liability is recognized because the company owes either products or services to the customer in the future. Properly managing deferred revenue ensures accurate financial reporting and compliance with revenue recognition standards such as ASC 606.

What is Earned Revenue?

Earned revenue represents the income a business recognizes after delivering goods or services to customers, fulfilling its performance obligations. It is recorded on the income statement and reflects actual earnings rather than cash received. Properly distinguishing earned revenue from deferred revenue ensures accurate financial reporting and compliance with accounting principles like GAAP or IFRS.

Key Differences Between Deferred and Earned Revenue

Deferred revenue represents payments received for goods or services not yet delivered, classified as a liability on the balance sheet. Earned revenue reflects income recognized after the company has fulfilled its obligations, recorded on the income statement. The key difference lies in timing: deferred revenue is unearned and reported as a liability until earned revenue realization, indicating actual completion of service or product delivery.

Recognizing Deferred Revenue in Financial Statements

Deferred revenue is recorded as a liability on the balance sheet because it represents cash received for goods or services not yet delivered. Recognizing deferred revenue in financial statements requires adjusting entries to reclassify the liability as earned revenue on the income statement once the service or product obligations are fulfilled. Proper recognition ensures compliance with revenue recognition principles and provides a transparent view of a company's financial position.

How Earned Revenue Impacts Profit and Loss

Earned revenue directly increases a company's profit by being recognized as income on the Profit and Loss statement, reflecting completed sales and services rendered. Unlike deferred revenue, which is recorded as a liability until fulfillment, earned revenue contributes to net income and informs operational profitability. Accurate recognition of earned revenue ensures financial statements represent true performance and aids in strategic decision-making.

Accounting Principles for Deferred Revenue

Deferred revenue represents payments received for goods or services not yet delivered, recorded as a liability according to the revenue recognition principle. Under accrual accounting, revenue must be recognized only when earned, aligning with matching expenses to revenues in the same period. Properly managing deferred revenue ensures accurate financial statements by reflecting obligations before fulfilling performance commitments.

Transitioning From Deferred to Earned Revenue

Transitioning from deferred revenue to earned revenue occurs as a company fulfills its service obligations or delivers products associated with advance payments. Accurate revenue recognition requires adjusting financial records by decreasing deferred revenue and increasing earned revenue in alignment with accounting standards such as GAAP or IFRS. Maintaining precise timing ensures compliance and reflects the true financial position and performance of the business.

Common Examples of Deferred Revenue in Business

Common examples of deferred revenue in business include prepaid subscriptions, gift cards, and advance customer deposits for services not yet delivered. These payments are recorded as liabilities on the balance sheet until the company fulfills its obligations, converting deferred revenue into earned revenue. Properly managing deferred revenue ensures accurate financial reporting and compliance with revenue recognition standards.

Importance of Accurate Revenue Recognition

Accurate revenue recognition in bookkeeping ensures compliance with accounting standards and provides a true financial position of the business by distinguishing deferred revenue--payments received but not yet earned--from earned revenue, which reflects goods or services delivered. Properly categorizing these revenues prevents financial misstatements and supports better decision-making for stakeholders, including investors and management. This precision in recording deferred and earned revenue is critical for maintaining trust and transparency in financial reporting.

Best Practices for Managing Deferred and Earned Revenue

Accurately distinguishing deferred revenue from earned revenue ensures compliance with revenue recognition principles and improves financial reporting transparency. Implementing automated accounting software to track deferred revenue schedules and recognizing earned revenue only upon delivery of goods or services minimizes errors and enhances audit readiness. Regularly reviewing deferred revenue balances and providing detailed disclosure in financial statements supports informed decision-making and maintains stakeholder trust.

Deferred Revenue vs Earned Revenue Infographic

bizdif.com

bizdif.com