Petty cash management involves handling small, day-to-day business expenses with immediate cash on hand, ensuring accurate recording and replenishment to maintain operational efficiency. Bank account management focuses on overseeing larger financial transactions, reconciling statements, and monitoring cash flow to maintain account accuracy and prevent fraud. Effective bookkeeping requires distinguishing between these two to optimize tracking, control expenditures, and maintain financial integrity.

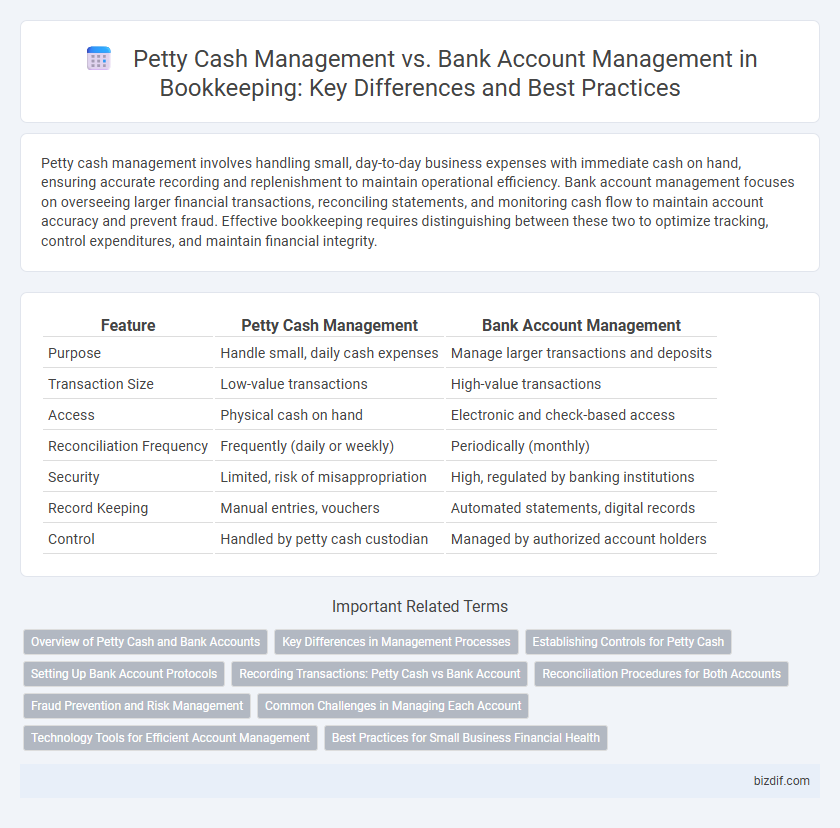

Table of Comparison

| Feature | Petty Cash Management | Bank Account Management |

|---|---|---|

| Purpose | Handle small, daily cash expenses | Manage larger transactions and deposits |

| Transaction Size | Low-value transactions | High-value transactions |

| Access | Physical cash on hand | Electronic and check-based access |

| Reconciliation Frequency | Frequently (daily or weekly) | Periodically (monthly) |

| Security | Limited, risk of misappropriation | High, regulated by banking institutions |

| Record Keeping | Manual entries, vouchers | Automated statements, digital records |

| Control | Handled by petty cash custodian | Managed by authorized account holders |

Overview of Petty Cash and Bank Accounts

Petty cash management involves handling small, everyday business expenses through a fixed, easily accessible cash fund, allowing quick payments without formal bank transactions. Bank account management focuses on monitoring and reconciling deposits, withdrawals, and transfers within checking or savings accounts to maintain accurate financial records and ensure liquidity. Both processes are essential for comprehensive bookkeeping, with petty cash addressing minor expenses and bank accounts managing larger, more formal transactions.

Key Differences in Management Processes

Petty cash management involves handling small, everyday expenses through a physical cash fund, requiring frequent reconciliation and meticulous record-keeping to prevent discrepancies. Bank account management centers on monitoring electronic transactions, maintaining accurate bank statements, and ensuring cash flow through deposits and withdrawals with robust security controls. The key differences lie in the scale and form of funds managed, where petty cash demands hands-on oversight for minor payments, while bank accounts necessitate digital tracking and reconciliation for larger, varied financial activities.

Establishing Controls for Petty Cash

Establishing controls for petty cash involves setting clear guidelines for disbursement limits, maintaining a petty cash log, and conducting regular reconciliations to prevent misuse and errors. Unlike bank account management, which relies on electronic records and authorized signatories, petty cash requires physical oversight and strict accountability measures, including receipts for every transaction. Effective petty cash control ensures accurate tracking of small expenses, reducing the risk of fraud and improving overall financial transparency.

Setting Up Bank Account Protocols

Setting up bank account protocols involves establishing clear procedures for account access, transaction approvals, and reconciliation processes to ensure accurate financial management and fraud prevention. Petty cash management requires separate controls such as petty cash limits, receipt documentation, and regular cash counts to maintain transparency and accountability. Implementing structured protocols for both bank accounts and petty cash enhances overall bookkeeping accuracy and internal control effectiveness.

Recording Transactions: Petty Cash vs Bank Account

Petty cash management involves recording small, day-to-day expenses immediately in a petty cash log or ledger to ensure accurate tracking and replenishment. Bank account management requires detailed reconciliation of recorded transactions with monthly bank statements to detect discrepancies and maintain accurate financial records. Accurate recording in both systems supports overall financial control and reporting integrity in bookkeeping.

Reconciliation Procedures for Both Accounts

Petty cash management reconciliation involves verifying physical cash on hand matches recorded transactions by counting cash and reviewing receipts for small expenses, ensuring discrepancies are documented. Bank account reconciliation requires comparing the company's ledger with the bank statement, identifying outstanding checks or deposits in transit, and adjusting for bank fees or errors to maintain accurate cash balances. Both procedures are essential for detecting errors, preventing fraud, and ensuring financial statements reflect true cash positions.

Fraud Prevention and Risk Management

Petty cash management requires rigorous tracking of small cash transactions with strict receipt documentation to prevent misuse and internal theft, while bank account management relies on electronic tracking and reconciliation processes to detect unauthorized activities. Implementing segregation of duties in petty cash handling limits fraud opportunities, whereas bank accounts benefit from advanced security features such as multi-factor authentication and real-time transaction alerts. Both systems require regular audits and exception reporting to mitigate financial risks and ensure accuracy in bookkeeping.

Common Challenges in Managing Each Account

Petty cash management often faces challenges such as tracking numerous small transactions, preventing fraud, and maintaining accurate records without digital support. Bank account management confronts issues like reconciling discrepancies, managing overdrafts, and handling transaction delays caused by banking processes. Both require diligent monitoring to ensure accurate financial reporting and operational efficiency.

Technology Tools for Efficient Account Management

Petty cash management benefits from mobile apps and digital expense tracking tools that enable real-time recording and easy reconciliation of small cash transactions. Bank account management integrates with online banking platforms and automated reconciliation software, ensuring seamless transaction monitoring and fraud detection. Leveraging these technology tools enhances accuracy and efficiency in managing both petty cash and bank accounts.

Best Practices for Small Business Financial Health

Effective petty cash management involves maintaining detailed records, regular reconciliations, and setting strict limits to prevent misuse, ensuring transparency in small business transactions. Bank account management for small businesses requires timely deposit tracking, monitoring for unauthorized transactions, and reconciling bank statements to maintain accurate financial records. Implementing these best practices supports cash flow control, reduces errors, and enhances overall financial health.

Petty Cash Management vs Bank Account Management Infographic

bizdif.com

bizdif.com