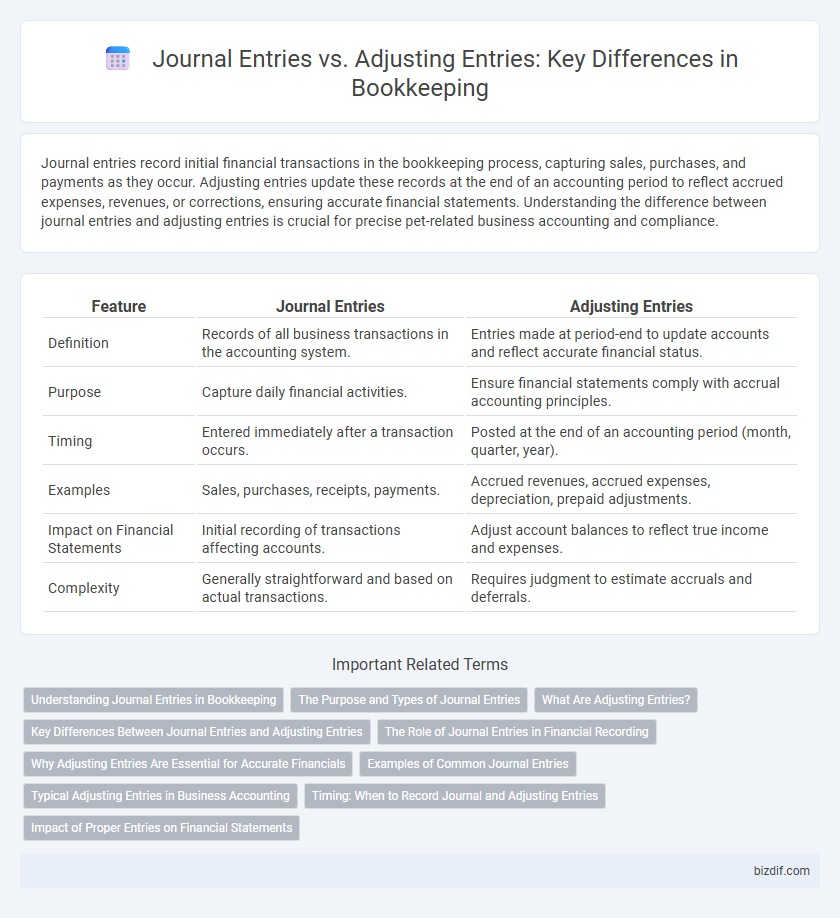

Journal entries record initial financial transactions in the bookkeeping process, capturing sales, purchases, and payments as they occur. Adjusting entries update these records at the end of an accounting period to reflect accrued expenses, revenues, or corrections, ensuring accurate financial statements. Understanding the difference between journal entries and adjusting entries is crucial for precise pet-related business accounting and compliance.

Table of Comparison

| Feature | Journal Entries | Adjusting Entries |

|---|---|---|

| Definition | Records of all business transactions in the accounting system. | Entries made at period-end to update accounts and reflect accurate financial status. |

| Purpose | Capture daily financial activities. | Ensure financial statements comply with accrual accounting principles. |

| Timing | Entered immediately after a transaction occurs. | Posted at the end of an accounting period (month, quarter, year). |

| Examples | Sales, purchases, receipts, payments. | Accrued revenues, accrued expenses, depreciation, prepaid adjustments. |

| Impact on Financial Statements | Initial recording of transactions affecting accounts. | Adjust account balances to reflect true income and expenses. |

| Complexity | Generally straightforward and based on actual transactions. | Requires judgment to estimate accruals and deferrals. |

Understanding Journal Entries in Bookkeeping

Journal entries in bookkeeping record all financial transactions chronologically, capturing debits and credits to maintain accurate accounts. These entries form the foundation for the general ledger, ensuring transparency and accountability in financial reporting. Accurate journal entries are essential for tracking business activities and preparing reliable financial statements.

The Purpose and Types of Journal Entries

Journal entries serve as the primary records of all financial transactions, capturing details such as date, accounts affected, amounts, and transaction descriptions. Types of journal entries include sales, purchases, cash receipts, and cash disbursements, each reflecting specific business activities. Adjusting entries, a subset of journal entries, update account balances at the end of an accounting period to ensure revenues and expenses are recorded accurately, including accruals, deferrals, and depreciation adjustments.

What Are Adjusting Entries?

Adjusting entries are accounting journal entries made at the end of an accounting period to update the balances of income and expense accounts to reflect the true financial position. These entries ensure that revenues are recorded in the period they are earned and expenses in the period they are incurred, following the accrual basis of accounting. Common types of adjusting entries include prepaid expenses, accrued revenues, accrued expenses, and depreciation.

Key Differences Between Journal Entries and Adjusting Entries

Journal entries record initial financial transactions chronologically in the general ledger, capturing sales, purchases, receipts, and payments. Adjusting entries occur at the end of an accounting period to correct or update account balances, ensuring compliance with accrual accounting principles by recognizing revenues and expenses in the period they occur. The key difference lies in timing and purpose: journal entries document daily transactions, while adjusting entries modify those accounts for accuracy before financial statement preparation.

The Role of Journal Entries in Financial Recording

Journal entries serve as the foundational records in bookkeeping, capturing each financial transaction chronologically to maintain an accurate and complete ledger. They document debits and credits for sales, expenses, assets, and liabilities, forming the basis for preparing financial statements. Adjusting entries are made later to correct discrepancies or account for accrued items, but initial journal entries are essential for detailed financial recording and audit trails.

Why Adjusting Entries Are Essential for Accurate Financials

Adjusting entries are essential for accurate financial statements because they ensure revenues and expenses are recorded in the correct accounting period, adhering to the matching principle. Unlike regular journal entries, adjusting entries account for accrued income, expenses, depreciation, and prepaid items that are not yet captured in daily transactions. Proper adjustments prevent misstated profits and financial misrepresentation, providing stakeholders with reliable, timely data for decision-making.

Examples of Common Journal Entries

Common journal entries in bookkeeping include recording sales revenue, cash receipts, and expense payments, such as utilities or rent. For example, debiting Accounts Receivable and crediting Sales Revenue captures a sale on credit. Adjusting entries, however, are made at the end of an accounting period to update account balances, like accruing unpaid expenses or recognizing unearned revenue.

Typical Adjusting Entries in Business Accounting

Typical adjusting entries in business accounting include accruals, deferrals, depreciation, and estimates to ensure financial statements reflect accurate financial positions. Accrued revenues and expenses account for income earned or expenses incurred but not yet recorded, while deferrals involve postponing the recognition of revenues or expenses until they are realized. Depreciation entries allocate the cost of tangible assets over their useful lives, aligning expenses with the periods benefited.

Timing: When to Record Journal and Adjusting Entries

Journal entries are recorded during the normal course of business transactions as they occur, ensuring real-time accuracy in financial records. Adjusting entries are made at the end of an accounting period to update account balances before financial statements are prepared. Proper timing of these entries is crucial for matching revenues and expenses to the correct period, maintaining compliance with accrual accounting principles.

Impact of Proper Entries on Financial Statements

Accurate journal entries form the foundation of reliable financial statements by recording all business transactions in chronological order, ensuring data integrity and traceability. Adjusting entries refine these records by accounting for accrued revenues and expenses, prepaid costs, and depreciation, which align the financial statements with the actual economic conditions at the reporting date. Proper entries enhance the accuracy of net income, asset valuations, and liabilities, providing stakeholders with trustworthy financial information for informed decision-making.

Journal Entries vs Adjusting Entries Infographic

bizdif.com

bizdif.com