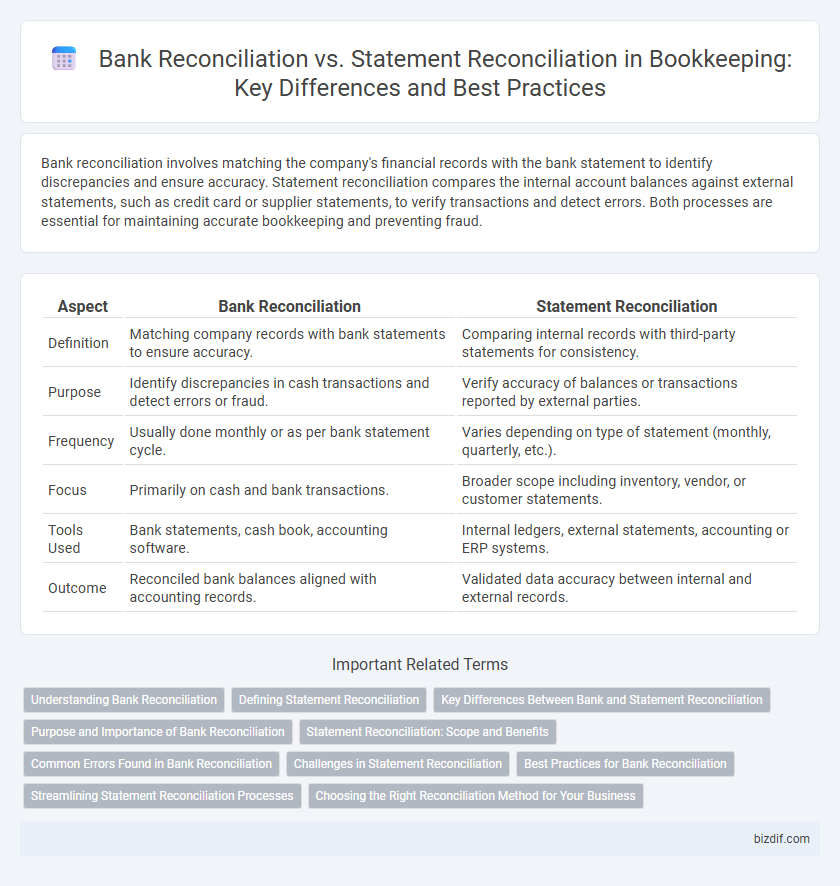

Bank reconciliation involves matching the company's financial records with the bank statement to identify discrepancies and ensure accuracy. Statement reconciliation compares the internal account balances against external statements, such as credit card or supplier statements, to verify transactions and detect errors. Both processes are essential for maintaining accurate bookkeeping and preventing fraud.

Table of Comparison

| Aspect | Bank Reconciliation | Statement Reconciliation |

|---|---|---|

| Definition | Matching company records with bank statements to ensure accuracy. | Comparing internal records with third-party statements for consistency. |

| Purpose | Identify discrepancies in cash transactions and detect errors or fraud. | Verify accuracy of balances or transactions reported by external parties. |

| Frequency | Usually done monthly or as per bank statement cycle. | Varies depending on type of statement (monthly, quarterly, etc.). |

| Focus | Primarily on cash and bank transactions. | Broader scope including inventory, vendor, or customer statements. |

| Tools Used | Bank statements, cash book, accounting software. | Internal ledgers, external statements, accounting or ERP systems. |

| Outcome | Reconciled bank balances aligned with accounting records. | Validated data accuracy between internal and external records. |

Understanding Bank Reconciliation

Bank reconciliation is a critical bookkeeping process that involves comparing an organization's internal financial records with bank statements to ensure accuracy and identify discrepancies such as outstanding checks or deposits in transit. This process helps detect errors, prevent fraud, and maintain accurate cash flow records by matching each transaction reported by the bank with corresponding ledger entries. Understanding bank reconciliation strengthens financial control and supports reliable financial reporting for better business decision-making.

Defining Statement Reconciliation

Statement reconciliation involves comparing financial statements from banks or vendors with internal accounting records to ensure accuracy and consistency in recorded transactions. This process verifies that all deposits, withdrawals, and fees match documented entries, identifying discrepancies such as bank errors, unauthorized transactions, or missed transactions. Proper statement reconciliation enhances financial accuracy, reduces errors, and supports effective cash flow management in bookkeeping.

Key Differences Between Bank and Statement Reconciliation

Bank reconciliation involves verifying the company's cash records against bank statements to identify discrepancies such as outstanding checks or deposits in transit. Statement reconciliation compares internal financial statements with external documents, ensuring all recorded transactions accurately reflect actual business activity. The primary difference lies in bank reconciliation focusing on cash account accuracy, while statement reconciliation validates the overall financial records' integrity.

Purpose and Importance of Bank Reconciliation

Bank reconciliation verifies the accuracy of a company's financial records against bank statements to identify discrepancies such as errors, unauthorized transactions, or missing entries. This process is crucial for maintaining accurate cash balance reports, preventing fraud, and ensuring reliable financial statements for informed business decisions. Unlike statement reconciliation, which simply matches entries on financial statements, bank reconciliation provides a detailed audit of cash inflows and outflows to uphold accounting integrity.

Statement Reconciliation: Scope and Benefits

Statement reconciliation in bookkeeping involves comparing and verifying balances on financial statements against internal records to ensure accuracy. This process helps identify discrepancies, prevent fraud, and maintain the integrity of financial data by aligning statements such as income statements, balance sheets, and cash flow statements with company records. Its scope extends beyond bank statements to encompass all financial documents, offering a comprehensive overview that enhances financial transparency and informed decision-making.

Common Errors Found in Bank Reconciliation

Bank reconciliation commonly reveals errors such as unrecorded bank fees, deposits in transit, and outstanding checks that cause discrepancies between the ledger and bank statement. Missing transactions, data entry mistakes, and timing differences frequently lead to inaccurate balances and require detailed review to correct. Regularly reconciling helps identify these common errors, ensuring accurate financial records and preventing potential cash flow misunderstandings.

Challenges in Statement Reconciliation

Statement reconciliation often faces challenges such as discrepancies between internal records and external statements due to timing differences, missing transactions, or data entry errors. Identifying and resolving these mismatches requires meticulous cross-verification of invoices, payments, and bank charges, which can be time-consuming and prone to human error. Complex transactions and unrecorded fees further complicate the accurate alignment of statements with financial books, impacting the accuracy of financial reporting.

Best Practices for Bank Reconciliation

Bank reconciliation involves comparing a company's internal financial records with bank statements to identify and rectify discrepancies, ensuring accurate cash flow management. Best practices include regularly scheduled reconciliations, maintaining detailed transaction logs, and promptly investigating variances to prevent errors and fraud. Effective use of accounting software and clear documentation further enhances accuracy and efficiency in the bank reconciliation process.

Streamlining Statement Reconciliation Processes

Streamlining statement reconciliation processes enhances accuracy by automating the matching of transactions between bank statements and company records, reducing manual errors and time consumption compared to traditional bank reconciliation. Leveraging software tools with AI capabilities accelerates identifying discrepancies and ensures timely adjustments to financial statements. This approach improves cash flow management and supports real-time financial reporting for better decision-making.

Choosing the Right Reconciliation Method for Your Business

Bank reconciliation involves matching your company's internal financial records with your bank statement to identify discrepancies, ensuring accuracy in cash balances. Statement reconciliation compares supplier or customer statements with your ledger to verify account balances and outstanding invoices. Choosing the right reconciliation method depends on your business size, transaction volume, and the complexity of your financial activities to maintain precise and efficient bookkeeping.

Bank Reconciliation vs Statement Reconciliation Infographic

bizdif.com

bizdif.com