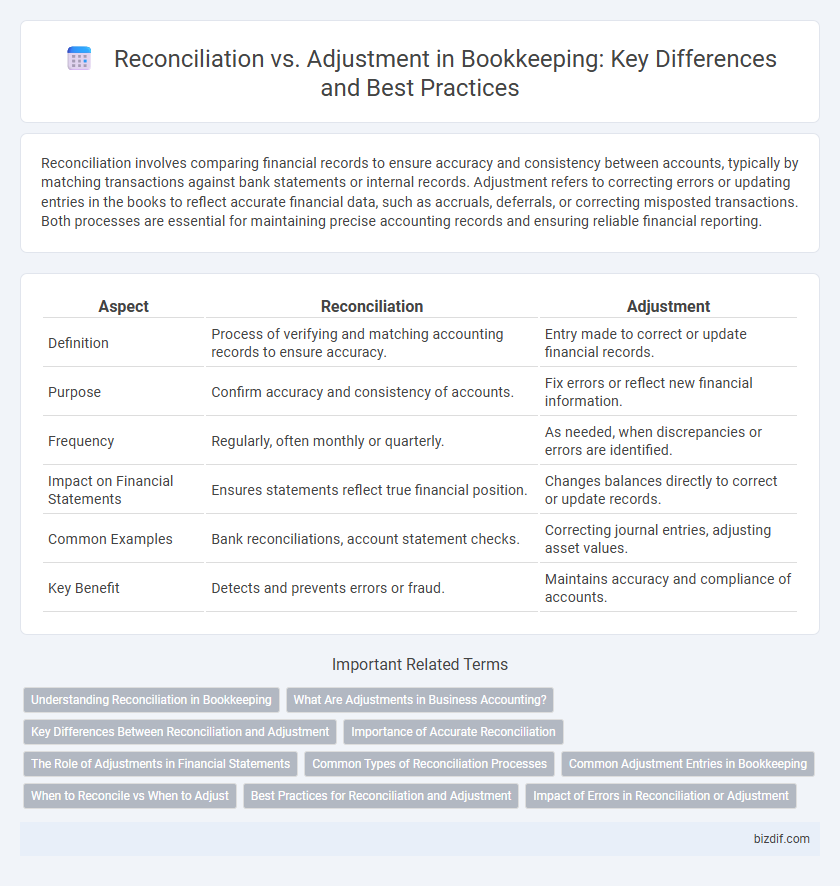

Reconciliation involves comparing financial records to ensure accuracy and consistency between accounts, typically by matching transactions against bank statements or internal records. Adjustment refers to correcting errors or updating entries in the books to reflect accurate financial data, such as accruals, deferrals, or correcting misposted transactions. Both processes are essential for maintaining precise accounting records and ensuring reliable financial reporting.

Table of Comparison

| Aspect | Reconciliation | Adjustment |

|---|---|---|

| Definition | Process of verifying and matching accounting records to ensure accuracy. | Entry made to correct or update financial records. |

| Purpose | Confirm accuracy and consistency of accounts. | Fix errors or reflect new financial information. |

| Frequency | Regularly, often monthly or quarterly. | As needed, when discrepancies or errors are identified. |

| Impact on Financial Statements | Ensures statements reflect true financial position. | Changes balances directly to correct or update records. |

| Common Examples | Bank reconciliations, account statement checks. | Correcting journal entries, adjusting asset values. |

| Key Benefit | Detects and prevents errors or fraud. | Maintains accuracy and compliance of accounts. |

Understanding Reconciliation in Bookkeeping

Reconciliation in bookkeeping involves comparing internal financial records with external statements to ensure accuracy and identify discrepancies. This process validates transaction details, detects errors, and confirms that account balances match authoritative sources like bank statements. Effective reconciliation supports accurate financial reporting and prevents fraud by maintaining the integrity of financial data.

What Are Adjustments in Business Accounting?

Adjustments in business accounting refer to the modifications made to financial records to correct errors, account for accrued or deferred expenses, and update asset values for accurate financial reporting. These changes ensure that the books reflect the true financial position and performance of a company at a given period. Unlike reconciliation, which compares and matches statements, adjustments actively alter ledger accounts to maintain compliance with accounting principles.

Key Differences Between Reconciliation and Adjustment

Reconciliation involves comparing two sets of records to ensure accuracy and consistency in financial statements by identifying and rectifying discrepancies. Adjustment refers to the process of making correcting entries in the accounting records to account for errors, accruals, deferrals, or other changes affecting account balances. The key differences lie in reconciliation being a verification step, while adjustment is an action that alters the actual ledger balances to reflect true financial position.

Importance of Accurate Reconciliation

Accurate reconciliation is essential in bookkeeping to ensure that financial records align with bank statements and other financial documents, preventing discrepancies that could lead to errors or fraud. It provides a clear audit trail, enhancing transparency and trustworthiness for stakeholders and regulatory compliance. Consistently precise reconciliation helps maintain financial integrity and supports informed decision-making.

The Role of Adjustments in Financial Statements

Adjustments in financial statements play a crucial role in ensuring the accuracy and completeness of the reported financial position by correcting errors, reflecting accruals, and aligning account balances with actual transactions. Unlike reconciliation, which verifies consistency between different financial records, adjustments actively modify ledger entries to account for depreciation, bad debts, or prepaid expenses. These adjustments enhance the reliability of financial statements, providing stakeholders with a more precise view of a company's financial health.

Common Types of Reconciliation Processes

Common types of reconciliation processes include bank reconciliations, which verify a company's cash records against bank statements to identify discrepancies or unauthorized transactions. Account reconciliations involve comparing ledger balances with supporting documents to ensure accuracy and completeness of financial data. Inventory reconciliations match physical stock counts with recorded inventory levels to detect losses, damages, or errors in record-keeping.

Common Adjustment Entries in Bookkeeping

Common adjustment entries in bookkeeping primarily include accruals, deferrals, depreciation, and error corrections, which ensure that financial statements reflect accurate periods and amounts. Reconciliation involves comparing internal records with external statements to identify discrepancies, while adjustments are the accounting entries made to correct those discrepancies or to account for unrecorded items. Effective bookkeeping requires both processes, with adjustments often following reconciliation to maintain precise financial reporting.

When to Reconcile vs When to Adjust

Reconciliation is performed when verifying and matching transactions between financial records and external statements to ensure accuracy and consistency. Adjustments are made after reconciliation identifies discrepancies or errors that require correcting entries in the accounting records. Businesses reconcile regularly, such as monthly or quarterly, while adjustments occur as needed to maintain precise financial reporting.

Best Practices for Reconciliation and Adjustment

Implementing best practices for reconciliation involves regularly comparing financial records against bank statements to identify discrepancies and ensure accuracy. Accurate adjustments require detailed documentation and justification to maintain transparent audit trails and prevent errors. Maintaining consistent schedules and standardized procedures enhances the integrity of bookkeeping and supports effective financial management.

Impact of Errors in Reconciliation or Adjustment

Errors in reconciliation can lead to inaccurate financial statements, causing misrepresentation of a company's true financial position and potentially resulting in regulatory penalties or loss of stakeholder trust. Adjustment errors may distort account balances and misstate net income, impacting budgeting decisions and taxation accuracy. Both reconciliation and adjustment errors disrupt the integrity of financial reporting and necessitate timely identification to maintain reliable bookkeeping records.

Reconciliation vs Adjustment Infographic

bizdif.com

bizdif.com