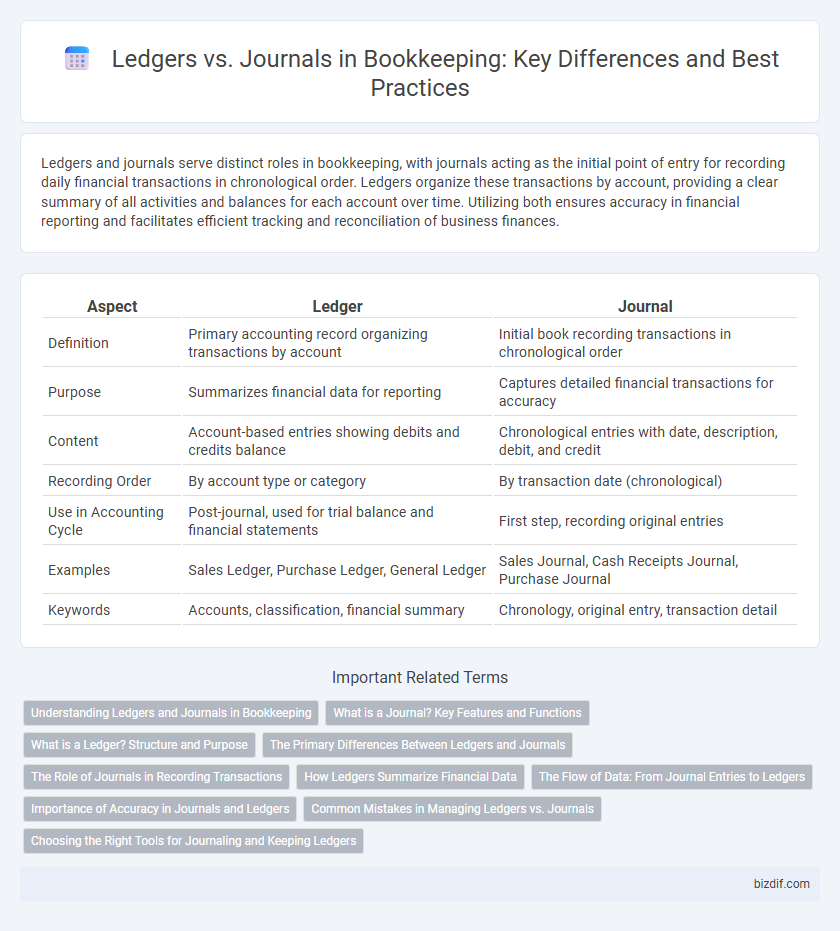

Ledgers and journals serve distinct roles in bookkeeping, with journals acting as the initial point of entry for recording daily financial transactions in chronological order. Ledgers organize these transactions by account, providing a clear summary of all activities and balances for each account over time. Utilizing both ensures accuracy in financial reporting and facilitates efficient tracking and reconciliation of business finances.

Table of Comparison

| Aspect | Ledger | Journal |

|---|---|---|

| Definition | Primary accounting record organizing transactions by account | Initial book recording transactions in chronological order |

| Purpose | Summarizes financial data for reporting | Captures detailed financial transactions for accuracy |

| Content | Account-based entries showing debits and credits balance | Chronological entries with date, description, debit, and credit |

| Recording Order | By account type or category | By transaction date (chronological) |

| Use in Accounting Cycle | Post-journal, used for trial balance and financial statements | First step, recording original entries |

| Examples | Sales Ledger, Purchase Ledger, General Ledger | Sales Journal, Cash Receipts Journal, Purchase Journal |

| Keywords | Accounts, classification, financial summary | Chronology, original entry, transaction detail |

Understanding Ledgers and Journals in Bookkeeping

Ledgers and journals serve distinct but complementary roles in bookkeeping, with journals acting as the initial point of entry where all financial transactions are recorded chronologically. Ledgers organize these transactions by account, providing a clear, categorized view essential for preparing accurate financial statements. Mastering the use of both journals and ledgers enhances transaction tracking and ensures comprehensive financial reporting.

What is a Journal? Key Features and Functions

A journal is the primary accounting record where all financial transactions are initially recorded in chronological order, serving as the book of first entry. Key features include detailed transaction descriptions, debit and credit amounts, and date entries, enabling accurate and systematic tracking of business activities. Its main function is to provide a complete and organized trail for subsequent posting to ledgers, ensuring data integrity and facilitating error detection.

What is a Ledger? Structure and Purpose

A ledger is a comprehensive accounting record that organizes all financial transactions by accounts, providing a clear and detailed summary of a company's financial status. Its structure consists of individual accounts, each containing debit and credit entries that reflect all transactional activities related to that account, facilitating accurate tracking and reconciliation. The primary purpose of a ledger is to consolidate information from journals, enabling the preparation of financial statements and ensuring accurate financial reporting and analysis.

The Primary Differences Between Ledgers and Journals

Ledgers and journals serve distinct roles in bookkeeping, with journals acting as the initial point of transaction entry, recording all financial events in chronological order. Ledgers organize these transactions by account, providing a consolidated view of financial activity to track balances and support financial statement preparation. The primary difference lies in journals capturing raw data while ledgers classify and summarize this data for detailed account analysis.

The Role of Journals in Recording Transactions

Journals serve as the initial point of entry for recording all financial transactions in chronological order, offering a detailed account of each transaction including date, accounts affected, and amounts. They ensure accuracy by capturing complete transaction data before posting to ledgers, which organize this information by account. This systematic approach in journals facilitates error detection and comprehensive tracking of financial activities crucial for maintaining accurate bookkeeping records.

How Ledgers Summarize Financial Data

Ledgers summarize financial data by organizing transactions from journals into specific accounts, providing a clear overview of all debits and credits. This structure enables accurate tracking of balances over time, facilitating efficient financial reporting and analysis. By consolidating detailed entries, ledgers ensure comprehensive monitoring of an organization's financial health.

The Flow of Data: From Journal Entries to Ledgers

Journal entries serve as the initial recording point where all financial transactions are documented chronologically, capturing essential details such as dates, accounts affected, and amounts. These entries are then systematically posted to ledgers, which organize the data by account, facilitating the summarization of financial activities and providing a clear view of account balances. This flow from journals to ledgers ensures accurate tracking and reconciliation of financial information, forming the backbone of effective bookkeeping and financial reporting.

Importance of Accuracy in Journals and Ledgers

Accuracy in journals and ledgers is crucial for reliable financial reporting and compliance with accounting standards. Errors in recording transactions can lead to misstated financial positions, impacting decision-making and tax obligations. Maintaining precise and consistent entries in both journals and ledgers ensures the integrity of the entire bookkeeping process and supports effective auditing.

Common Mistakes in Managing Ledgers vs. Journals

Common mistakes in managing ledgers versus journals include inaccurate data entry in journals, leading to discrepancies in ledgers that affect the overall financial accuracy. Failure to post journal entries promptly to the ledger can result in outdated financial statements and hinder audit trails. Misclassification of transactions between journals and ledgers often causes reconciliation errors and complicates financial reporting processes.

Choosing the Right Tools for Journaling and Keeping Ledgers

Selecting the appropriate tools for journaling and ledger management enhances accuracy and efficiency in bookkeeping. Digital accounting software like QuickBooks or Xero streamlines journal entries, while specialized ledger tools ensure organized tracking of financial transactions. Prioritizing user-friendly interfaces and seamless integration between journals and ledgers optimizes data consistency and financial reporting.

Ledgers vs Journals Infographic

bizdif.com

bizdif.com