Trial balance review involves verifying the accuracy of ledger balances to ensure that total debits equal total credits before financial statement preparation. Financial statement preparation uses the verified trial balance data to compile reports such as the income statement, balance sheet, and cash flow statement, reflecting the company's financial position. Accurate trial balance review is essential for producing reliable financial statements that inform business decisions.

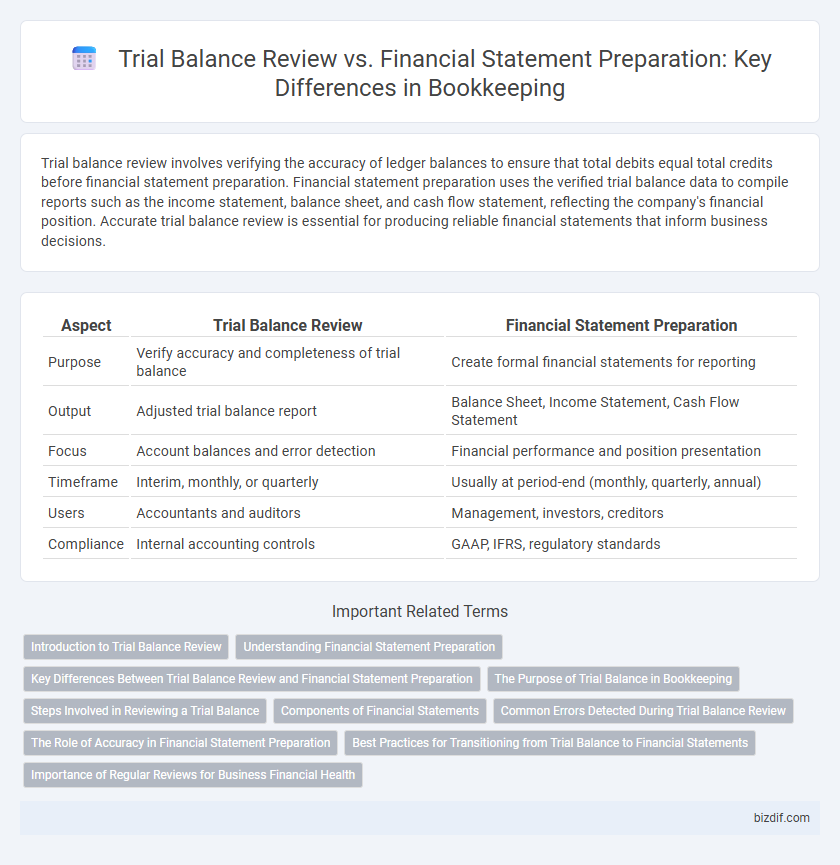

Table of Comparison

| Aspect | Trial Balance Review | Financial Statement Preparation |

|---|---|---|

| Purpose | Verify accuracy and completeness of trial balance | Create formal financial statements for reporting |

| Output | Adjusted trial balance report | Balance Sheet, Income Statement, Cash Flow Statement |

| Focus | Account balances and error detection | Financial performance and position presentation |

| Timeframe | Interim, monthly, or quarterly | Usually at period-end (monthly, quarterly, annual) |

| Users | Accountants and auditors | Management, investors, creditors |

| Compliance | Internal accounting controls | GAAP, IFRS, regulatory standards |

Introduction to Trial Balance Review

Trial balance review is a crucial step in bookkeeping that ensures the accuracy of ledger entries before preparing financial statements. This process involves verifying that total debits equal total credits, identifying discrepancies, and correcting errors to maintain the integrity of financial records. Proper trial balance review minimizes risks of financial misstatements, providing a reliable foundation for accurate financial statement preparation.

Understanding Financial Statement Preparation

Financial statement preparation involves compiling accurate reports such as the balance sheet, income statement, and cash flow statement that reflect a company's financial position and performance. This process requires adjusting trial balance figures for accruals, deferrals, and errors to ensure compliance with accounting standards like GAAP or IFRS. Understanding financial statement preparation enables businesses to present reliable financial information for decision-making, auditing, and regulatory purposes.

Key Differences Between Trial Balance Review and Financial Statement Preparation

Trial balance review involves verifying the accuracy and completeness of ledger balances to ensure debits equal credits, serving as an internal checkpoint before final reporting. Financial statement preparation compiles these verified balances into structured reports like the balance sheet, income statement, and cash flow statement, providing a comprehensive overview of financial performance. The key difference lies in trial balance review focusing on data validation, while financial statement preparation transforms validated data into formal financial reports for external stakeholders.

The Purpose of Trial Balance in Bookkeeping

The purpose of a trial balance in bookkeeping is to verify the accuracy of ledger entries by ensuring that total debits equal total credits, which helps identify any discrepancies before financial statements are prepared. This internal check supports the integrity of accounting records and facilitates the detection of errors such as duplicated or omitted transactions. Trial balance review is a critical step that underpins accurate financial statement preparation by providing a reliable summary of all account balances.

Steps Involved in Reviewing a Trial Balance

Reviewing a trial balance involves verifying the accuracy of ledger balances, ensuring that total debits equal total credits, and identifying discrepancies or errors in account entries. This process includes reconciling accounts, adjusting journal entries for accrued or deferred items, and confirming that all transactions are properly recorded before preparing financial statements. Effective trial balance review is crucial for accurate financial reporting and forms the foundation for reliable financial statement preparation.

Components of Financial Statements

Trial Balance Review involves verifying the accuracy of journal entries and ledger balances to ensure debits equal credits before financial statements are prepared. Financial Statement Preparation encompasses compiling key components such as the balance sheet, income statement, statement of cash flows, and statement of changes in equity to provide a comprehensive overview of a company's financial position. Understanding the distinct roles of trial balance and financial statements enhances accuracy and compliance in bookkeeping processes.

Common Errors Detected During Trial Balance Review

Common errors detected during trial balance review include incorrect account balances, misposted journal entries, and omitted transactions. These discrepancies often lead to imbalanced trial balances, signaling arithmetic mistakes or data entry errors needing correction before financial statement preparation. Identifying and resolving these errors ensures accurate financial statements that comply with accounting standards.

The Role of Accuracy in Financial Statement Preparation

Accuracy in financial statement preparation is critical for ensuring reliable reporting and informed decision-making by stakeholders. A thorough trial balance review identifies discrepancies early, laying the foundation for error-free financial statements. Maintaining precision during preparation enhances compliance with accounting standards and builds trust in the overall financial health of a business.

Best Practices for Transitioning from Trial Balance to Financial Statements

Ensuring accuracy during the transition from trial balance to financial statement preparation requires meticulous reconciliation of accounts and identification of discrepancies or adjustments. Implementing a standardized checklist for reviewing trial balances facilitates the validation of debits and credits, guaranteeing balanced accounts before progressing. Leveraging accounting software with integrated financial reporting tools enhances efficiency and reduces errors in generating accurate financial statements from trial balances.

Importance of Regular Reviews for Business Financial Health

Regular trial balance reviews ensure accuracy by identifying discrepancies in accounts before financial statement preparation, which ultimately supports reliable financial reporting. Consistent examination of trial balances prevents errors and fraud, helping businesses maintain a clear picture of their financial health. This practice promotes informed decision-making, timely adjustments, and compliance with accounting standards.

Trial Balance Review vs Financial Statement Preparation Infographic

bizdif.com

bizdif.com