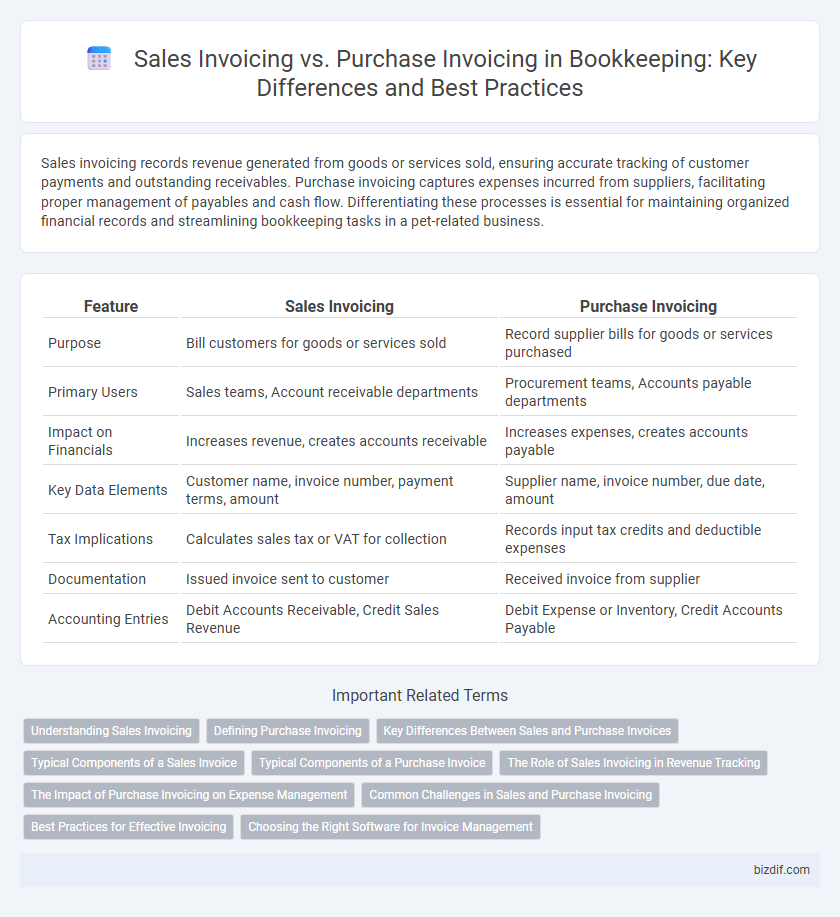

Sales invoicing records revenue generated from goods or services sold, ensuring accurate tracking of customer payments and outstanding receivables. Purchase invoicing captures expenses incurred from suppliers, facilitating proper management of payables and cash flow. Differentiating these processes is essential for maintaining organized financial records and streamlining bookkeeping tasks in a pet-related business.

Table of Comparison

| Feature | Sales Invoicing | Purchase Invoicing |

|---|---|---|

| Purpose | Bill customers for goods or services sold | Record supplier bills for goods or services purchased |

| Primary Users | Sales teams, Account receivable departments | Procurement teams, Accounts payable departments |

| Impact on Financials | Increases revenue, creates accounts receivable | Increases expenses, creates accounts payable |

| Key Data Elements | Customer name, invoice number, payment terms, amount | Supplier name, invoice number, due date, amount |

| Tax Implications | Calculates sales tax or VAT for collection | Records input tax credits and deductible expenses |

| Documentation | Issued invoice sent to customer | Received invoice from supplier |

| Accounting Entries | Debit Accounts Receivable, Credit Sales Revenue | Debit Expense or Inventory, Credit Accounts Payable |

Understanding Sales Invoicing

Sales invoicing documents the transaction where goods or services are sold, detailing the amount owed by the customer and the payment terms. Accurate sales invoices ensure timely revenue recognition and efficient accounts receivable management in bookkeeping. Understanding the components of sales invoices, such as item descriptions, quantities, prices, and tax calculations, is critical for maintaining precise financial records.

Defining Purchase Invoicing

Purchase invoicing refers to the process of documenting and recording all incoming invoices related to goods or services bought by a business. It ensures accurate tracking of expenses, supplier payments, and inventory management within bookkeeping systems. Proper purchase invoicing helps maintain financial transparency and supports efficient accounts payable management.

Key Differences Between Sales and Purchase Invoices

Sales invoicing records revenue generated from goods or services sold, detailing customer information, payment terms, and itemized charges. Purchase invoicing documents expenses incurred, capturing supplier details, purchase date, and total amounts payable. The key differences lie in their roles within accounting: sales invoices increase accounts receivable, while purchase invoices increase accounts payable.

Typical Components of a Sales Invoice

A sales invoice typically includes the seller's contact information, buyer's details, invoice number, date of issue, and a detailed list of goods or services provided with quantities and unit prices. It also features payment terms, tax information such as VAT or sales tax, total amount due, and payment methods accepted. These components ensure accurate record-keeping, facilitate timely payment, and support compliance with accounting standards.

Typical Components of a Purchase Invoice

A purchase invoice typically includes essential components such as the vendor's name and contact details, invoice number, date of issue, itemized list of goods or services purchased, quantities, unit prices, total amount payable, payment terms, and tax details like VAT or GST. Accurate recording of these elements ensures proper bookkeeping and compliance with accounting standards. These details facilitate timely payments, expense tracking, and financial auditing within a business's purchase invoicing process.

The Role of Sales Invoicing in Revenue Tracking

Sales invoicing plays a critical role in revenue tracking by providing a detailed record of completed sales transactions, which helps businesses monitor incoming cash flow accurately. Each sales invoice serves as an official document that reflects the amount owed by customers, enabling timely revenue recognition and improved financial reporting. Accurate sales invoicing ensures compliance with accounting standards and supports cash management strategies essential for maintaining business liquidity.

The Impact of Purchase Invoicing on Expense Management

Purchase invoicing directly influences expense management by accurately recording and categorizing business expenditures, which is essential for maintaining precise financial statements and budgeting processes. Effective handling of purchase invoices ensures timely payments, improved cash flow management, and better negotiation of supplier terms. This systematic approach to expense tracking enhances overall financial control and supports strategic decision-making.

Common Challenges in Sales and Purchase Invoicing

Sales invoicing and purchase invoicing both face challenges such as data entry errors, mismatched invoice details, and delayed approvals, leading to cash flow disruptions. Reconciling discrepancies between sales and purchase records often requires extensive manual review and correction, increasing the risk of accounting inaccuracies. Efficient invoice management systems and clear communication between departments help minimize errors and ensure timely processing.

Best Practices for Effective Invoicing

Sales invoicing requires accurate item descriptions, timely delivery, and clear payment terms to ensure prompt customer payments and maintain cash flow. Purchase invoicing demands thorough verification of vendor details, cross-checking purchase orders with received goods, and documenting approval processes to prevent discrepancies and fraud. Implementing automated invoicing software enhances accuracy, reduces manual errors, and streamlines reconciliation between sales and purchase records.

Choosing the Right Software for Invoice Management

Choosing the right software for sales invoicing and purchase invoicing is crucial to streamline financial operations and ensure accurate record-keeping. Sales invoicing software should offer customizable templates, automated payment reminders, and integration with CRM systems, while purchase invoicing tools must support vendor management, expense tracking, and multi-currency transactions. Opting for a comprehensive invoice management solution that combines both functionalities reduces errors, improves cash flow visibility, and simplifies tax compliance.

Sales Invoicing vs Purchase Invoicing Infographic

bizdif.com

bizdif.com