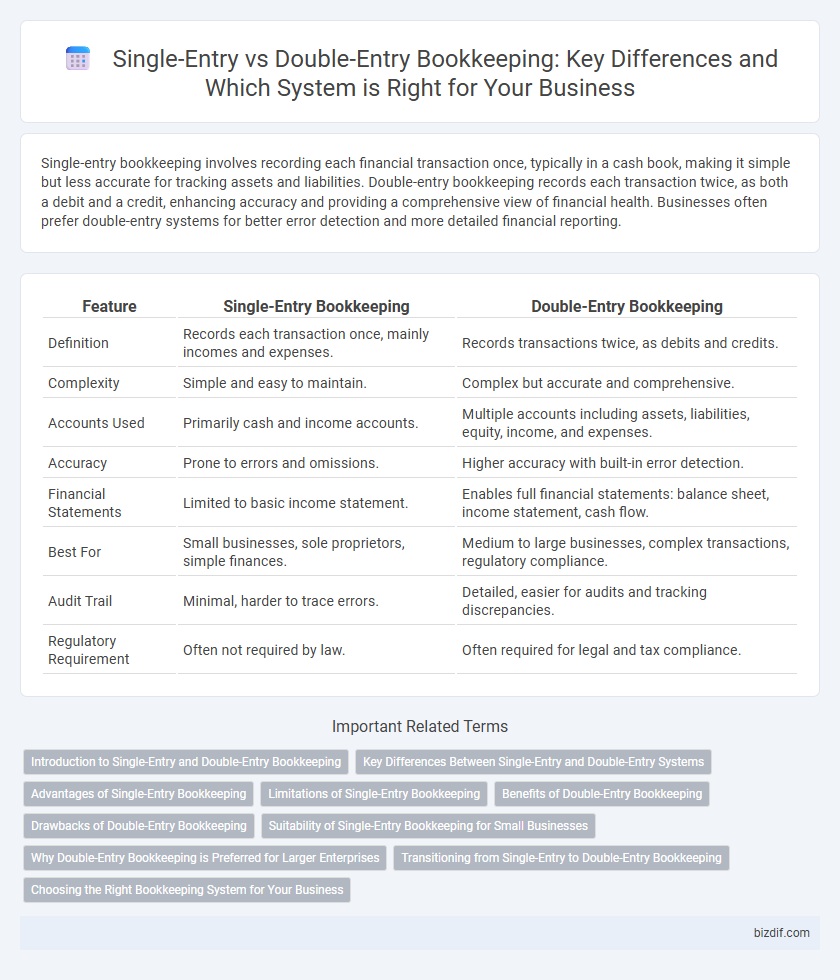

Single-entry bookkeeping involves recording each financial transaction once, typically in a cash book, making it simple but less accurate for tracking assets and liabilities. Double-entry bookkeeping records each transaction twice, as both a debit and a credit, enhancing accuracy and providing a comprehensive view of financial health. Businesses often prefer double-entry systems for better error detection and more detailed financial reporting.

Table of Comparison

| Feature | Single-Entry Bookkeeping | Double-Entry Bookkeeping |

|---|---|---|

| Definition | Records each transaction once, mainly incomes and expenses. | Records transactions twice, as debits and credits. |

| Complexity | Simple and easy to maintain. | Complex but accurate and comprehensive. |

| Accounts Used | Primarily cash and income accounts. | Multiple accounts including assets, liabilities, equity, income, and expenses. |

| Accuracy | Prone to errors and omissions. | Higher accuracy with built-in error detection. |

| Financial Statements | Limited to basic income statement. | Enables full financial statements: balance sheet, income statement, cash flow. |

| Best For | Small businesses, sole proprietors, simple finances. | Medium to large businesses, complex transactions, regulatory compliance. |

| Audit Trail | Minimal, harder to trace errors. | Detailed, easier for audits and tracking discrepancies. |

| Regulatory Requirement | Often not required by law. | Often required for legal and tax compliance. |

Introduction to Single-Entry and Double-Entry Bookkeeping

Single-entry bookkeeping records financial transactions as single entries in a ledger, focusing primarily on income and expenses, making it simple but less comprehensive. Double-entry bookkeeping involves recording each transaction in two accounts--debits and credits--ensuring accuracy and a clear financial position through a balanced accounting equation. Businesses use double-entry bookkeeping to generate detailed financial statements, while single-entry is often preferred by small businesses due to its simplicity.

Key Differences Between Single-Entry and Double-Entry Systems

Single-entry bookkeeping records each financial transaction as a single entry, primarily tracking income and expenses, making it simpler but less detailed. Double-entry bookkeeping records every transaction twice, once as a debit and once as a credit, ensuring accurate financial statements and enabling comprehensive error detection. The double-entry system provides a complete view of assets, liabilities, equity, income, and expenses, which is essential for complex business financial management.

Advantages of Single-Entry Bookkeeping

Single-entry bookkeeping offers simplicity and ease of use, making it ideal for small businesses and sole proprietors with straightforward financial transactions. It requires less time and accounting knowledge, reducing administrative costs and minimizing the risk of errors in data entry. This method provides a clear overview of cash flow and profit, facilitating quick financial decision-making without complex reconciliation processes.

Limitations of Single-Entry Bookkeeping

Single-entry bookkeeping lacks the ability to track assets and liabilities, making it difficult to generate comprehensive financial statements. This system increases the risk of errors and fraud because it does not provide a built-in method for cross-verifying transactions. Small businesses relying solely on single-entry bookkeeping may face challenges in accurately assessing financial health and obtaining external financing.

Benefits of Double-Entry Bookkeeping

Double-entry bookkeeping enhances accuracy by recording each transaction in two accounts, ensuring balanced financial statements and reducing errors. It provides comprehensive financial insights through detailed tracking of assets, liabilities, income, and expenses, facilitating better decision-making. This method supports audit trails and compliance, making it essential for businesses seeking transparency and accountability.

Drawbacks of Double-Entry Bookkeeping

Double-entry bookkeeping requires meticulous record-keeping, which can be time-consuming and complex for small businesses or sole proprietors. Errors in one entry often necessitate reviewing multiple accounts, increasing the risk of overlooked mistakes. The system's complexity may demand professional accounting knowledge, raising operational costs.

Suitability of Single-Entry Bookkeeping for Small Businesses

Single-entry bookkeeping is particularly suitable for small businesses with straightforward financial transactions and limited accounting needs, as it records only one aspect of each transaction, typically income or expenses. This simplicity reduces the time and cost of maintaining financial records, making it ideal for sole proprietors and small-scale operations with minimal inventory or fixed assets. However, it lacks the comprehensive error-checking and detailed financial insights provided by double-entry bookkeeping, limiting its effectiveness for businesses planning to scale.

Why Double-Entry Bookkeeping is Preferred for Larger Enterprises

Double-entry bookkeeping is preferred for larger enterprises because it provides a more accurate and comprehensive financial record by recording each transaction in two accounts, ensuring the accounting equation stays balanced. This method facilitates better error detection, improved financial reporting, and enhanced ability to track assets, liabilities, revenue, and expenses. Larger businesses benefit from the detailed financial insights and compliance advantages offered by double-entry systems, which support complex operations and regulatory requirements.

Transitioning from Single-Entry to Double-Entry Bookkeeping

Transitioning from single-entry to double-entry bookkeeping enhances accuracy by recording transactions in two accounts, promoting better financial tracking and error detection. This shift enables a comprehensive view of assets, liabilities, income, and expenses, which simplifies financial analysis and reporting. Implementing double-entry bookkeeping requires adopting accounting software or training to manage debits and credits, leading to improved financial control and compliance with accounting standards.

Choosing the Right Bookkeeping System for Your Business

Selecting the appropriate bookkeeping system depends on your business size and complexity; single-entry bookkeeping suits small businesses with straightforward transactions, providing a simple record of income and expenses. Double-entry bookkeeping is essential for larger businesses or those seeking detailed financial accuracy, as it records each transaction in two accounts, ensuring balanced books and facilitating error detection. Implementing the right system enhances financial management, streamlines tax preparation, and supports informed decision-making.

Single-Entry Bookkeeping vs Double-Entry Bookkeeping Infographic

bizdif.com

bizdif.com