Intercompany transactions involve financial exchanges between separate legal entities within a corporate group, requiring detailed documentation and reconciliation to ensure accurate consolidation of financial statements. Intracompany transactions occur within a single legal entity, reflecting internal transfers or allocations of resources that do not affect consolidated financial reports but are crucial for internal cost tracking and management accounting. Proper differentiation between these transactions enhances transparency, compliance, and the accuracy of financial reporting in bookkeeping practices.

Table of Comparison

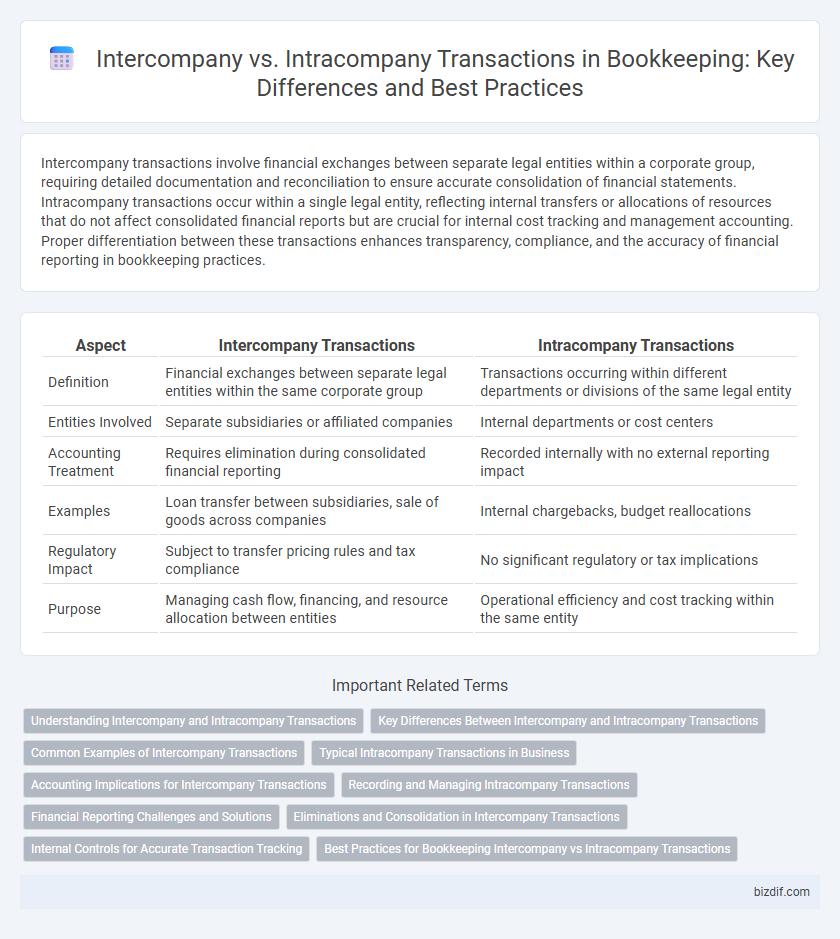

| Aspect | Intercompany Transactions | Intracompany Transactions |

|---|---|---|

| Definition | Financial exchanges between separate legal entities within the same corporate group | Transactions occurring within different departments or divisions of the same legal entity |

| Entities Involved | Separate subsidiaries or affiliated companies | Internal departments or cost centers |

| Accounting Treatment | Requires elimination during consolidated financial reporting | Recorded internally with no external reporting impact |

| Examples | Loan transfer between subsidiaries, sale of goods across companies | Internal chargebacks, budget reallocations |

| Regulatory Impact | Subject to transfer pricing rules and tax compliance | No significant regulatory or tax implications |

| Purpose | Managing cash flow, financing, and resource allocation between entities | Operational efficiency and cost tracking within the same entity |

Understanding Intercompany and Intracompany Transactions

Intercompany transactions occur between separate legal entities within the same corporate group, involving sales, loans, or cost allocations, which require careful consolidation to avoid double counting in financial statements. Intracompany transactions take place within a single entity, such as transfers between departments or divisions, and primarily affect internal accounting without impacting consolidated financial results. Understanding the distinction ensures accurate financial reporting, compliance with accounting standards, and effective internal control management.

Key Differences Between Intercompany and Intracompany Transactions

Intercompany transactions occur between separate legal entities within a corporate group, involving the exchange of goods, services, or funds that require intercompany reconciliation and elimination for consolidated financial statements. Intracompany transactions take place within the same legal entity, involving departments or divisions that affect internal cost allocations without impacting consolidated accounts. Key differences include the necessity for intercompany eliminations to avoid double counting in group accounts and differing implications for tax reporting and regulatory compliance.

Common Examples of Intercompany Transactions

Common examples of intercompany transactions include sales of goods or services between parent companies and subsidiaries, intercompany loans, and the transfer of fixed assets across different corporate entities. These transactions require careful documentation and reconciliation to ensure accurate financial reporting and compliance with tax regulations. Proper management of intercompany transactions helps prevent double counting of revenues and expenses in consolidated financial statements.

Typical Intracompany Transactions in Business

Typical intracompany transactions in business involve transfers of resources, expenses, or revenue within different departments or divisions of the same company, such as interdepartmental billing or allocation of shared services costs. These transactions are crucial for internal cost control, budgeting, and performance evaluation without affecting the company's external financial statements. Accurate recording of intracompany transactions ensures clear visibility into operational efficiency and maintains the integrity of internal financial reporting systems.

Accounting Implications for Intercompany Transactions

Intercompany transactions involve financial exchanges between two separate legal entities within the same corporate group and require careful reconciliation to eliminate double counting in consolidated financial statements. These transactions must be recorded in accordance with generally accepted accounting principles (GAAP) and International Financial Reporting Standards (IFRS) to ensure proper recognition of revenues, expenses, and intercompany balances. Accurate intercompany accounting prevents misstatements in consolidated financial reports and helps maintain compliance with regulatory requirements.

Recording and Managing Intracompany Transactions

Intracompany transactions involve the exchange of resources, services, or funds within different departments or divisions of the same company and require precise internal recording to maintain accurate financial statements. Managing intracompany transactions demands detailed documentation and reconciliation measures to prevent duplications and ensure consistency in departmental budgets and overall company financial reports. Automated bookkeeping systems streamline the tracking and allocation of intracompany expenses, improving financial transparency and operational efficiency.

Financial Reporting Challenges and Solutions

Intercompany transactions involve exchanges between separate legal entities within a corporate group, leading to complexities in eliminating intercompany profits and balances during consolidated financial reporting. Intracompany transactions, occurring within divisions of the same legal entity, pose fewer consolidation challenges but require detailed internal cost allocations to ensure accurate segment reporting. Effective solutions include implementing automated reconciliation tools and standardized accounting protocols to enhance accuracy and transparency in financial statements.

Eliminations and Consolidation in Intercompany Transactions

Intercompany transactions occur between separate legal entities within a corporate group, requiring eliminations during consolidation to prevent double counting of revenue, expenses, assets, and liabilities on the consolidated financial statements. Intracompany transactions happen within the same entity and do not necessitate eliminations, as they represent internal transfers that do not impact overall financial reporting. Effective elimination of intercompany balances and transactions ensures accurate consolidated financial statements that reflect the group's true financial position and performance.

Internal Controls for Accurate Transaction Tracking

Intercompany transactions involve the exchange of goods, services, or funds between different legal entities within the same corporate group, requiring stringent internal controls such as centralized reconciliation processes and consistent documentation to ensure accurate financial reporting. Intracompany transactions occur within a single legal entity, often between departments or divisions, where internal controls focus on precise allocation methods and real-time tracking to maintain clarity in financial records. Effective internal controls for both types include automated matching systems and regular audit trails, minimizing errors and enhancing transparency in transaction tracking.

Best Practices for Bookkeeping Intercompany vs Intracompany Transactions

Accurate bookkeeping for intercompany transactions requires separate ledger accounts and clear documentation to ensure transparency and compliance with tax regulations. Intracompany transactions, often involving cost allocations within departments or divisions, benefit from standardized internal transfer pricing policies and real-time reconciliation to maintain financial integrity. Implementing robust software systems that differentiate these transactions can improve accuracy and streamline audit processes for both intercompany and intracompany activities.

Intercompany Transactions vs Intracompany Transactions Infographic

bizdif.com

bizdif.com