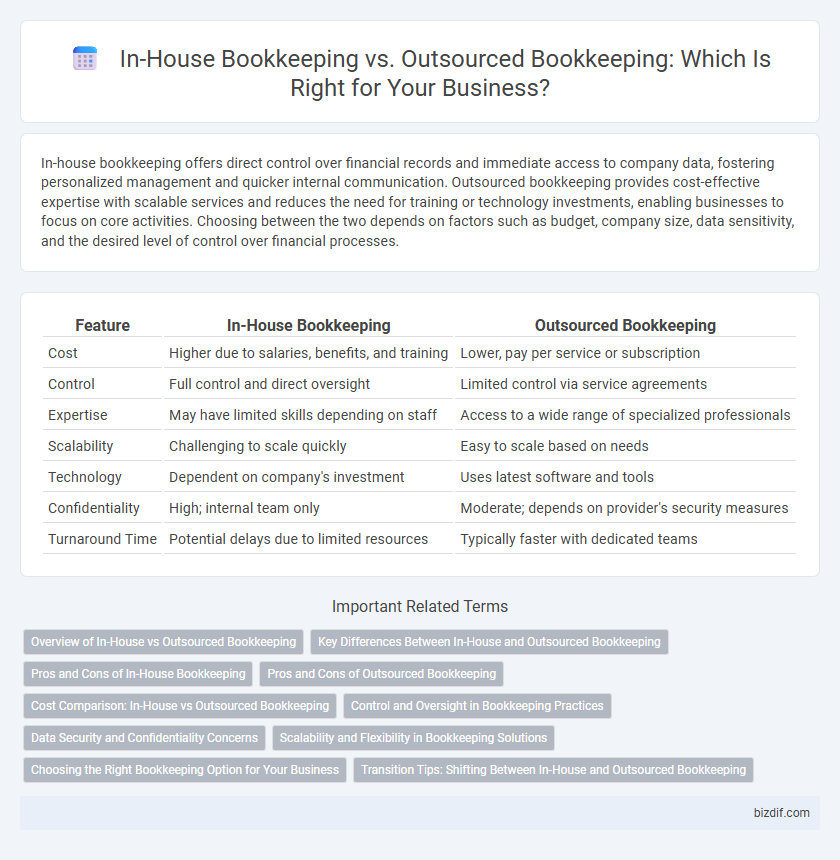

In-house bookkeeping offers direct control over financial records and immediate access to company data, fostering personalized management and quicker internal communication. Outsourced bookkeeping provides cost-effective expertise with scalable services and reduces the need for training or technology investments, enabling businesses to focus on core activities. Choosing between the two depends on factors such as budget, company size, data sensitivity, and the desired level of control over financial processes.

Table of Comparison

| Feature | In-House Bookkeeping | Outsourced Bookkeeping |

|---|---|---|

| Cost | Higher due to salaries, benefits, and training | Lower, pay per service or subscription |

| Control | Full control and direct oversight | Limited control via service agreements |

| Expertise | May have limited skills depending on staff | Access to a wide range of specialized professionals |

| Scalability | Challenging to scale quickly | Easy to scale based on needs |

| Technology | Dependent on company's investment | Uses latest software and tools |

| Confidentiality | High; internal team only | Moderate; depends on provider's security measures |

| Turnaround Time | Potential delays due to limited resources | Typically faster with dedicated teams |

Overview of In-House vs Outsourced Bookkeeping

In-house bookkeeping involves maintaining financial records within a company through dedicated staff, offering direct control and immediate access to financial data. Outsourced bookkeeping delegates these tasks to external professionals or firms specializing in finance, providing cost savings and access to expert knowledge without the overhead of full-time employees. Choosing between in-house and outsourced bookkeeping depends on factors such as budget, business size, and the need for real-time financial oversight.

Key Differences Between In-House and Outsourced Bookkeeping

In-house bookkeeping involves employing dedicated staff within the company to manage financial records, offering direct oversight and immediate access to sensitive information, whereas outsourced bookkeeping entrusts these tasks to external professionals, providing cost efficiency and scalability. Key differences include control, with in-house teams allowing for customized processes tailored to the company's specific needs, while outsourced services often leverage specialized software and expertise to ensure compliance and accuracy. Security protocols vary, as in-house bookkeeping relies on internal data protection measures, whereas outsourced providers implement advanced cybersecurity standards to safeguard client information.

Pros and Cons of In-House Bookkeeping

In-house bookkeeping offers direct oversight and immediate access to financial data, ensuring enhanced control and tailored financial management aligned with company goals. It allows for seamless communication with internal teams, fostering a deeper understanding of business operations and quicker resolution of accounting issues. However, in-house bookkeeping incurs higher costs related to salaries, training, and software, and may limit access to specialized expertise found in outsourced services.

Pros and Cons of Outsourced Bookkeeping

Outsourced bookkeeping offers cost savings by eliminating expenses related to full-time salaries, benefits, and training while providing access to specialized expertise and advanced accounting technologies. However, it can pose challenges like reduced control over financial data, potential communication barriers, and concerns about data security and confidentiality. Businesses must weigh the convenience and scalability of outsourcing against the need for direct oversight and customization when deciding on their bookkeeping strategy.

Cost Comparison: In-House vs Outsourced Bookkeeping

In-house bookkeeping often involves fixed costs such as employee salaries, benefits, and training expenses, which can lead to higher overhead. Outsourced bookkeeping services typically offer more flexible pricing models, including flat fees or pay-per-use options, reducing overall expenditure. Businesses can achieve significant cost savings by outsourcing bookkeeping, especially when factoring in the reduced need for office space and technology investments.

Control and Oversight in Bookkeeping Practices

In-house bookkeeping offers tighter control and direct oversight over financial data, ensuring real-time accuracy and compliance with company policies. Outsourced bookkeeping provides professional expertise and reduces internal resource burdens but may limit immediate access and direct supervision of daily financial transactions. Businesses must weigh the importance of hands-on management against the benefits of specialized external services for optimal bookkeeping practices.

Data Security and Confidentiality Concerns

In-house bookkeeping offers direct control over data security protocols, reducing the risk of unauthorized access by limiting access to internal staff. Outsourced bookkeeping requires rigorous vetting of third-party providers to ensure compliance with industry-standard encryption and confidentiality agreements. Choosing between these options depends on evaluating the firm's internal data protection capabilities versus the security certifications and practices of external bookkeeping services.

Scalability and Flexibility in Bookkeeping Solutions

In-house bookkeeping offers limited scalability as it requires hiring additional staff and investing in training to handle increased workloads, which can be time-consuming and costly. Outsourced bookkeeping solutions provide greater flexibility by allowing businesses to easily adjust service levels based on demand, ensuring efficient resource allocation without long-term commitments. This adaptability makes outsourced services ideal for growing companies seeking scalable bookkeeping support that aligns with fluctuating financial recordkeeping needs.

Choosing the Right Bookkeeping Option for Your Business

Choosing the right bookkeeping option hinges on your business size, budget, and control preferences. In-house bookkeeping offers direct oversight and immediate access to financial data, ideal for larger companies with complex transactions. Outsourced bookkeeping reduces overhead costs and provides access to expert professionals, making it suitable for small to medium-sized businesses seeking scalable financial management solutions.

Transition Tips: Shifting Between In-House and Outsourced Bookkeeping

Transitioning between in-house and outsourced bookkeeping requires clear communication of financial processes and access permissions to ensure data accuracy. Establishing standardized documentation of accounting systems and transaction history facilitates a smooth handover and minimizes data discrepancies. Leveraging cloud-based accounting software like QuickBooks or Xero enables real-time collaboration and seamless integration during the transition.

In-House Bookkeeping vs Outsourced Bookkeeping Infographic

bizdif.com

bizdif.com