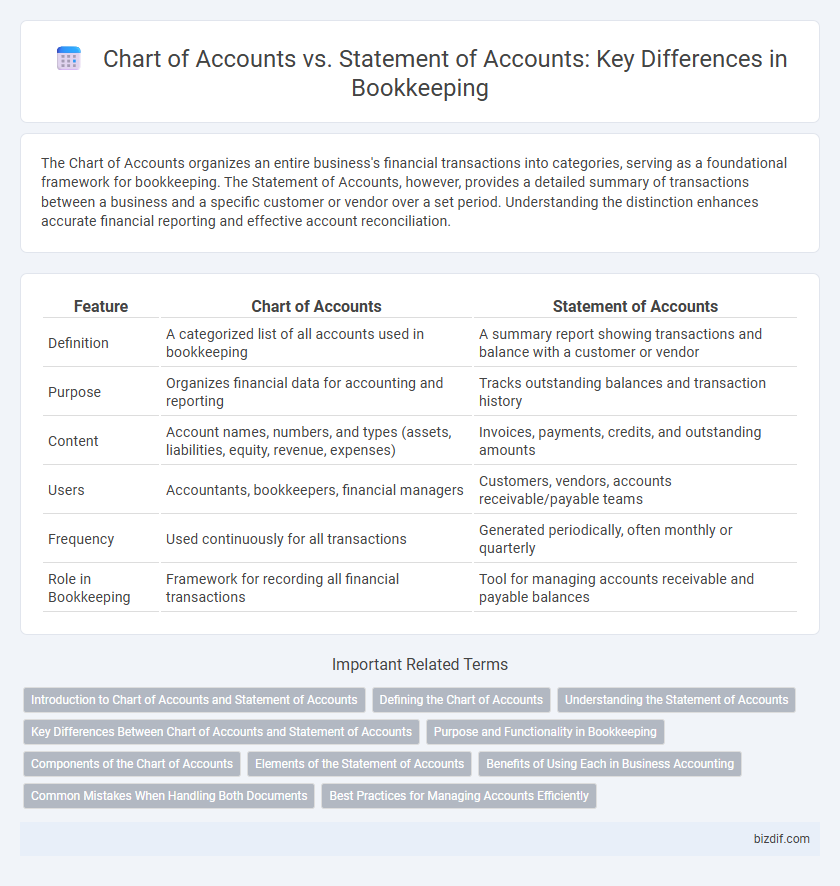

The Chart of Accounts organizes an entire business's financial transactions into categories, serving as a foundational framework for bookkeeping. The Statement of Accounts, however, provides a detailed summary of transactions between a business and a specific customer or vendor over a set period. Understanding the distinction enhances accurate financial reporting and effective account reconciliation.

Table of Comparison

| Feature | Chart of Accounts | Statement of Accounts |

|---|---|---|

| Definition | A categorized list of all accounts used in bookkeeping | A summary report showing transactions and balance with a customer or vendor |

| Purpose | Organizes financial data for accounting and reporting | Tracks outstanding balances and transaction history |

| Content | Account names, numbers, and types (assets, liabilities, equity, revenue, expenses) | Invoices, payments, credits, and outstanding amounts |

| Users | Accountants, bookkeepers, financial managers | Customers, vendors, accounts receivable/payable teams |

| Frequency | Used continuously for all transactions | Generated periodically, often monthly or quarterly |

| Role in Bookkeeping | Framework for recording all financial transactions | Tool for managing accounts receivable and payable balances |

Introduction to Chart of Accounts and Statement of Accounts

The Chart of Accounts is a structured list of all financial accounts used by a business to organize transactions and generate financial statements, categorized into assets, liabilities, equity, income, and expenses. The Statement of Accounts, on the other hand, is a detailed report that summarizes all transactions between a company and a customer or vendor over a specific period, reflecting account balances and outstanding amounts. Understanding the Chart of Accounts is essential for accurate bookkeeping, while the Statement of Accounts helps in managing receivables, payables, and reconciling customer or vendor activity.

Defining the Chart of Accounts

The Chart of Accounts is a structured list of all financial accounts used by a business to organize transactions and track financial activity, including assets, liabilities, equity, revenues, and expenses. It serves as the foundation for record-keeping and financial reporting, ensuring consistent categorization and accurate financial statements. Unlike the Statement of Accounts, which is a summary of transactions with a specific customer or vendor, the Chart of Accounts provides the comprehensive framework underlying the entire accounting system.

Understanding the Statement of Accounts

A Statement of Accounts provides a detailed summary of transactions between a business and its customer, including invoices, payments, credits, and outstanding balances. It helps track account activity over time, ensuring accurate records for accounts receivable or payable. Unlike the Chart of Accounts, which categorizes financial transactions by account type, the Statement of Accounts focuses specifically on individual account history and current financial status.

Key Differences Between Chart of Accounts and Statement of Accounts

The Chart of Accounts is a comprehensive list of all financial accounts used by a business, categorized to organize financial transactions systematically, while the Statement of Accounts is a detailed report showing transactions and balances between a company and a specific customer or supplier. The Chart of Accounts serves as the foundation for recording and reporting financial data, enabling accurate bookkeeping and financial analysis, whereas the Statement of Accounts facilitates reconciliation by providing a summary of invoices, payments, and outstanding balances. Key differences lie in their purpose and scope: the Chart of Accounts structures internal accounting records across all accounts, while the Statement of Accounts communicates specific account activity and status with external parties.

Purpose and Functionality in Bookkeeping

The Chart of Accounts organizes and categorizes all financial transactions within a business, serving as the backbone for accurate bookkeeping and financial reporting. The Statement of Accounts, however, provides a detailed summary of transactions between a business and a specific customer or vendor, reflecting outstanding balances and payment histories. While the Chart of Accounts ensures systematic recording and classification, the Statement of Accounts focuses on tracking individual account activity for reconciliation and credit management.

Components of the Chart of Accounts

The Chart of Accounts consists of categorized components such as assets, liabilities, equity, revenues, and expenses, providing a structured framework for organizing financial transactions. Each account within these categories is assigned a unique account number, facilitating accurate ledger entries and financial reporting. This systematic arrangement contrasts with the Statement of Accounts, which is a summary of transactions between a business and its customers or suppliers.

Elements of the Statement of Accounts

The Statement of Accounts includes elements such as the account holder's name, statement period, beginning balance, detailed list of transactions with dates and descriptions, credits and debits, and the ending balance. It provides a comprehensive overview of all activities within an account to facilitate accurate financial tracking and reconciliation. Unlike the Chart of Accounts, which categorizes accounts for bookkeeping structure, the Statement of Accounts focuses on transactional data and balances for a specific period.

Benefits of Using Each in Business Accounting

The Chart of Accounts organizes all financial transactions into specific categories, enhancing clarity and accuracy in business bookkeeping by allowing detailed tracking of assets, liabilities, income, and expenses. The Statement of Accounts provides a summarized view of transactions between a business and its customers or suppliers, offering clear insights into outstanding balances and payment histories that improve cash flow management. Utilizing both tools together optimizes financial oversight, facilitates accurate reporting, and supports informed decision-making in business accounting.

Common Mistakes When Handling Both Documents

Confusing the Chart of Accounts with the Statement of Accounts often leads to misclassification of financial transactions and inaccurate reporting. The Chart of Accounts organizes all accounts for consistent bookkeeping, while the Statement of Accounts summarizes a specific customer's transactions and balances. Overlooking these distinctions results in errors such as posting customer payments to incorrect ledger accounts or misinterpreting account balances, disrupting financial clarity and compliance.

Best Practices for Managing Accounts Efficiently

Organizing a comprehensive Chart of Accounts ensures precise categorization of all financial transactions, streamlining bookkeeping and facilitating accurate financial reporting. Regularly reconciling the Statement of Accounts with the Chart of Accounts identifies discrepancies early, promoting accountability and reducing errors. Implementing consistent naming conventions and periodic reviews enhances clarity and efficiency in managing both accounts and financial statements.

Chart of Accounts vs Statement of Accounts Infographic

bizdif.com

bizdif.com