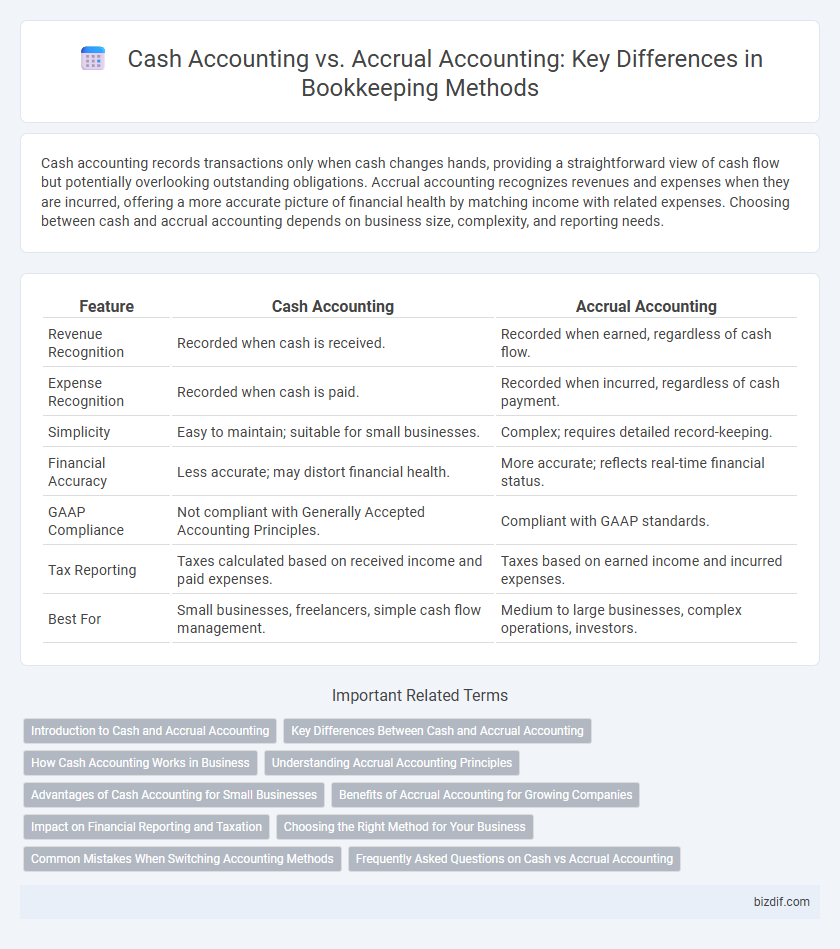

Cash accounting records transactions only when cash changes hands, providing a straightforward view of cash flow but potentially overlooking outstanding obligations. Accrual accounting recognizes revenues and expenses when they are incurred, offering a more accurate picture of financial health by matching income with related expenses. Choosing between cash and accrual accounting depends on business size, complexity, and reporting needs.

Table of Comparison

| Feature | Cash Accounting | Accrual Accounting |

|---|---|---|

| Revenue Recognition | Recorded when cash is received. | Recorded when earned, regardless of cash flow. |

| Expense Recognition | Recorded when cash is paid. | Recorded when incurred, regardless of cash payment. |

| Simplicity | Easy to maintain; suitable for small businesses. | Complex; requires detailed record-keeping. |

| Financial Accuracy | Less accurate; may distort financial health. | More accurate; reflects real-time financial status. |

| GAAP Compliance | Not compliant with Generally Accepted Accounting Principles. | Compliant with GAAP standards. |

| Tax Reporting | Taxes calculated based on received income and paid expenses. | Taxes based on earned income and incurred expenses. |

| Best For | Small businesses, freelancers, simple cash flow management. | Medium to large businesses, complex operations, investors. |

Introduction to Cash and Accrual Accounting

Cash accounting records transactions only when cash is exchanged, providing a straightforward method ideal for small businesses and individuals. Accrual accounting recognizes revenue and expenses when they are incurred, regardless of cash flow, offering a more accurate financial picture for larger companies. Understanding the differences between cash and accrual accounting is essential for accurate bookkeeping and compliance with accounting standards.

Key Differences Between Cash and Accrual Accounting

Cash accounting records revenues and expenses only when money changes hands, providing a clear view of cash flow but potentially missing outstanding liabilities or receivables. Accrual accounting records revenues and expenses when they are earned or incurred, offering a comprehensive financial picture by including accounts payable and receivable. Key differences include timing of income and expense recognition, impact on financial statements, and suitability for different business sizes or regulatory requirements.

How Cash Accounting Works in Business

Cash accounting records revenues and expenses only when cash transactions occur, providing a straightforward method for tracking actual cash flow. Businesses using this method recognize income when payments are received and record expenses when bills are paid, which helps maintain clear visibility of available funds. This approach simplifies tax reporting and cash management, especially for small businesses with less complex financial activities.

Understanding Accrual Accounting Principles

Accrual accounting records revenues and expenses when they are earned or incurred, regardless of cash flow timing, providing a more accurate financial picture. This method aligns income and related expenses in the same period, enhancing matching principles and financial statement reliability. Businesses using accrual accounting adhere to GAAP standards, enabling better decision-making and compliance with regulatory reporting requirements.

Advantages of Cash Accounting for Small Businesses

Cash accounting offers small businesses a straightforward method to track income and expenses, improving cash flow visibility and simplifying tax preparation. This approach records transactions only when cash changes hands, reducing the complexity of managing accounts payable and receivable. Small business owners benefit from improved financial clarity, better budgeting control, and reduced accounting costs using cash accounting.

Benefits of Accrual Accounting for Growing Companies

Accrual accounting provides growing companies with a clearer financial picture by recording revenues and expenses when they are incurred, not when cash changes hands. This method improves decision-making through accurate matching of income and expenses, facilitating better budgeting and forecasting. It also enhances credibility with investors and lenders by presenting a more comprehensive view of financial health.

Impact on Financial Reporting and Taxation

Cash accounting records transactions only when cash changes hands, providing a straightforward view of cash flow but potentially distorting profitability and financial position in financial reports. Accrual accounting recognizes revenues and expenses when they are earned or incurred, offering a more accurate picture of a company's financial health and aligning with Generally Accepted Accounting Principles (GAAP). For taxation, cash accounting can defer tax liabilities by delaying income recognition, whereas accrual accounting may result in earlier tax liabilities due to recognizing income and expenses regardless of cash movement.

Choosing the Right Method for Your Business

Selecting the appropriate bookkeeping method hinges on your business size, complexity, and financial reporting needs. Cash accounting tracks income and expenses only when money exchanges hands, ideal for small businesses with straightforward transactions. Accrual accounting records revenues and expenses when they are earned or incurred, providing a more accurate financial picture suitable for larger businesses seeking detailed financial analysis.

Common Mistakes When Switching Accounting Methods

Switching from cash accounting to accrual accounting often leads to common mistakes such as failing to properly record accounts receivable and accounts payable, which can distort financial statements. Many businesses overlook the need to adjust opening balances, causing discrepancies in income and expenses between periods. Inaccurate timing of revenue and expense recognition can result in tax reporting errors and cash flow mismanagement.

Frequently Asked Questions on Cash vs Accrual Accounting

Cash accounting records transactions only when cash changes hands, making it simpler and ideal for small businesses. Accrual accounting recognizes revenues and expenses when they are incurred, providing a more accurate financial picture for larger companies. Common FAQs include when to choose each method, tax implications, and how each affects financial reporting and cash flow management.

Cash Accounting vs Accrual Accounting Infographic

bizdif.com

bizdif.com