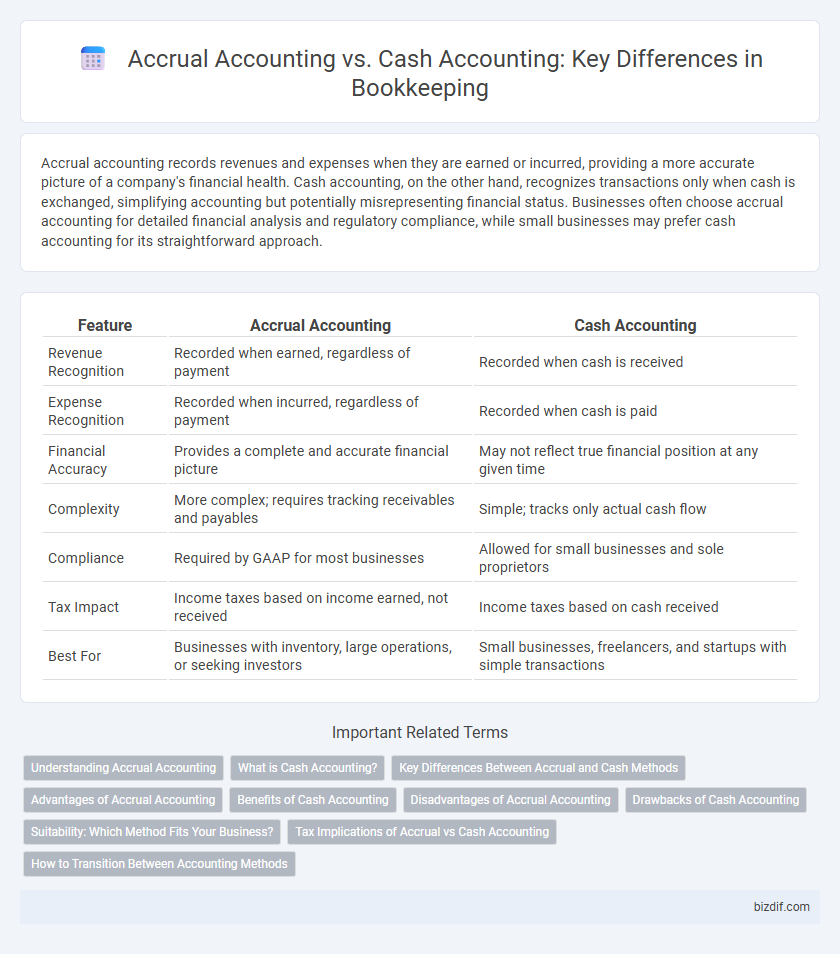

Accrual accounting records revenues and expenses when they are earned or incurred, providing a more accurate picture of a company's financial health. Cash accounting, on the other hand, recognizes transactions only when cash is exchanged, simplifying accounting but potentially misrepresenting financial status. Businesses often choose accrual accounting for detailed financial analysis and regulatory compliance, while small businesses may prefer cash accounting for its straightforward approach.

Table of Comparison

| Feature | Accrual Accounting | Cash Accounting |

|---|---|---|

| Revenue Recognition | Recorded when earned, regardless of payment | Recorded when cash is received |

| Expense Recognition | Recorded when incurred, regardless of payment | Recorded when cash is paid |

| Financial Accuracy | Provides a complete and accurate financial picture | May not reflect true financial position at any given time |

| Complexity | More complex; requires tracking receivables and payables | Simple; tracks only actual cash flow |

| Compliance | Required by GAAP for most businesses | Allowed for small businesses and sole proprietors |

| Tax Impact | Income taxes based on income earned, not received | Income taxes based on cash received |

| Best For | Businesses with inventory, large operations, or seeking investors | Small businesses, freelancers, and startups with simple transactions |

Understanding Accrual Accounting

Accrual accounting records revenues and expenses when they are earned or incurred, regardless of cash flow, providing a more accurate financial picture for businesses with complex transactions. This method matches income and related expenses within the same period, enhancing financial analysis and decision-making. Accrual accounting complies with Generally Accepted Accounting Principles (GAAP), making it essential for companies seeking external financing or investors.

What is Cash Accounting?

Cash accounting records transactions only when cash changes hands, capturing income and expenses at the moment of payment or receipt. This method offers simplicity and real-time insight into cash flow, making it ideal for small businesses and freelancers. Unlike accrual accounting, cash accounting avoids tracking receivables or payables, which streamlines bookkeeping but may obscure overall financial health.

Key Differences Between Accrual and Cash Methods

Accrual accounting records revenues and expenses when they are earned or incurred, regardless of when cash is exchanged, providing a more accurate financial picture for businesses with complex transactions. Cash accounting recognizes revenue and expenses only when cash is received or paid, simplifying bookkeeping for small businesses or sole proprietors with straightforward cash flow. Key differences include timing of revenue recognition, expense matching, and financial statement accuracy, which significantly impact tax reporting and financial analysis.

Advantages of Accrual Accounting

Accrual accounting provides a more accurate financial picture by recording revenues and expenses when they are incurred, regardless of cash flow timing, allowing for better matching of income and related costs. This method enhances decision-making through real-time insight into financial performance and liabilities, supporting improved budgeting and forecasting. It also complies with generally accepted accounting principles (GAAP), making it essential for businesses seeking external financing or investment.

Benefits of Cash Accounting

Cash accounting provides a straightforward method for small businesses to track income and expenses by recording transactions only when cash changes hands, enhancing simplicity and clarity in financial management. This method improves cash flow visibility, allowing business owners to monitor real-time cash availability and plan expenditures more effectively. Small businesses and sole proprietors often prefer cash accounting due to its ease of use and alignment with actual cash movements, reducing complexities associated with accounts receivable and payable.

Disadvantages of Accrual Accounting

Accrual accounting can complicate cash flow management due to recording revenues and expenses when they are incurred rather than when cash is exchanged. This method often requires more complex bookkeeping processes and increased time commitment from accounting staff. Small businesses may face challenges with tax planning since taxable income can differ significantly from actual cash on hand.

Drawbacks of Cash Accounting

Cash accounting often results in incomplete financial insights because it records transactions only when cash changes hands, ignoring accounts receivable and payable. This method can distort the timing of income and expenses, complicating accurate profit measurement and cash flow management. Businesses using cash accounting may face challenges in securing financing or tax planning due to the lack of comprehensive financial data.

Suitability: Which Method Fits Your Business?

Accrual accounting suits businesses with complex transactions or those seeking accurate financial insights by recording revenues and expenses when incurred, not cash flow. Cash accounting fits small businesses or sole proprietors prioritizing simplicity and immediate cash flow tracking, recognizing revenue and expenses only when cash changes hands. Choosing the right method depends on business size, transaction volume, and financial reporting needs, with accrual offering detailed insight and cash providing straightforward management.

Tax Implications of Accrual vs Cash Accounting

Accrual accounting records income and expenses when they are earned or incurred, impacting taxable income by recognizing revenue before cash is received, which can lead to higher tax liabilities in the short term. Cash accounting recognizes income and expenses only when cash is exchanged, often deferring tax obligations until payments are received or made, providing potential tax deferral benefits. The choice between accrual and cash accounting affects tax reporting and timing, influencing cash flow management and tax planning strategies for businesses and self-employed individuals.

How to Transition Between Accounting Methods

Transitioning from cash to accrual accounting requires careful adjustment of income and expenses to reflect revenues earned and liabilities incurred during the period, often involving journal entries for accounts receivable, accounts payable, and inventory. Businesses must reconcile opening balances and ensure tax compliance by consulting IRS guidelines or accounting professionals to avoid reporting errors. Implementing accounting software compatible with accrual methods streamlines the transition and improves financial accuracy.

Accrual Accounting vs Cash Accounting Infographic

bizdif.com

bizdif.com