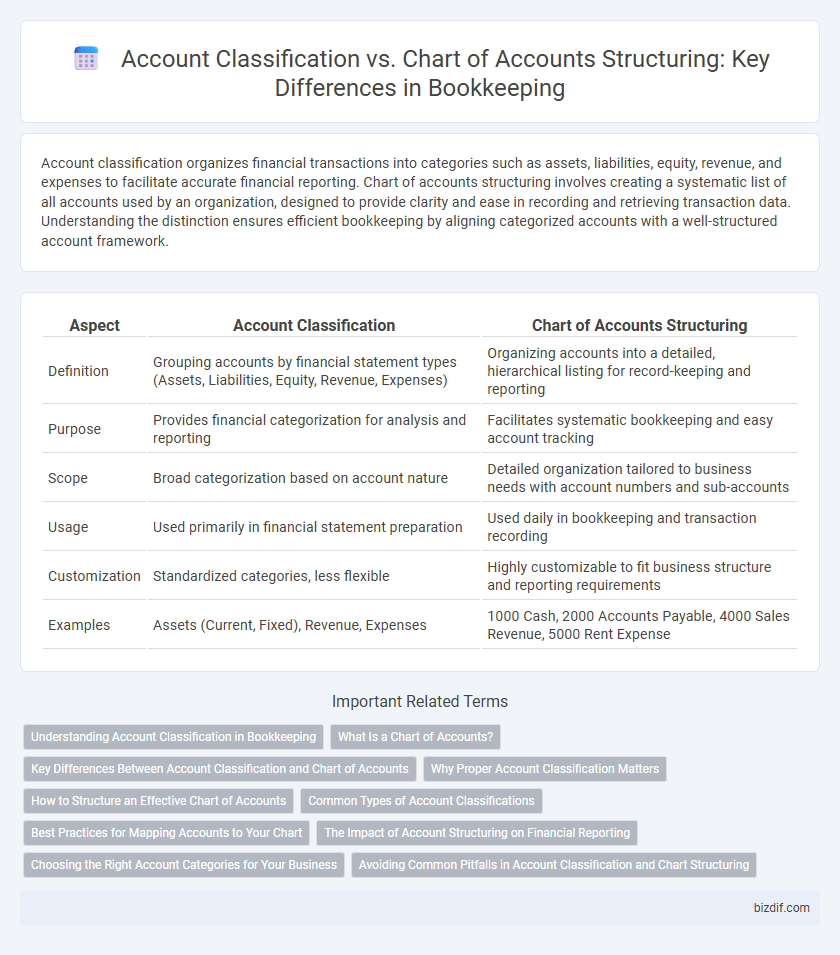

Account classification organizes financial transactions into categories such as assets, liabilities, equity, revenue, and expenses to facilitate accurate financial reporting. Chart of accounts structuring involves creating a systematic list of all accounts used by an organization, designed to provide clarity and ease in recording and retrieving transaction data. Understanding the distinction ensures efficient bookkeeping by aligning categorized accounts with a well-structured account framework.

Table of Comparison

| Aspect | Account Classification | Chart of Accounts Structuring |

|---|---|---|

| Definition | Grouping accounts by financial statement types (Assets, Liabilities, Equity, Revenue, Expenses) | Organizing accounts into a detailed, hierarchical listing for record-keeping and reporting |

| Purpose | Provides financial categorization for analysis and reporting | Facilitates systematic bookkeeping and easy account tracking |

| Scope | Broad categorization based on account nature | Detailed organization tailored to business needs with account numbers and sub-accounts |

| Usage | Used primarily in financial statement preparation | Used daily in bookkeeping and transaction recording |

| Customization | Standardized categories, less flexible | Highly customizable to fit business structure and reporting requirements |

| Examples | Assets (Current, Fixed), Revenue, Expenses | 1000 Cash, 2000 Accounts Payable, 4000 Sales Revenue, 5000 Rent Expense |

Understanding Account Classification in Bookkeeping

Account classification in bookkeeping involves categorizing financial transactions into specific groups such as assets, liabilities, equity, revenues, and expenses to ensure accurate financial reporting. This classification provides a clear framework for organizing financial data, enabling consistent recording and analysis of business activities. Understanding account classification is essential for creating a coherent chart of accounts structure that aligns with regulatory standards and internal management needs.

What Is a Chart of Accounts?

A Chart of Accounts (COA) is a systematic listing of all accounts used by a business to organize financial transactions and ensure accurate bookkeeping. It categorizes accounts into key groups such as assets, liabilities, equity, revenue, and expenses, enabling clear financial reporting and analysis. Proper COA structuring facilitates efficient account classification, streamlining financial management and compliance.

Key Differences Between Account Classification and Chart of Accounts

Account classification organizes financial transactions into categories such as assets, liabilities, equity, revenues, and expenses to ensure accurate financial reporting and compliance with accounting standards. Chart of accounts structuring refers to the systematic arrangement and coding of these individual accounts within a company's accounting system to facilitate detailed tracking and reporting. Key differences include account classification focusing on the nature and purpose of accounts for financial statement presentation, while chart of accounts structuring emphasizes the organization and hierarchy necessary for efficient bookkeeping and internal management.

Why Proper Account Classification Matters

Proper account classification ensures accurate financial reporting by grouping transactions into relevant categories, facilitating clearer insights into a company's financial health. This classification supports compliance with accounting standards and enhances decision-making by providing stakeholders with precise data on assets, liabilities, revenues, and expenses. Effective chart of accounts structuring relies on well-defined account classifications to organize financial information systematically and improve the efficiency of bookkeeping processes.

How to Structure an Effective Chart of Accounts

To structure an effective Chart of Accounts, categorize accounts clearly into assets, liabilities, equity, revenues, and expenses, ensuring each category supports accurate financial reporting and compliance. Assign unique, consistent account numbers that reflect the hierarchy and facilitate easy identification and tracking of transactions. Regularly review and update the Chart of Accounts to accommodate business growth, changes in operations, and industry-specific requirements.

Common Types of Account Classifications

Common types of account classifications in bookkeeping include assets, liabilities, equity, revenue, and expenses, each serving a distinct financial function. Proper account classification ensures accurate financial reporting and aids in the organization of the chart of accounts structure. Structuring the chart of accounts involves grouping these classifications into detailed accounts to streamline transaction tracking and financial analysis.

Best Practices for Mapping Accounts to Your Chart

Effective account classification ensures accurate grouping of financial transactions, which streamlines the process of mapping accounts to your chart of accounts. Best practices include maintaining consistency in account naming conventions, aligning account categories with industry standards, and regularly reviewing account hierarchies to reflect changes in business operations. Proper structuring facilitates clear financial reporting, enhances audit readiness, and supports strategic decision-making.

The Impact of Account Structuring on Financial Reporting

Account classification organizes financial data into categories such as assets, liabilities, equity, revenues, and expenses, enhancing clarity and consistency in reporting. Chart of accounts structuring defines the hierarchical arrangement and numbering system of accounts, directly influencing the granularity and accuracy of financial statements. Effective account structuring improves data retrieval, facilitates compliance with accounting standards, and supports detailed analysis for strategic decision-making.

Choosing the Right Account Categories for Your Business

Selecting the appropriate account categories ensures accurate financial reporting and streamlined bookkeeping processes. Account classification groups similar accounts into logical categories like assets, liabilities, equity, revenue, and expenses, while chart of accounts structuring organizes these categories into a customized framework tailored to business needs. Proper categorization facilitates precise tracking of financial transactions, improves budgeting accuracy, and supports compliance with accounting standards.

Avoiding Common Pitfalls in Account Classification and Chart Structuring

Avoiding common pitfalls in account classification and chart of accounts structuring requires clear categorization aligned with business activities and consistent account labeling, which prevents errors in financial reporting and analysis. Misclassification of accounts often leads to inaccurate financial statements, complicating tax preparation and compliance with accounting standards such as GAAP or IFRS. Structuring the chart of accounts with logical grouping and scalable numbering systems supports efficient data retrieval and simplifies audit processes, improving overall financial management.

Account Classification vs Chart of Accounts Structuring Infographic

bizdif.com

bizdif.com