Deferred revenue and unearned revenue both refer to payments received for goods or services yet to be delivered, representing a liability on the balance sheet. Deferred revenue often applies to revenue recognized gradually over time, while unearned revenue emphasizes the obligation before earning the income. Proper bookkeeping distinguishes these terms to ensure accurate financial reporting and compliance with revenue recognition standards.

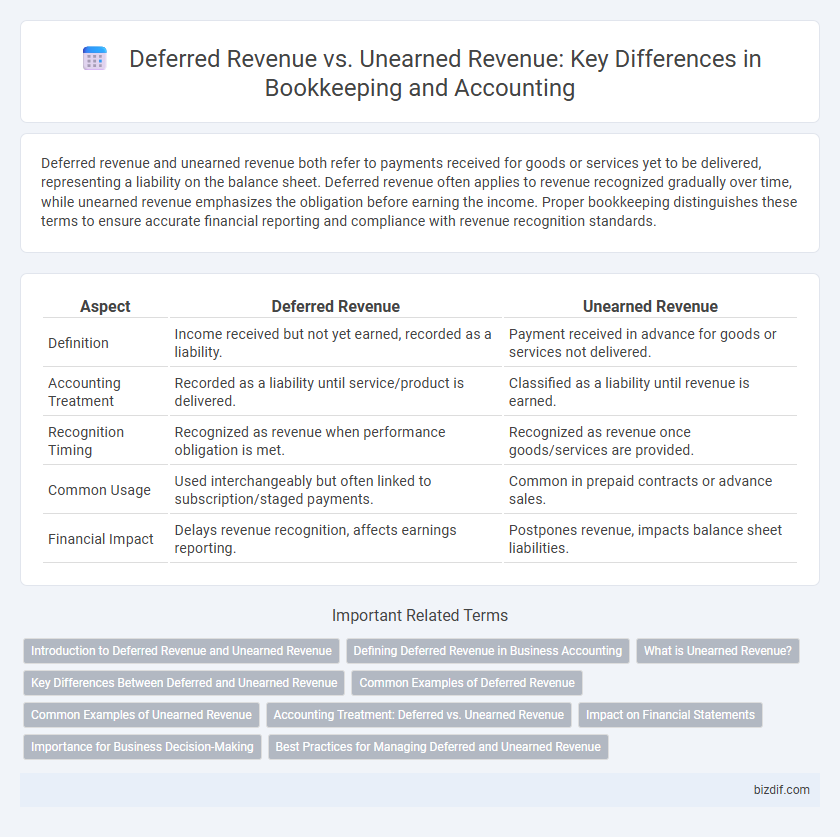

Table of Comparison

| Aspect | Deferred Revenue | Unearned Revenue |

|---|---|---|

| Definition | Income received but not yet earned, recorded as a liability. | Payment received in advance for goods or services not delivered. |

| Accounting Treatment | Recorded as a liability until service/product is delivered. | Classified as a liability until revenue is earned. |

| Recognition Timing | Recognized as revenue when performance obligation is met. | Recognized as revenue once goods/services are provided. |

| Common Usage | Used interchangeably but often linked to subscription/staged payments. | Common in prepaid contracts or advance sales. |

| Financial Impact | Delays revenue recognition, affects earnings reporting. | Postpones revenue, impacts balance sheet liabilities. |

Introduction to Deferred Revenue and Unearned Revenue

Deferred revenue and unearned revenue both represent liabilities on a company's balance sheet, reflecting payments received for goods or services yet to be delivered. Deferred revenue arises when an organization receives advance payments and recognizes revenue only upon fulfilling contractual obligations. Unearned revenue specifically denotes cash received prior to earning it, requiring careful tracking to ensure accurate financial reporting and compliance with revenue recognition standards.

Defining Deferred Revenue in Business Accounting

Deferred revenue in business accounting represents money received by a company for goods or services yet to be delivered or performed, creating a liability on the balance sheet. This liability reflects the obligation to provide products or services in the future, ensuring accurate revenue recognition in compliance with accounting standards. Proper management of deferred revenue is essential for maintaining transparent financial reporting and aligning income with actual business performance.

What is Unearned Revenue?

Unearned revenue refers to payments received by a business for goods or services that have not yet been delivered or performed, representing a liability on the balance sheet. It is recorded as a current liability until the company fulfills its obligations, at which point it is recognized as earned revenue on the income statement. Properly managing unearned revenue ensures accurate financial reporting and compliance with accounting standards like GAAP and IFRS.

Key Differences Between Deferred and Unearned Revenue

Deferred revenue and unearned revenue both represent liabilities on a company's balance sheet, reflecting payments received before delivering goods or services. The key difference lies in their usage: deferred revenue often refers to income recognized over time as the service is performed, while unearned revenue is the broader term for any advance payment not yet earned. Understanding this distinction ensures accurate revenue recognition and compliance with accounting standards like GAAP or IFRS.

Common Examples of Deferred Revenue

Deferred revenue, often synonymously called unearned revenue, commonly arises in industries with subscription models, such as software-as-a-service (SaaS) and magazine publishing, where payments are received before services are delivered. Examples include annual gym memberships paid upfront, prepaid insurance premiums, and advance ticket sales for events. These transactions require businesses to recognize revenue gradually over the service period, matching income with delivery obligations under accrual accounting principles.

Common Examples of Unearned Revenue

Common examples of unearned revenue in bookkeeping include customer prepaid subscriptions, advance rent payments, and deposits received for future services or products. These transactions represent liabilities on the balance sheet until the service or product delivery is completed. Properly tracking unearned revenue ensures accurate financial reporting and compliance with revenue recognition principles.

Accounting Treatment: Deferred vs. Unearned Revenue

Deferred revenue and unearned revenue both represent liabilities on the balance sheet, indicating cash received before the delivery of goods or services. Accounting treatment for deferred revenue involves recognizing it as a liability until the revenue is earned over time or upon fulfillment of performance obligations, while unearned revenue is recorded similarly but is often associated with single, upfront payments requiring future service delivery. Both require systematic revenue recognition matching the income statement with the underlying business activity to ensure accurate financial reporting under GAAP or IFRS standards.

Impact on Financial Statements

Deferred revenue and unearned revenue both represent liabilities on the balance sheet, reflecting cash received before services are performed or goods delivered. These liabilities reduce reported revenue on the income statement until the earning process is complete, ensuring accurate matching of income and expenses. Proper recognition of these revenues affects key financial metrics, such as net income and working capital, influencing financial analysis and decision-making.

Importance for Business Decision-Making

Deferred revenue and unearned revenue both represent payments received before delivering goods or services, but understanding their distinctions is crucial for accurate financial reporting. Properly classifying these liabilities ensures businesses avoid overstating income, which directly impacts cash flow analysis and forecasting accuracy. Accurate tracking of deferred and unearned revenue enables informed decisions on resource allocation and compliance with accounting standards, thereby supporting long-term financial stability.

Best Practices for Managing Deferred and Unearned Revenue

Effective management of deferred and unearned revenue requires accurate tracking of payment dates and corresponding service periods to ensure timely revenue recognition. Implementing automated accounting software enhances visibility and compliance with Generally Accepted Accounting Principles (GAAP) by correctly classifying liabilities and revenue. Regular reconciliation and clear documentation of deferred revenue schedules support financial reporting accuracy and audit readiness.

Deferred Revenue vs Unearned Revenue Infographic

bizdif.com

bizdif.com