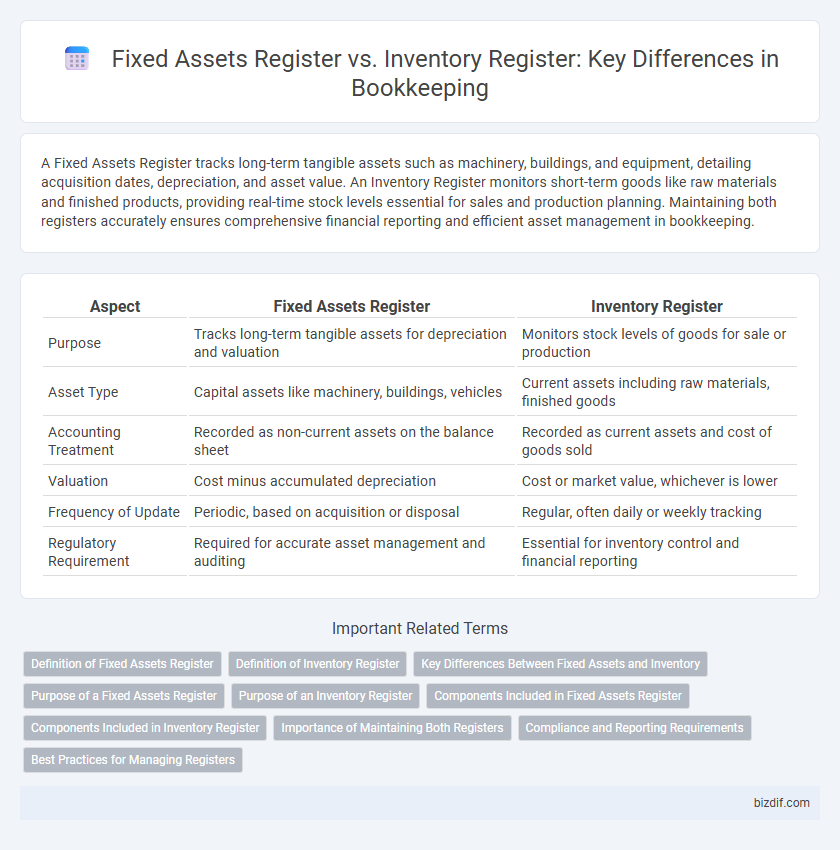

A Fixed Assets Register tracks long-term tangible assets such as machinery, buildings, and equipment, detailing acquisition dates, depreciation, and asset value. An Inventory Register monitors short-term goods like raw materials and finished products, providing real-time stock levels essential for sales and production planning. Maintaining both registers accurately ensures comprehensive financial reporting and efficient asset management in bookkeeping.

Table of Comparison

| Aspect | Fixed Assets Register | Inventory Register |

|---|---|---|

| Purpose | Tracks long-term tangible assets for depreciation and valuation | Monitors stock levels of goods for sale or production |

| Asset Type | Capital assets like machinery, buildings, vehicles | Current assets including raw materials, finished goods |

| Accounting Treatment | Recorded as non-current assets on the balance sheet | Recorded as current assets and cost of goods sold |

| Valuation | Cost minus accumulated depreciation | Cost or market value, whichever is lower |

| Frequency of Update | Periodic, based on acquisition or disposal | Regular, often daily or weekly tracking |

| Regulatory Requirement | Required for accurate asset management and auditing | Essential for inventory control and financial reporting |

Definition of Fixed Assets Register

A Fixed Assets Register is a detailed record of a company's long-term tangible assets, such as machinery, buildings, and vehicles, that are used in operations and depreciated over time. It provides essential data on acquisition dates, asset cost, depreciation methods, and accumulated depreciation, enabling accurate financial reporting and asset management. Unlike an Inventory Register, which tracks current stock and materials for sale or production, the Fixed Assets Register focuses solely on fixed assets that are not intended for sale but for long-term use.

Definition of Inventory Register

The inventory register is a detailed record that tracks all goods, raw materials, and merchandise held by a business for resale or production purposes. Unlike a fixed assets register, which monitors long-term assets such as machinery and buildings, the inventory register focuses on items that are intended to be sold or consumed within the normal operating cycle. Accurate maintenance of the inventory register is essential for effective stock control, financial reporting, and ensuring the availability of goods for business operations.

Key Differences Between Fixed Assets and Inventory

Fixed assets register tracks long-term tangible assets like buildings, machinery, and vehicles used in business operations, while inventory register records goods held for sale or raw materials used in production. Fixed assets depreciate over time, impacting the balance sheet, whereas inventory is valued at cost or market price and affects the cost of goods sold. The key difference lies in their purpose: fixed assets support operations, and inventory is intended for sale or manufacturing processes.

Purpose of a Fixed Assets Register

A Fixed Assets Register maintains detailed records of a company's long-term tangible assets, tracking acquisition dates, depreciation, and current values to ensure accurate financial reporting and asset management. It supports compliance with accounting standards and facilitates asset tracking for audits and taxation purposes. Unlike the Inventory Register, which monitors goods for sale or production, the Fixed Assets Register focuses exclusively on property, plant, and equipment holdings.

Purpose of an Inventory Register

An Inventory Register primarily tracks the quantity, description, and value of consumable goods and stock items available for sale or use, ensuring accurate stock management and preventing shortages or overstocking. It facilitates daily operational control and financial reporting by providing detailed records of inventory levels and movements. Unlike a Fixed Assets Register, which focuses on long-term tangible assets, the Inventory Register supports efficient inventory turnover and cost monitoring.

Components Included in Fixed Assets Register

The Fixed Assets Register includes detailed components such as asset descriptions, purchase dates, acquisition costs, depreciation methods, accumulated depreciation, and current book values, which are essential for tracking long-term tangible assets. This register distinguishes assets like machinery, vehicles, buildings, and equipment from inventory items, which are recorded separately in the Inventory Register and typically encompass raw materials, work-in-progress, and finished goods. Maintaining an accurate Fixed Assets Register supports compliance with accounting standards, facilitates asset management, and ensures precise financial reporting.

Components Included in Inventory Register

The Inventory Register primarily includes raw materials, work-in-progress items, finished goods, and consumables essential for daily business operations. It tracks quantities, locations, and valuation of stock to ensure accurate inventory management and control. Unlike the Fixed Assets Register, it excludes long-term assets such as machinery, buildings, and equipment.

Importance of Maintaining Both Registers

Maintaining both a Fixed Assets Register and an Inventory Register is crucial for accurate financial reporting and effective asset management. The Fixed Assets Register tracks long-term tangible assets such as machinery, buildings, and vehicles, ensuring proper depreciation calculation and compliance with accounting standards. The Inventory Register manages short-term assets like raw materials and finished goods, enabling precise stock control and operational efficiency in business processes.

Compliance and Reporting Requirements

A Fixed Assets Register tracks long-term tangible assets for depreciation and audit purposes, ensuring compliance with accounting standards such as IFRS and GAAP. An Inventory Register records short-term stock items for operational management and cost control, supporting accurate VAT reporting and inventory valuation. Both registers are essential for regulatory adherence, but the Fixed Assets Register plays a critical role in financial statement disclosures and tax compliance.

Best Practices for Managing Registers

Maintaining a Fixed Assets Register involves detailed tracking of asset acquisition, depreciation, and disposal to ensure accurate financial reporting and compliance with accounting standards. An Inventory Register requires systematic recording of stock levels, movement, and valuation to optimize supply chain management and prevent stockouts or overstocking. Implementing regular audits, using integrated asset management software, and establishing clear update protocols enhance accuracy and transparency in both registers.

Fixed Assets Register vs Inventory Register Infographic

bizdif.com

bizdif.com