Reconciliation ensures the accuracy of financial records by comparing internal ledger entries with external statements, identifying discrepancies to maintain data integrity. Ledger posting involves recording all financial transactions systematically in the ledger, providing a comprehensive overview of account balances. While ledger posting organizes financial data, reconciliation verifies its correctness, making both processes essential for reliable bookkeeping.

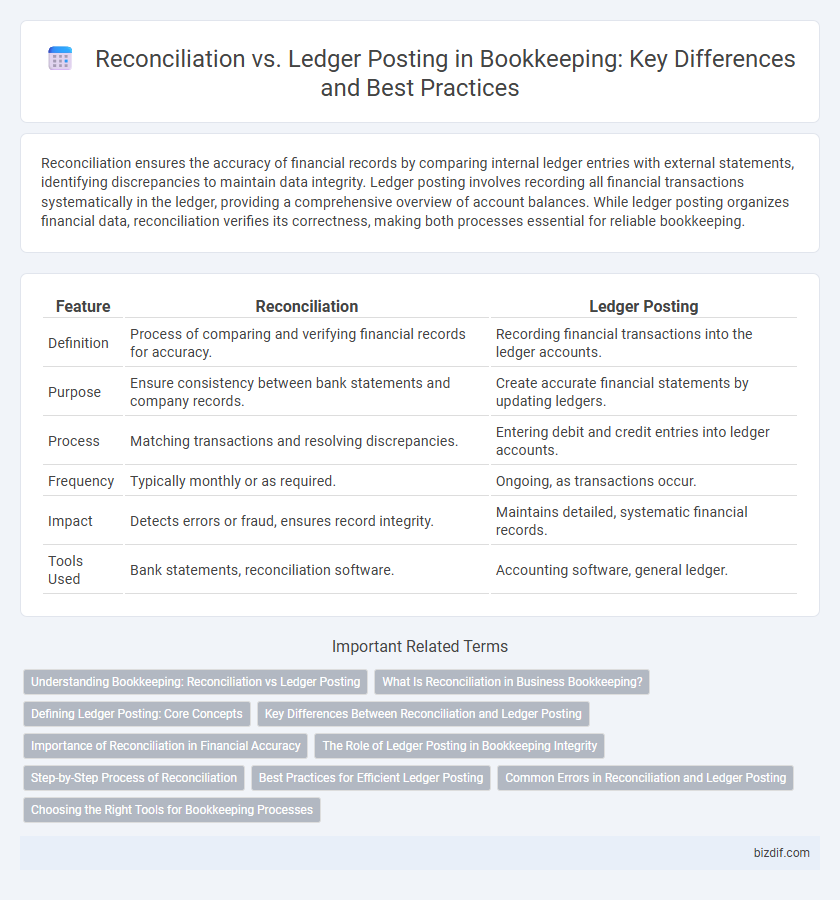

Table of Comparison

| Feature | Reconciliation | Ledger Posting |

|---|---|---|

| Definition | Process of comparing and verifying financial records for accuracy. | Recording financial transactions into the ledger accounts. |

| Purpose | Ensure consistency between bank statements and company records. | Create accurate financial statements by updating ledgers. |

| Process | Matching transactions and resolving discrepancies. | Entering debit and credit entries into ledger accounts. |

| Frequency | Typically monthly or as required. | Ongoing, as transactions occur. |

| Impact | Detects errors or fraud, ensures record integrity. | Maintains detailed, systematic financial records. |

| Tools Used | Bank statements, reconciliation software. | Accounting software, general ledger. |

Understanding Bookkeeping: Reconciliation vs Ledger Posting

Reconciliation involves comparing financial records with external statements to ensure accuracy and identify discrepancies, while ledger posting is the process of recording financial transactions systematically in the general ledger. Both are essential bookkeeping tasks: reconciliation validates the data recorded through ledger postings, maintaining financial integrity. Accurate ledger posting supports efficient reconciliation by providing organized transaction data for verifying account balances.

What Is Reconciliation in Business Bookkeeping?

Reconciliation in business bookkeeping is the process of comparing financial records, such as bank statements and ledgers, to ensure accuracy and consistency. It helps identify discrepancies, errors, or fraudulent activities by matching transactions recorded internally with external financial statements. Regular reconciliation improves financial integrity and supports accurate reporting for business decision-making and compliance.

Defining Ledger Posting: Core Concepts

Ledger posting involves systematically recording financial transactions into specific accounts within the general ledger, ensuring accurate categorization and traceability of all business activities. Each entry reflects debits and credits that maintain the accounting equation's balance, providing a foundational structure for financial statements. This process directly supports reconciliation by offering detailed, organized data necessary to verify the accuracy of accounts and detect discrepancies.

Key Differences Between Reconciliation and Ledger Posting

Reconciliation verifies the accuracy of accounts by comparing bank statements with company records to identify discrepancies, while ledger posting involves recording financial transactions systematically into the general ledger for organization and tracking. Reconciliation focuses on ensuring the integrity of accounting data through error detection and correction, whereas ledger posting centers on data entry and classification of financial activities. Both processes are crucial but serve different purposes: reconciliation validates the accuracy of recorded data, and ledger posting maintains the structured financial record.

Importance of Reconciliation in Financial Accuracy

Reconciliation ensures financial records accurately reflect actual transactions by comparing ledger entries with external documents like bank statements. This process identifies discrepancies, errors, or fraud, maintaining the integrity of financial data. Accurate reconciliation supports reliable financial reporting and informed decision-making, critical for business accountability and compliance.

The Role of Ledger Posting in Bookkeeping Integrity

Ledger posting ensures bookkeeping integrity by accurately recording financial transactions in the appropriate accounts, establishing a clear and traceable financial history. It provides the foundation for reconciling accounts, allowing discrepancies to be identified and corrected promptly. Consistent ledger posting supports accurate financial reporting and compliance with accounting standards.

Step-by-Step Process of Reconciliation

Reconciliation involves systematically comparing internal ledger entries with external statements to identify discrepancies and ensure accuracy. The step-by-step process includes gathering bank statements, cross-referencing each transaction with ledger records, and investigating any unmatched or erroneous entries. Completing reconciliation secures financial integrity by verifying that posted ledger balances align with actual account activity.

Best Practices for Efficient Ledger Posting

Efficient ledger posting requires timely and accurate recording of financial transactions to maintain up-to-date accounts and facilitate seamless reconciliation. Implementing standardized coding systems and automated software reduces errors and ensures consistent data entry across all ledger accounts. Regular review and cross-verification with bank statements during reconciliation processes improve accuracy and support reliable financial reporting.

Common Errors in Reconciliation and Ledger Posting

Common errors in reconciliation include mismatched transaction dates, incorrect amounts, and unrecorded bank fees that lead to discrepancies. Ledger posting errors often involve duplicate entries, misclassification of accounts, and omission of transactions, which distort financial statements. Regularly reviewing and cross-verifying reconciliations and ledger postings ensures accurate financial reporting and prevents costly mistakes.

Choosing the Right Tools for Bookkeeping Processes

Selecting the right tools for bookkeeping processes enhances accuracy in both reconciliation and ledger posting, ensuring financial data integrity. Reconciliation software automates transaction comparison, identifying discrepancies quickly, while ledger posting tools streamline recording and categorizing financial entries. Investing in integrated bookkeeping platforms that support seamless data synchronization between reconciliation and ledger posting stages improves efficiency and reduces errors in financial management.

Reconciliation vs Ledger Posting Infographic

bizdif.com

bizdif.com