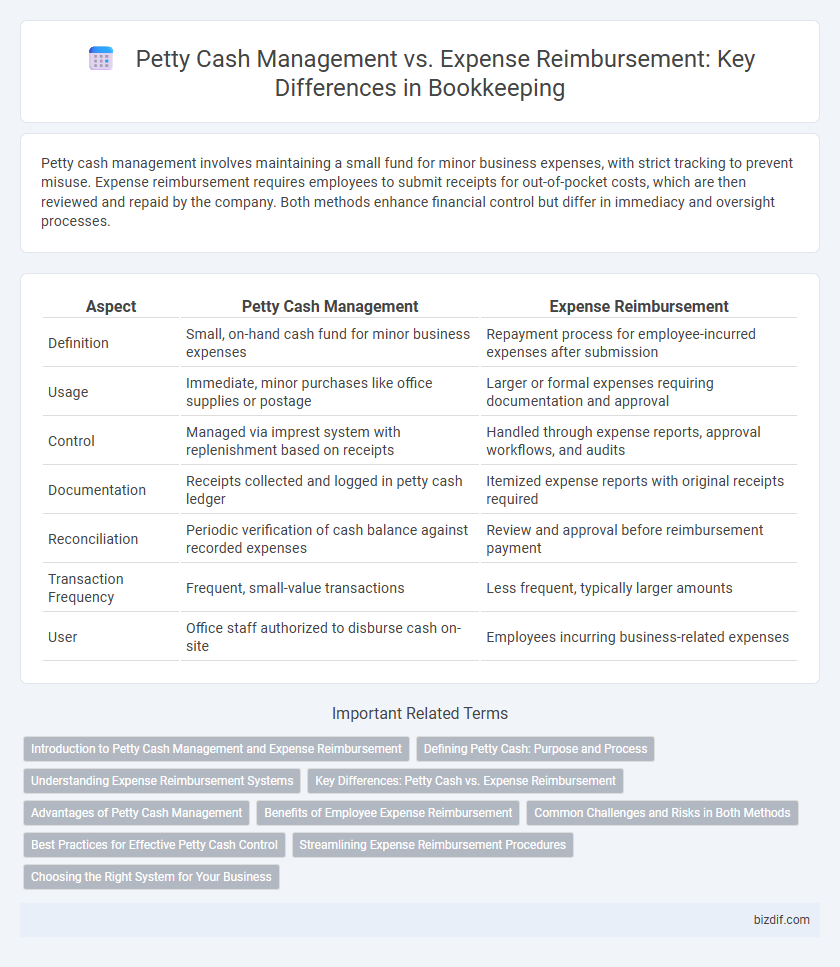

Petty cash management involves maintaining a small fund for minor business expenses, with strict tracking to prevent misuse. Expense reimbursement requires employees to submit receipts for out-of-pocket costs, which are then reviewed and repaid by the company. Both methods enhance financial control but differ in immediacy and oversight processes.

Table of Comparison

| Aspect | Petty Cash Management | Expense Reimbursement |

|---|---|---|

| Definition | Small, on-hand cash fund for minor business expenses | Repayment process for employee-incurred expenses after submission |

| Usage | Immediate, minor purchases like office supplies or postage | Larger or formal expenses requiring documentation and approval |

| Control | Managed via imprest system with replenishment based on receipts | Handled through expense reports, approval workflows, and audits |

| Documentation | Receipts collected and logged in petty cash ledger | Itemized expense reports with original receipts required |

| Reconciliation | Periodic verification of cash balance against recorded expenses | Review and approval before reimbursement payment |

| Transaction Frequency | Frequent, small-value transactions | Less frequent, typically larger amounts |

| User | Office staff authorized to disburse cash on-site | Employees incurring business-related expenses |

Introduction to Petty Cash Management and Expense Reimbursement

Petty cash management involves maintaining a small fund for minor business expenses, ensuring quick access and easy tracking of small payments using vouchers and receipts. Expense reimbursement refers to the process where employees submit claims for out-of-pocket expenses, which are then reviewed and repaid by the company based on established policies. Both systems require detailed record-keeping to maintain accurate financial statements and support audit compliance.

Defining Petty Cash: Purpose and Process

Petty cash is a small fund of money kept on hand to cover minor business expenses that require immediate payment without formal invoicing. Its primary purpose is to streamline small transactions such as office supplies or postage, reducing the need for expense reimbursements. The process involves establishing a fixed cash amount, recording each disbursement with receipts, and regularly reconciling the fund to ensure accountability and proper financial tracking.

Understanding Expense Reimbursement Systems

Expense reimbursement systems streamline the process of compensating employees for out-of-pocket business expenses, ensuring accurate tracking and compliance with company policies. Effective petty cash management involves maintaining a small fund for minor expenses, while expense reimbursement relies on documented claims supported by receipts for larger or infrequent expenses. Understanding these systems helps businesses maintain financial control, improve transparency, and simplify audit procedures in bookkeeping.

Key Differences: Petty Cash vs. Expense Reimbursement

Petty cash management involves maintaining a small on-hand fund for minor business expenses, allowing immediate payments without formal claims, whereas expense reimbursement requires employees to submit detailed expense reports for repayment of out-of-pocket costs. Petty cash is managed through a physical cash box with controlled disbursements and regular reconciliation, while expense reimbursement relies on systematic approval workflows and documentation submission. The key differences lie in fund accessibility, control mechanisms, and process formality, impacting bookkeeping accuracy and internal financial controls.

Advantages of Petty Cash Management

Petty cash management offers immediate access to funds for small expenses, reducing delays associated with reimbursement processes. It simplifies record-keeping by maintaining a dedicated cash fund, enhancing tracking and accountability for minor business expenditures. This system also minimizes administrative overhead, allowing employees to handle incidental costs efficiently without awaiting formal approval cycles.

Benefits of Employee Expense Reimbursement

Employee expense reimbursement streamlines financial tracking by ensuring accurate documentation of business-related expenditures, reducing errors in bookkeeping. It promotes accountability through clear policies and receipts, minimizing misuse of funds and simplifying audit processes. This approach improves employee satisfaction by providing timely repayment, enhancing overall operational efficiency.

Common Challenges and Risks in Both Methods

Petty cash management and expense reimbursement both face challenges like inaccurate record-keeping, risk of fraud, and difficulty in ensuring timely documentation. In petty cash, risks include misappropriation due to lack of stringent controls, while expense reimbursement challenges revolve around delayed submissions and improper expense claims. Both methods require robust internal controls and regular audits to mitigate financial discrepancies and ensure compliance.

Best Practices for Effective Petty Cash Control

Implement strict documentation protocols and maintain a petty cash log to track disbursements accurately, ensuring accountability and minimizing errors in petty cash management. Set clear spending limits and require receipt submissions for every transaction to prevent misuse and facilitate easier reconciliation with expense reimbursement processes. Conduct regular audits and replenish funds based on verified expenses, aligning petty cash control with overall financial governance and expense reimbursement policies.

Streamlining Expense Reimbursement Procedures

Streamlining expense reimbursement procedures involves automation tools that reduce manual errors and accelerate approval workflows, ensuring timely cost recovery and accurate financial tracking. Petty cash management, while useful for small, immediate expenses, often lacks the transparency and control provided by digital reimbursement systems integrated with accounting software. Effective expense reimbursement frameworks enhance compliance, optimize cash flow management, and provide detailed audit trails, crucial for maintaining accurate bookkeeping records.

Choosing the Right System for Your Business

Petty cash management involves maintaining a small fund for minor business expenses, providing quick access to cash with simplified tracking, while expense reimbursement requires employees to pay upfront and submit detailed reports for repayment, ensuring stricter financial control and documentation. Businesses with frequent low-value transactions benefit from petty cash for operational efficiency, whereas companies prioritizing accurate expense tracking and accountability should opt for an expense reimbursement system. Selecting the right system depends on transaction volume, internal controls, and the need for real-time financial oversight in bookkeeping practices.

Petty Cash Management vs Expense Reimbursement Infographic

bizdif.com

bizdif.com