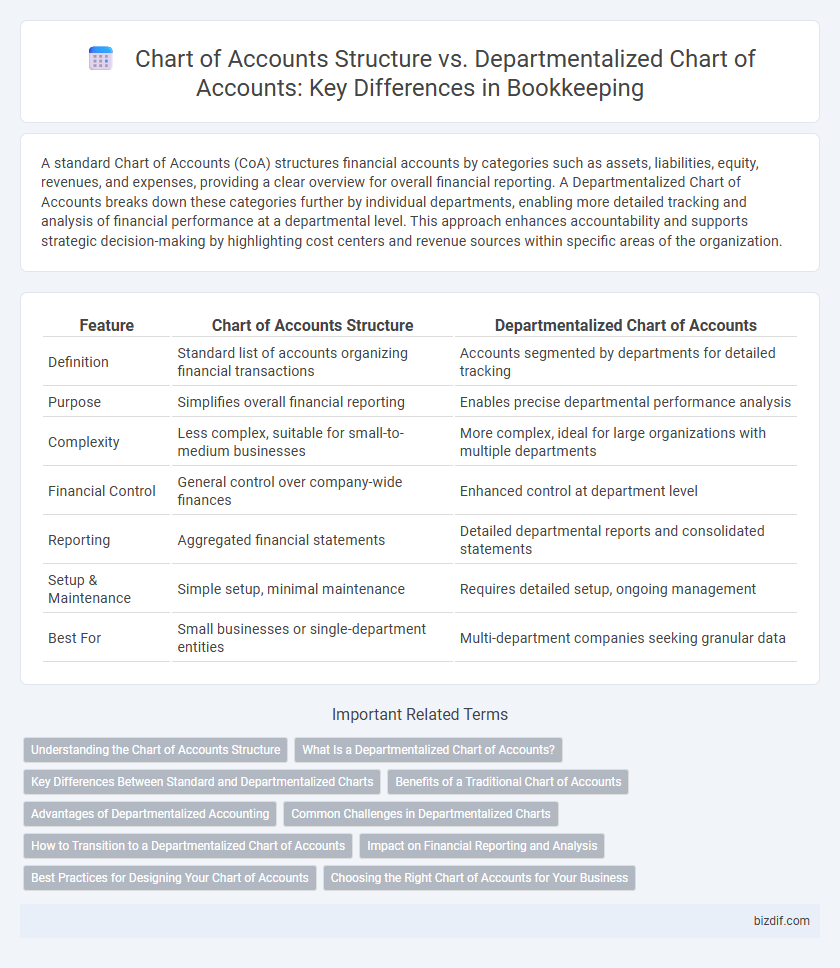

A standard Chart of Accounts (CoA) structures financial accounts by categories such as assets, liabilities, equity, revenues, and expenses, providing a clear overview for overall financial reporting. A Departmentalized Chart of Accounts breaks down these categories further by individual departments, enabling more detailed tracking and analysis of financial performance at a departmental level. This approach enhances accountability and supports strategic decision-making by highlighting cost centers and revenue sources within specific areas of the organization.

Table of Comparison

| Feature | Chart of Accounts Structure | Departmentalized Chart of Accounts |

|---|---|---|

| Definition | Standard list of accounts organizing financial transactions | Accounts segmented by departments for detailed tracking |

| Purpose | Simplifies overall financial reporting | Enables precise departmental performance analysis |

| Complexity | Less complex, suitable for small-to-medium businesses | More complex, ideal for large organizations with multiple departments |

| Financial Control | General control over company-wide finances | Enhanced control at department level |

| Reporting | Aggregated financial statements | Detailed departmental reports and consolidated statements |

| Setup & Maintenance | Simple setup, minimal maintenance | Requires detailed setup, ongoing management |

| Best For | Small businesses or single-department entities | Multi-department companies seeking granular data |

Understanding the Chart of Accounts Structure

The Chart of Accounts (COA) structure organizes financial transactions into categories such as assets, liabilities, equity, revenues, and expenses, providing a clear framework for accurate financial reporting. This hierarchical system enhances data consistency and simplifies the tracking of financial activities across different accounts. Understanding the COA structure is essential for effective bookkeeping, ensuring that all financial information is systematically classified and easily accessible for analysis and auditing.

What Is a Departmentalized Chart of Accounts?

A Departmentalized Chart of Accounts organizes financial data by dividing accounts according to specific departments within a business, allowing for precise tracking of revenues, expenses, and assets per department. This structure enhances departmental performance analysis and budget management by providing detailed insights into each unit's financial activities. It contrasts with a traditional Chart of Accounts, which categorizes accounts by type rather than by operational divisions.

Key Differences Between Standard and Departmentalized Charts

The Chart of Accounts (COA) structure organizes financial transactions by account types such as assets, liabilities, income, and expenses, providing a clear overview of the company's financial status. In contrast, a Departmentalized Chart of Accounts segments accounts by business units or departments, allowing granular tracking and reporting of financial performance across various divisions. Key differences include the level of detail and reporting focus, where the standard COA is company-wide, while the departmentalized version enhances accountability and budget management within specific departments.

Benefits of a Traditional Chart of Accounts

A traditional Chart of Accounts provides a streamlined and standardized framework that facilitates straightforward financial reporting and easier regulatory compliance. It enhances clarity by categorizing accounts uniformly across the organization, which simplifies audit processes and financial analysis. This structure supports consistent data entry and reduces complexity compared to a departmentalized system, improving overall bookkeeping efficiency.

Advantages of Departmentalized Accounting

Departmentalized Chart of Accounts allows precise tracking of financial performance across multiple business units, enhancing decision-making and resource allocation. It improves accountability by assigning revenues and expenses directly to specific departments, facilitating targeted budgeting and cost control. This structure also streamlines reporting for complex organizations, enabling detailed analysis of departmental profitability and operational efficiency.

Common Challenges in Departmentalized Charts

Departmentalized Chart of Accounts often presents challenges such as increased complexity in tracking financial data across multiple business units, leading to potential errors in allocation and reporting. Maintaining consistency and accuracy requires robust internal controls to avoid misclassifications and ensure compliance with accounting standards. Limited scalability can also hinder timely financial analysis, complicating decision-making processes for management.

How to Transition to a Departmentalized Chart of Accounts

Transitioning to a departmentalized chart of accounts requires first defining clear departmental categories aligned with business operations. Assign unique account numbers for each department, ensuring transactions can be tracked accurately by function or location. Implement accounting software features that support departmental segmentation and train staff to classify entries appropriately for precise financial reporting.

Impact on Financial Reporting and Analysis

A traditional Chart of Accounts provides a standardized framework for organizing financial transactions by account type, enabling consistent and comparable financial reporting across periods. A Departmentalized Chart of Accounts further segments financial data by specific business units or departments, enhancing the granularity of financial analysis and enabling targeted performance evaluation. This departmental detail improves the accuracy of budget tracking, cost control, and profitability assessment, providing deeper insights for strategic decision-making and resource allocation.

Best Practices for Designing Your Chart of Accounts

Designing an effective Chart of Accounts (COA) requires balancing simplicity and specificity to ensure accurate financial tracking and reporting. A standard COA organizes accounts by categories such as assets, liabilities, equity, revenues, and expenses, while a departmentalized Chart of Accounts further segments these categories by business units or departments, enabling granular performance analysis. Best practices include using consistent numbering schemes, limiting the total number of accounts for manageability, and aligning the structure with organizational reporting needs to enhance clarity and facilitate decision-making.

Choosing the Right Chart of Accounts for Your Business

Selecting the right chart of accounts involves evaluating whether a standard or departmentalized structure best fits your business needs. A standard chart of accounts offers simplicity and ease of use, suitable for smaller businesses with less complexity. In contrast, a departmentalized chart of accounts enables detailed tracking and reporting by specific departments, ideal for larger organizations seeking granular financial insights and improved internal accountability.

Chart of Accounts Structure vs Departmentalized Chart of Accounts Infographic

bizdif.com

bizdif.com